RIA and dually registered advisory channels will grow their share of the advised assets to 26 percent by 2016, up from 21 percent today, according to a new report by Cerulli Associates. That growth will largely come at the expense of the wirehouse channel, said Cerulli associate director Kenton Shirk.

Headcount in these channels is also expected to grow, but at a lower rate than assets. Advisor count should increase from 15 percent today to about 17.5 percent through 2016.

“The asset growth and share gain of the RIA channel has been so strong that it cannot solely be attributed to advisors choosing the independent business model,” Shirk said. “Clients have also increasingly been choosing to hold their assets with an independent advisor."

While the breakaway movement is not as strong as past hype has suggested, the wirehouse channel is still the biggest feeder into both the RIA and hybrid channels. Cerulli defines dually registered advisors as those who have an independent RIA and a b/d affiliation, but are not using a corporate RIA. “[Advisors] are giving up the support of the broker/dealer; they’re giving up that traditional model to have more flexibility, to have a different economic makeup.”

The role of big banks in the financial crisis could be one reason more clients are putting their money with RIAs, Shirk said. It created some distrust of large financial institutions.

“If clients are not wanting to hold their money with the banks, if they want to hold those banks responsible, advisors are going to follow suit,” Shirk said.

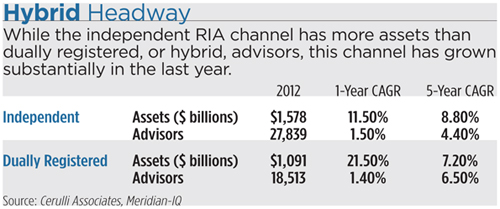

While the RIA channel holds more assets than dually registered advisors, Cerulli believes the hybrid model may become more appealing over the next several years. In fact, in 2012, the asset growth rate in the hybrid space was nearly double (21.5 percent) that of the pure RIA channel (11.5 percent).

“The dual model has historically been looked at as a stepping stone to go RIA,” Shirk said. “But it’s becoming more permanent as a channel. It’s being legitimized.”

Hybrid advisors say they want to continue to serve their clients with a mix of both fee-based and commission-based business, he added. Many also have legacy commission business, and they don’t want to give up that revenue.

Also, some of the operational and regulatory challenges of the hybrid model have been reduced, Shirk said.

“Dual reporting of trades is a good example, where five years ago it was difficult—considered a pain—and now there have been technology solutions and everyone’s kind of figured out how to deal with it.”