When it comes to choosing investment products, millennials are largely passive and far more likely to go with what their employers offer, such as 401(k) plans with mutual funds and life insurance, than independently set up investment strategies.

A survey released Tuesday by iQuantifi, in partnership with Middle Tennessee State University’s Jones College of Business, recently asked 500 Americans between the ages of 21 and 35 what investment products they currently own and which they’re planning to use in the future.

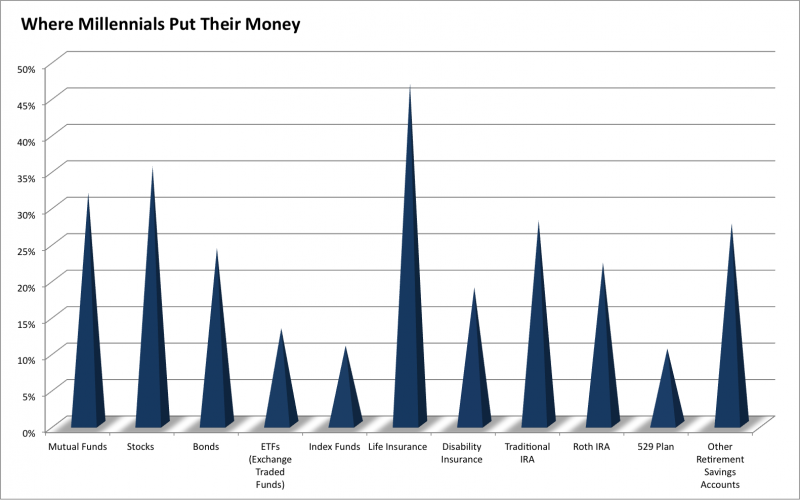

Almost half (47 percent) said they owned life insurance, while about a third owned mutual funds and stocks. Far fewer millennials said they currently owned any exchange traded funds (13 percent) or index funds (11 percent). And when asked if they planned to use ETFs or index funds in the future, only about 14 percent said yes.

“It's not surprising that life insurance is at the top of the list,” says Eric Roberge, founder of Beyond Your Hammock, a fee-only RIA focused on serving millennials. “The outcome of not buying life insurance is fairly tangible. People often commit to buying the life insurance policy because they are afraid of what would happen if they don't,” Roberge says. “Life insurance salesmen know this and use fear inducing sales techniques.”

Katie Brewer, a financial coach with Your Richest Life, says life insurance, mutual funds and stocks are more widely known because they are the ones that are sold more often. “Mutual funds are by far the most common investment inside of a 401(k), so millennials are familiar with them. I would bet that a lot of the respondents that said they own stock actually own company stock through an employee stock purchase plan,” she says.

Roberge adds that the lack of financial education is also playing into these choices, as many millennials may encounter investment products like mutual funds early on because of the wide public advertising campaigns “They may not even know anything about other investments (i.e. exchange traded funds),” he says.

That’s not to say that mutual funds are a poor investment choice. “These are actually the ideal mutual funds for young professionals just starting out on the road to building wealth,” Roberge says. “They can actually be quite inexpensive if chosen correctly and consistently investing in these products over time may offer growth and diversification within a portfolio.”

And yet a Roth IRA with low cost index ETFs that track the broad market are the exact type of investment vehicles Marcio Silveira, founder of Pavlov Financial Planning, says also should be high in the millennials’ priority lists. “This shows how limited our industry is in doing what is mostly sensible to our clients.”