Good news: When a worker retires, if certain requirements are satisfied, other family members may qualify to receive benefits based on the worker’s Social Security (SS) record. And not just the ordinary spousal retirement benefit we discussed in ”Social Security Spousal Benefits Simplified.” Your children can also get a benefit. But the bad news: There’s a maximum family benefit (MFB) that can severely limit the amount paid to other family members.

Here are the requirements and benefits applicable to family members at the worker’s retirement and the calculation of the MFB. In a subsequent article, we’ll look at how these things apply when a worker dies.

Hypothetical Scenario

Assume your client has been told that other family members may qualify for benefits based on his SS record. However, the amount of benefits will be subject to the MFB.

Your client is age 62 and has a $2,000 primary insurance amount (PIA) at his full retirement age ((FRA), assume age 66). His spouse is age 56. Her work history isn’t long enough to qualify for her own SS benefit. They have four children, two sons ages 19 and 16, and twin girls age 14. They would like to know the extra benefits they might get, how the MFB is determined and whether it will limit them.

Keep in mind that benefits are based on your client’s work record. For the spouse and/or children to receive a benefit based on the client’s work record, he must be receiving benefits himself or have reached FRA and “filed and suspended” his benefits. (See “Social Security Spousal Benefits Simplified,” for more information.

Child in Care Benefit

Now let’s take a look at all those potential extra benefits. Assume your client is receiving a $1,500 per month early retirement benefit at age 62. The spouse, on the other hand, has a problem. At age 56, she’s too young for a regular spousal retirement benefit. But because she has children under the age of 16, she may be entitled to a special “child in care” benefit.

Here are the requirements for the spouse to qualify for a child in care benefit based on the client’s SS record. The couple must be married for at least one year, and the spouse must be the parent caring for their child under the age of 16. If that’s the case, the spouse will qualify-- regardless of age-- for the child in care benefit. The benefit will be 50 percent of the client’s $2,000 PIA. She’ll only receive one child in care benefit at a time (total benefit $1,000), regardless of how many qualifying children she has. This benefit will terminate when the last child reaches age 16.

Benefits to Children

In addition to the child in care benefit, the children themselves may also be eligible for benefits.

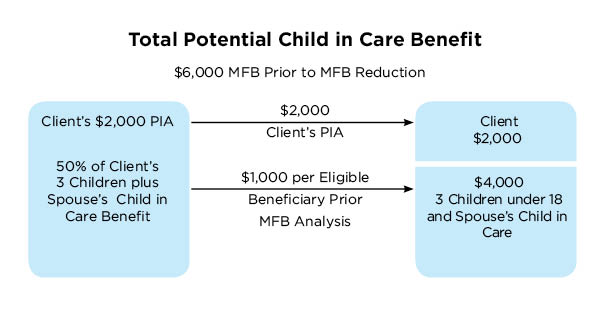

The three children under age 18 are eligible to receive benefits until age 18 (age 19 if still in high school). Benefits are paid directly to a representative for the children. The benefit amount before any MFB reduction would be $1,000 (50 percent of your client’s $2,000 PIA) for each of the three eligible children. The oldest child is already age 19 and, thus, not eligible.

In your client’s case, the three children under age 18 will each qualify for benefits. The spouse will qualify for a single child in care benefit for one of the twins under age 16. Thus, the total potential benefit is $6,000.

Now the bad news.

MFB Limits

The MFB is derived using a four-tiered “bend point” calculation. It can be complicated, but the resulting MFB is generally between 150 percent and 188 percent of the worker’s PIA. In this case, based on your client’s PIA, assume the number works out to 175 percent. Multiply 175 percent times the $2,000 PIA to get $3,500. Note that the MFB isn’t applicable if both spouses are receiving benefits based only on their personal SS records. It’s applicable in this case because the spouse won’t qualify for any personal benefits.

Benefits payable prior to or after FRA. If benefits are paid for early retirement (resulting in a benefit reduction) or delayed retirement (benefit increase), the current benefit is adjusted accordingly. But neither will affect your client’s MFB, which is based solely on his PIA. In this case, the MFB is calculated from your client’s $2,000 PIA, even though he took an early retirement benefit of $1,500. Had he instead waited until age 70 and received deferred retirement credits (DRCs) of 8 percent per year, he would collect $2,640 per month, but the MFB would still be based on $2,000.

Spousal benefit. The spouse isn’t eligible for a regular spousal retirement benefit until she reaches age 62. At that time, the reduced spousal benefit would be 35 percent of your client’s $2,000 PIA. It would be the full 50 percent if she were FRA or older. In this case, once she reaches age 62, the spouse can get either the regular spousal benefit or the child in care benefit. She’ll only qualify for the higher of the two. Either one would be included in the MFB calculation.

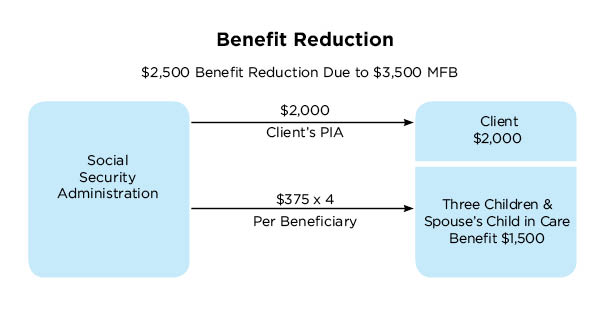

Now let’s take a look at the effect of the MFB. The $6,000 of potential benefits to family members will be reduced because the total exceeds the $3,500 MFB amount by $2,500. The client’s retirement benefit must be paid ($1,500), and his full $2,000 PIA must be charged to the MFB. That leaves just $1,500 of MFB remaining for the spouse and the children’s benefits.

Proportional benefit reduction. If the total benefits for the spouse and children exceed the MFB, those benefits will be reduced proportionally among the eligible beneficiaries. All four must be designated to receive benefits. The reduced benefit works out to $375 each per month ($375 x 4 = $1,500).

But over time, the situation will change. In two years, the 16-year-old son will reach age 18 and will no longer be eligible for a child’s benefit. And in two years, the 14-year-old daughters will reach age 16, thus eliminating the child in care benefit. But those two remaining beneficiaries (twin girls) would then have an increased child’s benefit. The benefit would go from $500 to $750 each ($750 x 2 = $1,500). So even after the two previous benefits terminate, there would still be enough benefit payable to use up the entire $1,500 MFB. In other words, the family as a whole will still receive the same combined benefit. Remember that the maximum for each beneficiary before MFB in this case is $1,000 apiece.

The earnings test. If any individual beneficiary has earnings in excess of the $15,720 earnings limit prior to FRA, the earnings test will apply. Excess earnings will cause a $1 benefit reduction for every $2 over the limit, although the limit is more generous in the year FRA is reached. See “Qualifying for Social Security Retirement Benefits,” for more information on the earnings test.

One additional note. Remember that for anyone to qualify for a benefit, the working spouse must be receiving benefits or have reached FRA and have filed and suspended his benefits. In this case, he retired at age 62 and took a reduced benefit of $1,500 for doing so. Had he waited the additional four years until age 66, his benefit wouldn’t have been reduced. But by then, all four of the children would be age 18 or older and thus not eligible for benefits. So unlike many workers, your client may have an additional incentive to file at 62 rather than FRA. He can always suspend his benefit when he gets to 66 and qualify for his 8 percent DRCs, albeit from a lower starting point.

Analyze the economics of each arrangement to determine the one that would be most desirable. Also, bear in mind that by delaying his benefits, your client is increasing the so-called “widow’s benefit” payable at his death.

Our next article will cover the MFB applicable to survivor benefits.