Sponsored by Brighthouse Financial

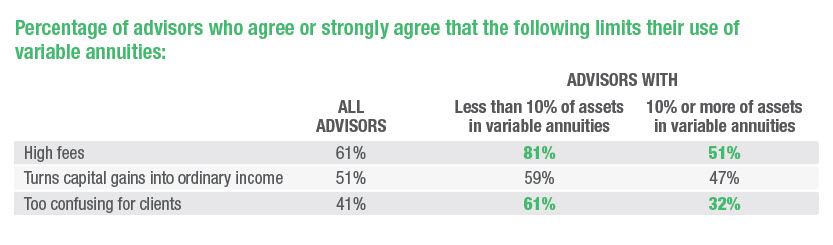

High fees remain the most common limiting factor to the use of variable annuities—six out of 10 advisors (61%) agreed that high fees limited their use of the product.

And yet, many advisors say fees were not a crucial factor when evaluating variable annuities. The role of high fees makes more sense when you separate the two groups of advisors by how much they currently use variable annuities.

It’s perhaps not surprising that advisors who are already using variable annuities less frequently would be more likely to see a particular factor as an obstacle. But the groups differed most strongly when it came to fees and confusion among clients, while the difference was less pronounced in terms of the unfavorable tax treatment.

For instance, among low-use advisors, 81% agreed or strongly agreed that high fees limited their use. Meanwhile, just 51% of high-use advisors felt the pinch from high fees—just a few percentage points above their next most common answer, which was the unfavorable tax treatment of variable annuities (47%).

Another big difference between these two groups: Low-use advisors felt far more strongly that clients were confused by variable annuities (61%) than did high-use advisors (32%). “They’re far too complex for most clients to understand and manage,” says one advisor from an independent RIA. “They’re complex for most advisers to understand and to remember details, and they’re far too cumbersome to manage.”