Veteran advisors have been hearing about fee compression for years, and quite frankly, it hasn’t affected them very much. For new advisors, the story will be quite different. With the growth of low-cost alternatives and decades potentially left in their careers, the impact will be felt.

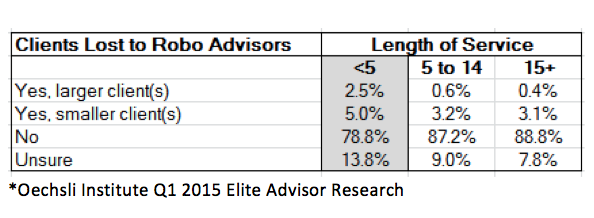

Not to mention, younger advisors typically have younger clients, who are more likely to use these high-tech, low cost options. You can see this already taking shape in client attrition over the past 12 months. In our January 2015 research, we segmented advisors based on years of service. The figure below shows that while the client attrition isn’t earth-shattering, it’s being felt by the newer advisors more so than their veteran counterparts:

This isn’t just about competing against robo-advisors; our 2015 Affluent Investor Research shows that less than 3% of today’s affluent have ever heard of the most popular robo-advisor firms. The real competition is against low cost offerings in general.

What do you say when someone asks you about do-it-yourself options, robo-advisors, and other low-cost alternatives? Most of your competition is caught off-guard when asked. Don’t let this be you!

We thought it might be helpful to use this edition of FastTrack for Growth to give everyone an opportunity to think about two very-common scenarios in advance, polish your language, and shine when asked in real life.

“Why wouldn’t I just do it myself?”

Suggested Answer: That option is great for some people…if they want that responsibility. Even for a do-it-yourselfer, it makes sense to have a professional take a look at it periodically and give you feedback.

Your Language: ____________________________________________________________

“Seems like your industry is really getting hit by these robo-advisors…”

Suggested Answer: There’s been a lot of media hype, but at this point, there aren’t many people clamoring for the cheapest possible advice. I read recently that less than 3% of serious investors have even heard of the most popular robo-advisor companies.

Your Language: ____________________________________________________________

We’re not asking you to memorize our language. Make it your own – customize it. It might surprise you that when we speak at top-producer conferences, they are much more into the role play exercises than the general population of advisors. They take their language very seriously. They all have different personalities, but they’re all very well-polished.

Stephen Boswell and Kevin Nichols are thought-leaders with The Oechsli Institute, a firm that specializes in research and training for the financial services industry. @StephenBoswell @KevinANichols www.oechsli.com