So far this year, merger and acquisition activity in the registered investment advisor space has hit record levels, and the average size of deals are bigger than ever, according to new data by DeVoe & Company.

The first half of 2015 saw a total of eight “mega-deals”—those over $5 billion, said Managing Partner David DeVoe. That compares to one acquisition over $5 billion in the first half of 2014 and two deals over $5 billion during the same period in 2013.

“2015 is shaping up to be the year of the mega-deals for this industry, and that’s related to well-financed large acquirers being interested in the space,” DeVoe said.

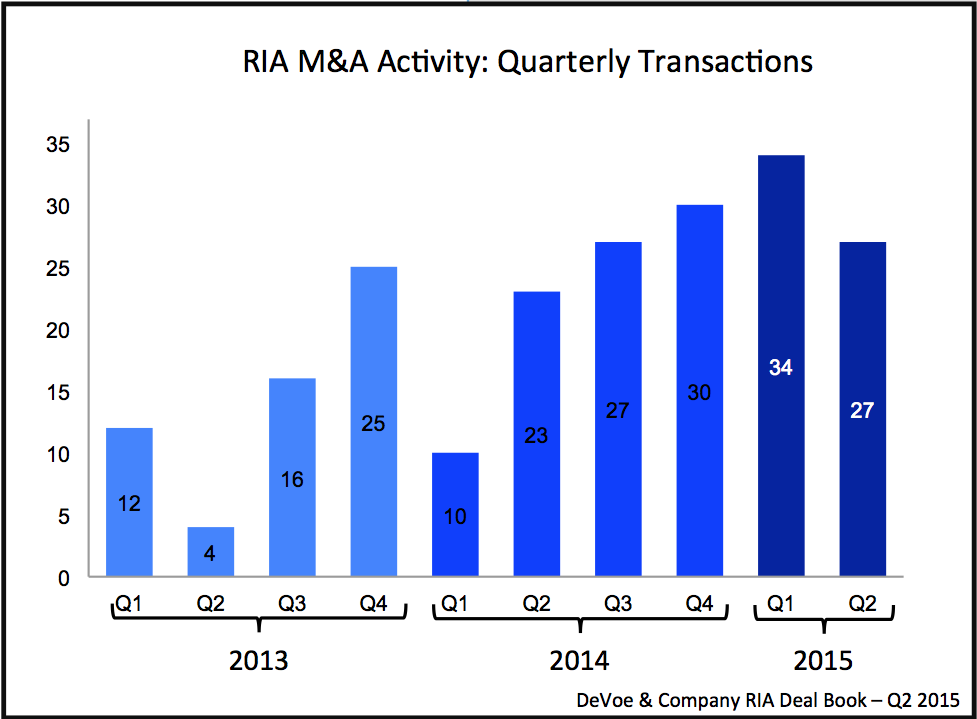

The first half of this year saw a total of 61 transactions, up 84 percent from the same period in 2014, according to DeVoe, which tracks all RIA transactions with over $100 million in assets.

At this rate, 2015 M&A activity is on track to exceed 2014, which had a total of 90 deals. DeVoe estimates we could see between 120 and 150 total deals this year.

RIA firms and consolidators—defined as an organization whose business model is predicated on making RIA acquisitions—have dominated M&A over the last couple years. But lately private equity firms and banks are again buying RIA firms. Banks accounted for 10 percent of the deals in the first half of this year, up from 5 percent in 2014, while other acquirers—which includes private equity and trust companies—accounted for 17 percent of deals this year, up from none last year.

Several of the mega deals were completed by these well-financed large acquirers. In June, First Republic Bank announced plans to buy Constellation Wealth Advisors, an independent multi-family office firm with $6.1 billion in assets, for $115 million in cash. Earlier this year, private equity firm TA Associates took a majority stake in NorthStar, the holding company for CLS Investments, Orion Advisor Services and Gemini Fund Services. In March, private equity firm Genstar Capital penned a deal with Lovell Minnick Partners to purchase Mercer Advisors, an RIA with over $6 billion in client assets.

Even excluding those over $5 billion, average deal size is getting bigger - up to $877 million in the first half of 2015, compared to $656 million in 2014 and $679 million in 2013.

And thd deal activity is likely going to be driven by demographics of firm owners, which are nearing retirement, DeVoe said.

“The activity to date has not been primarily driven by succession planning and exits from the industry, but my logic for that steady acceleration of M&A in this industry for the next five to seven years is based on the fact that we need to have so many more acquisitions just to clear the industry of all the folks that are going to retire.”