The indpendent advisory space is maturing. Many of the 1,000 registered investment advisors surveyed in Charles Schwab’s 2015 Benchmarking Study surpassed 20 years in business, and and reported all-time high revenue and profitability.

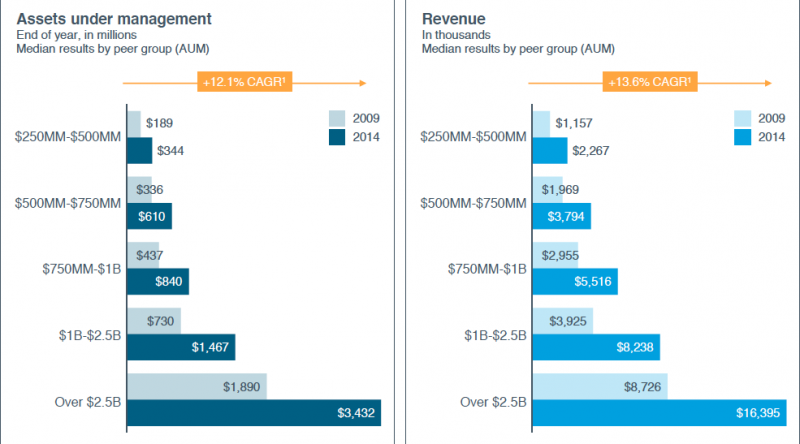

In fact half of the firms surveyed by the custodian increased assets under management by at least 75 percent since 2009 and increased the number of clients by 24 percent. Forty-two percent doubled their revenue over the same period.

Firms also increased operating margins by 36 percent over the last year. The gap between the most profitable and least profitable firms also decreased, which Jon Beatty, the senior vice president of sales and relationship management at Schwab Advisor Services, said is related to the industry’s maturity.

“As RIAs and the industry-at-large continue to mature, firms are learning from each other and sharing best practices to help build scale and fuel growth,” Beatty said.

"It is a time of abundance in the RIA industry, but having said that, we still see a huge opportunity."

That opportunity is the $23 trillion that high-net-worth investors still hold outside of the advisory industry. Eighty-two percent of the firms in the survey named client acquisition as one of their top three priorities.

One way they are doing that is by being more rigorous in segmenting clients, and using automated investment technology to grow more efficienctly.

“Twice as many firms in this year’s study tell us that they have a documented client segmentation strategy than just three years ago,” Beatty said. “We know client segmentation is a tool that helps advisors dedicate resources to the types of investors that they want to serve and, if implemented in a strategic way, can really marry… the client service model [and] desired goals around profitability.”

Beatty added that firms are also focused on talent acquisition and named it as the third-highest priority behind growth with new clients and growth from existing clients. In particular, RIAs are hiring professional managemers to tackle challenges associated with increasingly large and comples businesses. Three-quarters of firms are looking to add relationship managers or investment professionals to drive growth, and 10 percent are adding “dedicated management” employees to focus on running business operations, freeing up time for others to focus on clients and prospects.

The survey also found firms are driving profitability by going after larger accounts. According to the study, the median RIA firm reported $554,000 revenue per professional in 2014, and the top-performing firms reported $800,000 revenue per professional.

“The power in the business model is more around the scale related to client size,” Beatty said. “As they’re able to acquire larger and larger clients, that allows them to scale without having to add staff.”