By Noah Smith

(Bloomberg View) --When most people think of wealth in the modern economy, they tend to think of stocks and bonds. The word “capital” is often synonymous with corporate ownership. Land wealth, meanwhile, is often relegated to a footnote. Yes, people own houses, but vast fortunes are made in the stock market, while the fates of nations rise and fall with the bond market.

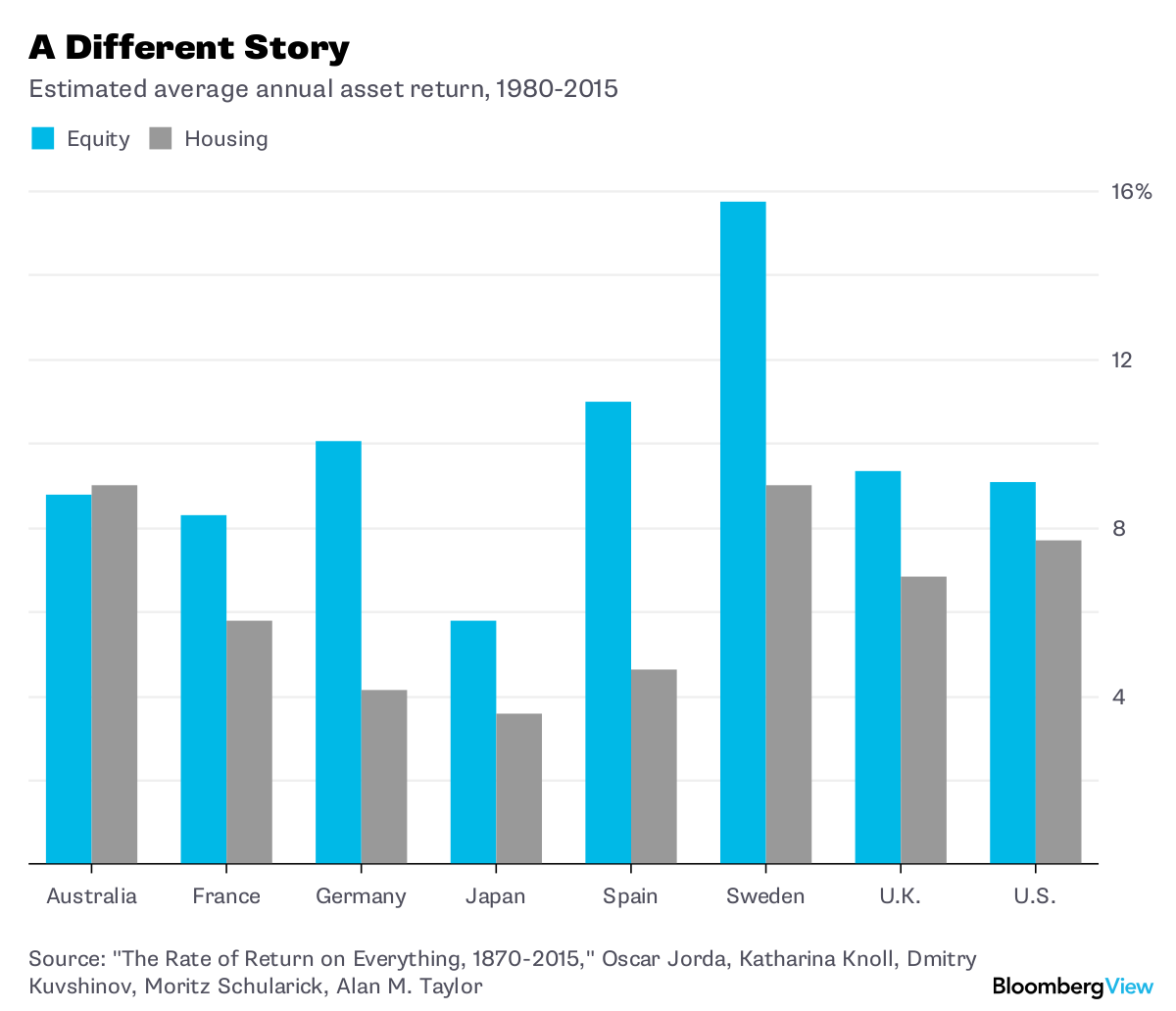

At least in the U.S., the bursting of the housing bubble has given some the idea that land appreciates more slowly than other assets. If one looks only at capital gains, stocks have outperformed housing by a wide margin in recent decades:

But ignoring land is a mistake. Despite the explosive growth of corporations since the Industrial Revolution, land still represents a huge percent of all the wealth in the economy. What’s more, focusing only on capital gains neglects the extremely important fact that land earns income from rent. If you live in your own house, this income is implicit -- living in your own home means you don’t have to pay rent to someone else. But if you’re a landlord, you get checks every month, just like stockholders receive quarterly dividends. And in the same way that a stockholder can use dividends to buy more shares, a landlord can use rental income to buy more property -- thus, rent needs to be counted in the return to housing.

And that total return is higher than people realize. According to new research, the return on residential real estate has been as high as or higher than the return on equity. As modern economies have grown and developed, owners of the ground on which we live have been steadily enriched.

In their new paper, titled “The Rate of Return on Everything, 1870-2015,” economists Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick and Alan Taylor compare stocks, bonds and housing over the past century and a half. Housing is by far the hardest asset to measure -- its price varies enormously from unit to unit and city to city, and records are hit or miss. Knoll and Schularick, together with Thomas Steger, have worked heroically to overcome these data deficiencies and create a long-term database of housing prices in advanced economies.

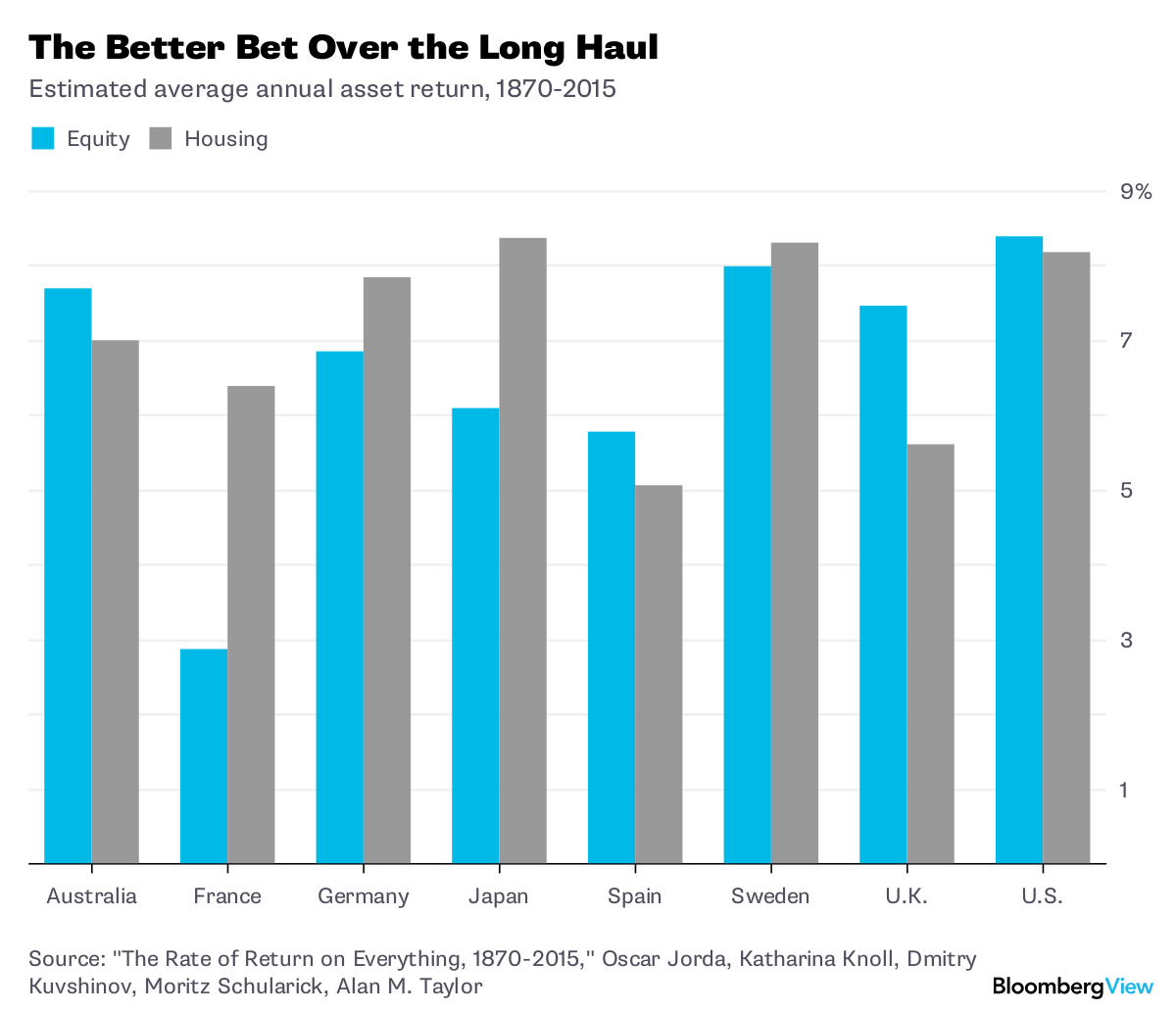

Here is a sampling of their results:

The U.K. is one of the few countries Jorda et al. survey where stocks have significantly outperformed housing over the long run. In most countries, the returns are comparable, and in some places such as France and Japan, housing has done much better. It’s much less volatile than stocks, too (though also much less liquid).

Now, there are caveats to this result. Data from the 19th century is notoriously patchy and unreliable -- Knoll and Schularick have done the best they can to abstract across differences in location, quality and data gaps, but there are always assumptions involved. Furthermore, it’s inherently difficult to compare the return on a real asset such as housing to that of a paper asset like stocks, where price changes are easy to document. Housing also involves maintenance costs, physical depreciation, vacancy costs, the cost of searching for tenants and capital losses to things like fire, flood and war. Knoll and Schularick make good-faith attempts to account for most of these factors, but they’re working with inherently limited data -- for example, houses that burn down simply disappear from the records.

Also, it’s important to remember that returns change over time. Stock markets have gotten more developed in rich countries in the past few decades, making it easier for small investors to put their money into equities. Here are Jorda et al.’s numbers for the period since 1980:

But even with somewhat different numbers, the broad lesson would be clear -- over the long term, housing has been a great investment. That doesn’t mean that investors should ditch their stocks and run out to buy houses -- liquidity is a real issue, property taxes are substantial and it’s harder to diversify a real estate portfolio than a stock portfolio. But it does mean that a wise investor should diversify into land by buying things like real estate investment trusts.

The more important implication, however, is for inequality. To some degree, housing acts as an equalizer between the rich and the middle-class, since the latter puts more of its wealth into real estate by virtue of buying homes. But many big landlords are very rich. And homeownership is a way that the middle class and upper-middle class pull away from the working class and poor, a larger portion of which can't afford to buy and must rent. The ownership disparity is also responsible for a big share of the racial wealth gap. As economist Matt Rognlie has found, the return to land is responsible for the lion’s share of the increase in wealth inequality documented by French economist Thomas Piketty.

So in order to address wealth inequality, it’s important to focus on land. Even after the rise of the modern corporate economy, unequal ownership of the most basic and ancient asset of them all is still creating big divisions in our society.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Noah Smith is a Bloomberg View columnist. He was an assistant professor of finance at Stony Brook University, and he blogs at Noahpinion.

To contact the author of this story: Noah Smith at [email protected] To contact the editor responsible for this story: James Greiff at [email protected]

For more columns from Bloomberg View, visit Bloomberg view