Despite how much time and energy is spent writing, talking and thinking about the rise of online financial advice, it's still a fairly misunderstood topic, according to the Tiburon Research Group. Everyone seems to have a different definition of “robo-advisor,” and they lead to huge differences when determining the impact online advice has on the wealth management industry.

“Depending on how you measure the market, it’s either tiny or its been around a long time,” said Chip Roame, a managing partner at Tiburon. “To believe it’s large and just-started would be inaccurate.”

In other words: while every robo-advisor is online, not every online advisor is a robo.

So while Tiburon expects the online advice market to grow to $655.2 billion in 2019, Roame said its important to understand that the majority of this growth won't come from the direct-to-consumer advisors. Instead, it will be the online firms focused on the defined contribution space that will dominate the online financial advice market.

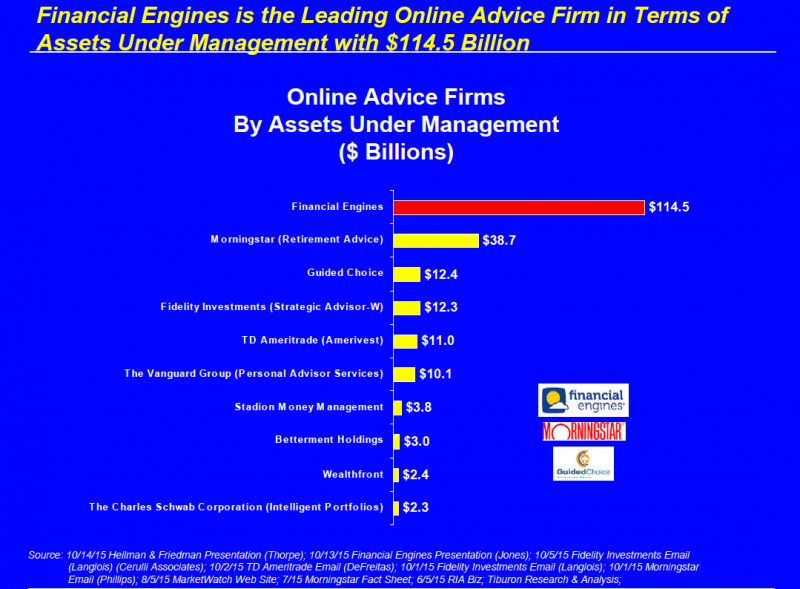

One reason is that these companies have simply been around the longest. Financial Engines was founded in 1998 and has since gathered $114.5 billion in assets, making it the biggest online advisory firm across all categories, according to Tiburon. The second-largest company, Morningstar Retirement Advice, has more assets ($38.7 billion) than the entire D2C space combined ($31.6 billion).

Greg Vigrass, head of Folio Institutional, said one reason these companies have been successful is that managing retirement accounts online is just a good idea.

“It’s a good way to provide sound, consistent, disciplined guidance to a broad, and I mean very broad, range of consumers,” Vigrass said, adding that online companies solved the dilemma of how to appropriately advise participants across asset levels, position and tenure at company.

Tiburon projects companies like Financial Engines and Morningstar’s Retirement Advice to continue their growth and begin expanding into other asset classes. Financial Engines has already started down this path with its recent acquisition of The Mutual Fund Store.

When it comes to the D2C online advisors, Roame said there are two major distinctions: the robo advisors and the discount brokerage firms. The latter – comprised of platforms like TD Ameritrade’s Amerivest, Vanguard Group’s Personal Advisor Services and Schwab’s Intelligent Portfolios – dominate this D2C space, with TD and Vanguard managing more assets than 22 robo advisors combined. As more institutional brands jump in with their own automatic advisory products, Tiburon projects them to own at least 80 percent of the market.

“We don’t think all [22] robos are going to be trillion dollar firms,” Roame said. Five will survive at most, Roame added, and even those may merge together or be bought by larger institutions. “M&A activity will be quite aggressive in this space. Some will be selling from a position of strength; others will be from a position of weakness.”

Roame said 2016 will be the year the overall number of players in the online advice market begins to shrink. For the robos that do survive, Roame believes they’ll be able to increase assets from about $8.3 billion today to $80 billion in 2019, but still the smallest portion of the overall online advice market.

For Vigrass, the biggest takeaway isn’t which technology companies will survive and which ones won’t, but that market growth proves more and more clients demand digital interaction with their advisor.

“There’s an increasing market for people who wish to have better engagement,” Vigrass said. “I hesitate to say ‘all,’ but I’d be surprised if most firms don’t look to accommodate that [digital] business model.”