(Bloomberg) -- With informed discussion, creative thinking, and timely legislative action, Social Security can continue to protect future generations.

That boilerplate language has been featured more or less verbatim in the yearly status report from the trustees of the Social Security and Medicare funds since 2001, through Presidents George W. Bush, Barack Obama, and now Donald Trump.

It's the numbers that have changed dramatically, as the U.S. population ages. The 2003 report noted that “Social Security plays a critical role in the lives of over 46 million beneficiaries, and over 150 million covered workers and their families.” The report released late last week cites 61 million beneficiaries and 171 million covered workers and their families. That’s an increase of more than 32 percent and 14 percent, respectively, over 13 years.

The outlook for the program is pretty grim. The trust fund for Social Security's retirement and disability benefits will stop being fully funded in 2034, as projected last year. If no solution is found, promised benefits will take about a 25 percent cut. Medicare's hospital insurance trust fund is projected to suffer a similar fate in 2029.

That's a lot of Americans facing a lot of uncertainty. Add trends in income inequality and health care, and millions of Americans without workplace savings plans—or any retirement savings at all—and the report takes on a special, scary resonance this year.

While Washington fiddles, income inequality has risen to dizzy heights. Since 1980, there has been "a sharp divergence in the [income] growth experienced by the bottom 50% versus the rest of the economy," according to a December 2016 paper by economists Thomas Piketty, Emmanuel Saez, and Gabriel Zucman. The average pre-tax income of the bottom half of adults—117 million people—has been stuck at $16,200, adjusted for inflation, for more than three decades. The average pre-tax income of the top 1 percent was $1.3 million as of 2014, more than three times what it was in 1980.

Credit: Gabriel Zucman, University of California, Berkeley

Over the past 15 years, stock and bond investing has transferred a greater share of the nation's income to the top 1 percent, the Piketty study found. That top 1 percent now earn about 20 percent of the national income, while the bottom half earn 12 percent.

Now, on top of that, changes to the Affordable Care Act, or Obamacare, Medicare, and Medicaid could remove coverage or make it more expensive for millions of Americans, many of whom already face daunting challenges paying for health care, even as a trend toward high-deductible health plans (HDHPs) puts more of the responsibility for managing health care costs on workers. Medicaid, the government program for the poor and disabled, faces severe challenges in the Republicans' proposed replacement for Obamacare, which itself has seen a sharp rise in premiums and a narrowing of choices of insurer over the years.

All the while, the steady shift away from once-guaranteed income streams of defined-benefit pension plans to defined-contribution plans leaves the financial risks and responsibilities of saving for retirement squarely on largely unprepared individuals—and around 30 percent of the workforce doesn't even have access to those plans.

At the center of this storm, Social Security remains one of the few havens available to most Americans, one that is free from the vagaries of the financial markets and, to some extent, inflation. Without it, many elderly Americans would be living in poverty. U.S. Census data for 2016 show that more than 22 million people in the U.S. would have slipped into poverty without Social Security benefits. And it's not just the elderly who rely on Social Security checks. That 22 million figure includes 1.1 million children.

For all that, Social Security recipients aren't exactly rolling in dough. The average Social Security benefit is about $1,360 a month, or $16,300 a year. After Medicare premiums, a chunk of any Social Security check often goes to pay for so-called Medigap, or supplemental insurance that covers some of what Medicare doesn't. The percentage of benefit checks that goes to paying for health care will grow over time with health care inflation, which rises faster than inflation in the general economy.An annual report from HealthView Services, which makes retirement health care cost projection software, estimates that retiree health care costs will likely rise at an average annual rate of 5.5 percent over the next decade. That's more than double the company's projected cost-of-living adjustment (COLA) on Social Security benefits.

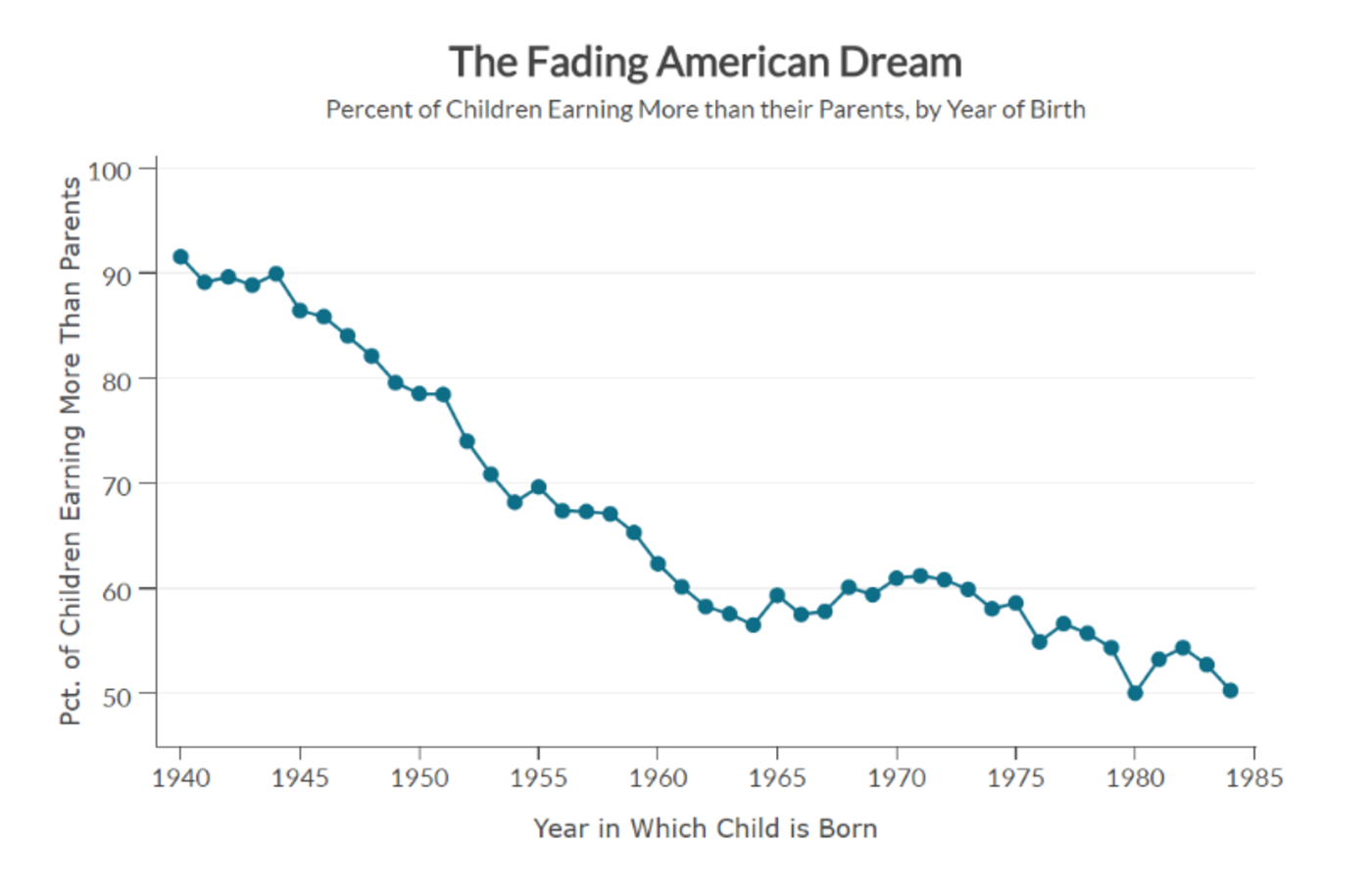

All of this is shrinking the definition of the American dream. Millennials in particular sound disillusioned. Over 50 years, “children’s prospects of earning more than their parents have fallen from 90 percent to 50 percent,” according to home page of The Equality of Opportunity Project, a research effort that analyzes income mobility. The Project is citing figures from a 2016 study, (PDF) The Fading American Dream: Trends in Absolute Income Mobility Since 1940.

Credit: The Equality of Opportunity Project

Fifty-one percent of the 18- to 29-year-olds who took part in a national poll released by Harvard’s Institute of Politics in late 2016 said they were “fearful” about the future of America. Those fears centered on the attainability of the American dream, with every demographic within the 2,150 people polled more fearful than hopeful. The groups with the most widespread anxiety about the future were white women, at 60 percent, and white men, at 54 percent. Separately, only 32 percent of white females think they will do better than their parents financially; just 36 percent of white men think they will.

That pessimism—or reality— extends to expectations for getting Social Security when they need it. Eighty-one percent of millennials worry that Social Security won't be there for them when they want to retire, according to a 2016 survey by the Transamerica Center for Retirement Studies. While there are a lot of data showing that millennials are good savers, there’s only so much one can save if economic opportunity and income mobility are limited.

A sturdier, more comprehensive safety net wouldn't ensure the American dream, but it would reduce the retirement dread.

To contact the author of this story: Suzanne Woolley in New York at [email protected] To contact the editor responsible for this story: Peter Jeffrey at [email protected]