The technology industry loves buzzwords, and fintech is no exception. Words and phrases like "virtual reality," "artificial intelligence," "big data," "frictionless" and "integration" get thrown around without much clarification for how it actually impacts the day-to-day life of financial services professionals.

So to help put these ideas into context, Pershing hosted an Advanced Technology Lab at this week's INSITE conference in Orlando where it showcased just how the engineers are thinking about using cutting-edge technology to benefit advisors. Focusing on five key themes — the Internet of things, simplified security, digital experience, blockchain and machine learning — Pershing demonstrated technology that isn't available today, but could become the standard for financial advisors in the next five to 10 years.

The Internet of Things

When people talk about the Internet of things, they talk about using connectivity to improve the functionality of everyday objects like home temperature control to refrigerators. The Amazon Echo, a wireless speaker that responds to voice commands, has been a hit with consumers for letting them access their personal agenda, listen to music, and place Amazon orders with simple commands.

How could this work for advisors? Pershing Advanced Technology Lab connected the Echo with the NetX360 platform, allowing advisors to get a briefing of their daily tasks while enjoying their morning coffee. Pershing imagines an advisor can have this in their living space or office to someday use similar tools to get simple tasks accomplished without lifting a finger.

The future: advisors using Amazon Echo to hear the day's tasks from @Pershing NetX360. #PershingINSITE pic.twitter.com/ffYwT3dflh

— Ryan W. Neal (@ryanWneal) June 8, 2016

Simplified Security

Two years ago at Pershing INSITE, the Advanced Technology team introduced the ability to log in to Pershing's mobile application with a fingerprint scan. This year, it's upping the ante with a new wristband that monitors heart rate and EKG. Using these unique biometric patterns, an advisor can verify their identity just by walking up their computer, and the computer will log off as soon as they walk way.

Virtual Reality

While some advisors still rely on paper reports and calling their clients, using new technology like video conferencing or screen sharing is an increasingly common way to interact with clients without having them visit the office.

As a new age of virtual products from Google, Samsung and Oculus are becoming mainstream, Pershing sees an opportunity to provide even more interactive engagement with clients. Using the Oculus, Pershing demonstrated a virtual advice session, making the user feel like they are sitting in the firm's conference room from the comfort of their couch.

Instead of sending a paper report, Pershing also created three-dimensional rooms a client can enter to see digital representations of their balances, performance and debt. Pershing hopes that it will give clients a more visceral feel of their finances, helping to visualize their plans.

Blockchain

Blockchain, the public ledger technology that underpins digital currencies like Bitcoin, has been getting a lot of attention recently as financial institutions continue to invest in it. But what does it have in store for the industry, exactly?

Using Ehtereum, a programmable version of the blockchain, Pershing's Advanced Technology Lab demonstrated how it could be used to recreate real-life transactions beyond exchanging bitcoin, such as buying currencies, creating options contracts, or creating derivatives. The hope is that blockchain could replace financial institutions' legacy systems, reducing friction between disparate networks and ultimately reducing costs for home offices and institutional investors.

Machine Learning - IBM Watson

When it comes to artificial intelligence or machine learning, IBM's Watson project is probably the most recognized. The company is employing the tech in a number of industries and has a dedicated team working in wealth management.

IBM Watson has partnered with Pershing to develop practice management functionality that helps firms improve revenues by seizing on new opportunities. For example, Watson can use predicative analytics to know what sort of life events a client is experiencing, then use prescriptive analytics to show the advisor what sort of actions he or she can take. The team says it can help "level up" an advisor to help them keep pace with both digital advisors and the wirehouses.

Natural Language

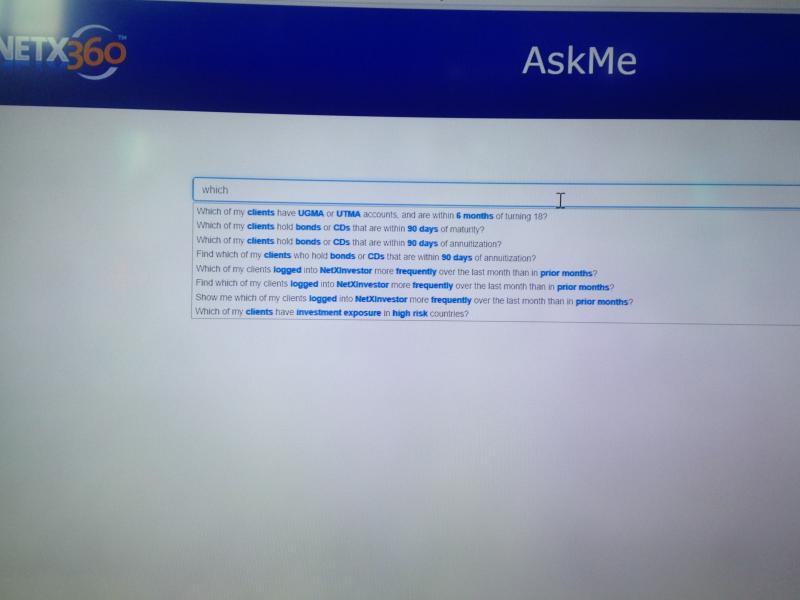

Pershing also wants to improve an advisors ability to navigate it's technology platform. Similar to using Amazon Echo to access NetX360, Pershing is adding natural language search functions to make it easier for advisors to find the information they are looking for.