Most hotel real estate investment trusts (REITs) have spent the past year working overtime to clean up their highly overleveraged balance sheets. Many of these publicly traded companies also have stockpiled cash to buy properties at a deep discount. The problem is that this much-anticipated wave of sales has yet to materialize.

“Roughly a year ago many of the hotel REITs were in financial distress, far too much leverage, facing looming debt maturities that could not be dealt with,” says John Arabia, a managing director with New York-based REIT research firm Greet Street Advisors. As occupancies, room rates and property values dropped precipitously, money to refinance the loans coming due was almost non-existent last year.

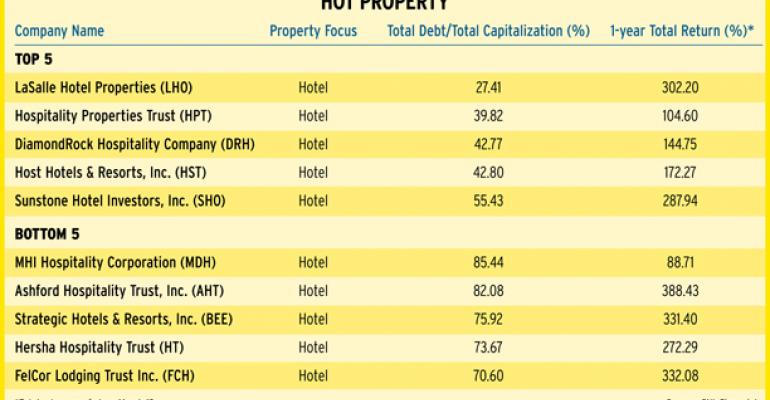

But hotel REITs did not cave under the pressure. Instead they raised billions of dollars of equity through secondary stock offerings. They dealt with problem assets by handing the keys back to the bank, renegotiating loans and extending maturities. Today, the top five lodging REITs have a debt-to-market capitalization ratio of 55 percent or less, with LaSalle Hotel Properties (NYSE Arca: LHO) holding the lowest ratio at 27 percent. From February 2007 to March 2009, the group lost 88 percent of its market value. But for all of 2009 hotel REITs regained more than 67 percent in market value.

Slim pickings

Even though REITs have raised equity and are raring to put it to work, few transactions are closing. The volume for transactions $5 million and greater peaked in 2007 at 2,666 deals, totaling $78.4 billion, according to New York-based research firm Real Capital Analytics.

By 2009, transactions dropped to 158, totaling $2.4 billion. And in January this year, just 14 deals closed, at a value of $314 million. One cause for the weakness, says Dan Beider, a senior managing director with hotel brokerage and advisory firm Paramount Lodging Advisors, is that lenders now require 50 percent equity on hotel loans.

Investing in hotel REITs can be tricky in a volatile marketplace. With no long-term leases, the lodging sector is hypersensitive to the overall economy. While hotel occupancy for the top 25 U.S. markets rose 2.5 percent in January on a year-over-year basis, overall real estate fundamentals are anemic. Revenue per available room (RevPAR), a key industry metric, plummeted 19 percent in 2009, while the average daily rate dropped nearly 12 percent during the same period, according to Henderson, Tenn.-based Smith Travel Research.

Beider believes that distressed deals are just around the corner. “Come June, July, August, we expect there will be a number of good opportunities. Anything from single assets to small portfolios to medium-size portfolios will be available.”

Where the Deals Are

Many opportunities will likely arise out of situations where borrowers cannot refinance properties as a result of underwater mortgages, serious declines in cash flow, or a combination of factors. For borrowers paying back securitized loans — loans that were originated by banks, pooled together and sold to investors as commercial mortgage-backed securities (CMBS) — the problem is especially acute.

CMBS loans, which offered borrowers the highest amount of loan proceeds at the lowest interest rates, were rampant at the height of the commercial real estate boom, from 2005 to 2007, when underwriting grew lax. With the weak economy putting a stranglehold on travel, many of these borrowers have been unable to generate sufficient cash flow to make their mortgage payments.

According to commercial real estate data firm Trepp LLC, by the end of February more than 20 percent of the total outstanding CMBS balance in the lodging sector was in the hands of special servicers charged with figuring out the best course of action to protect the financial interests of bondholders.

Of the $14.9 billion in special servicing, 71 percent of this volume is 60 days or more delinquent. “This current level of distressed properties offers patient and well-capitalized hotel REITS the opportunity to add both reach and value to their portfolio with proper due diligence,” explains Paul Mancuso, a vice president at New York-based Trepp.

Prevention measures

So far, banks have been flexible with borrowers on distressed loans. “There have been a fair number of extensions, amendments or lenders basically sitting on their hands and not taking action, or doing so very slowly,” says Arabia of Green Street Advisors. “It now appears that the number of buyers is far greater than the number of sellers and asset values have increased.”

This contrarian view, held by Green Street Advisors, says values hit bottom in the second quarter of 2009 and have since been recovering. According to the Green Street Advisors Lodging Property Price Index, after falling by 45 percent from their peak in 2007 to the second quarter of 2009, values are now up to 55 percent of peak value.

In addition to rising values, REITs are not the only investors with significant war chests looking for high-quality assets. “If all of the domestic groups say we have $1 billion, that's wonderful,” says Beider. “But the international groups have $1 billion, too. If their money is cheaper [to borrow than U.S. investors] they're the ones who are going to be buying assets.”

In fact, foreign equity has been the predominant winner of the few large deals that closed over the past 12 months. For example, Hong Kong-based Keck Seng Investments Ltd. last summer acquired the W San Francisco from Starwood Hotels & Resorts Worldwide for $90 million.

In March, however, LaSalle Hotel Properties bought the 237-room Sofitel in Washington, D.C., for $95 million at a reported 5 percent capitalization rate, the annual return to investors based on the net operating income and the purchase price. The acquisition was a good sign for U.S. hotel REITs because it proved they could compete with foreign buyers for trophy assets.

The deal also made a strong point about market sentiment, says Ralph Block, CEO of Essential REIT Publishing based in Westlake Village, Calif. “LaSalle figured there was going to be so much growth in room rates over the next several years that its internal rate of return would be very substantial.”