Clients of Bob Dreizler, a Chartered Financial Consultant with Sacramento, Calif.-based Protected Investors, probably suspect that he is an extrovert. It’s not that he sends his clients birthday cards; lots of advisors do that. It’s how Dreizler injects himself into the birthday card. A hobbyist photographer, Dreizler puts his image on the front and adds a handwritten message on the otherwise blank page inside.

Most of his clients find the practice charming, but more introverted clients probably don’t have the same reaction.

No one is a pure introvert or extrovert. All successful people can function in both camps, but most people are more comfortable communicating, interacting and making decisions in a certain way. The smarter you can be in recognizing how to make introverted and extroverted clients comfortable, the more successful you will be in serving those clients and getting referrals.

Shyness has nothing to do with it, nor do introverts have to be fixed or managed, says Devora Zack, author of Networking for People Who Hate Networking. “Introverts process the world by thinking through and even writing down their impressions, reactions and responses,” she says. Extroverts primarily process verbally—discovering what they think through discussing thoughts as they express them. (See the sidebar, “Six Myths about Introverts.”)

When it comes to meeting clients or prospects for the first time, Dreizler has a strategy to assess whether they are introverts of extroverts. The first question he asks is, “Why did you come to see me today?” And then he waits. This type of open-ended question usually reveals the client’s preferred communication style, a good clue about their comfort zone.

If clients are reflective, comfortable with silence, but then succinct and to the point in their responses, chances are good that Dreizler is dealing with an introvert. On the other hand, “extroverted clients will start talking right away in an attempt to figure out what they really want to accomplish. Likely the client will offer generalities and too much information. The advisor will need to help these clients focus and prioritize. The takeaway: Introverts “think to talk,” and extroverts “talk to think.”

You’re an Extrovert, Aren’t You?

If you’re reading this article, chances are you’re an extrovert. Upwards of 65 percent of registered financial advisors working on the retail level are extroverts, according to estimates by a number of social scientists.

A 2005 study conducted by Professor Adam Grant, who teaches management at the Wharton School of the University of Pennsylvania, of 4,000 managers at U.S. companies found that 96 percent of people in supervisory positions exhibited extroverted personalities. That makes sense because as relationship management becomes more important than asset management, extroverted reps have a certain advantage in promoting themselves in a crowded, noisy world. The study relied on self-reporting based on well-accepted qualities of introverts and extroverts.

On the other hand, introverts probably perform a little better than extroverts in actually managing assets. Researchers have found that introverted investors register better overall investment returns. Investors who exhibit extroverted tendencies tend to be impulsive, overconfident in their investing abilities, overoptimistic about market conditions and more likely to gravitate towards short-term investing. Yet, the actual performance returns of extroverts are significantly lower than that of introverted investors.

These patterns implicate advisors and money managers, too. “There is an inverse correlation between extroversion and investment returns,” says Richard Peterson, a psychiatrist and financial advisor at MarketPsych in Westport, Conn. “Advisors who score higher on extroversion tend to score lower on performance.” The correlation is not beyond dispute, but it is significant, Peterson says.

This disconnect between extroverts and introverts is most significant in relation to risk tolerance. Extroverts have more difficulty resisting the temptation of the “sure thing.” When extroverts actually buy something that takes off, they are more likely to sell out too early. Research shows that introverts take 28 percent less financial risk than extroverts. No one should be surprised that Warren Buffett, the poster child for prudent investing, is a confirmed introvert, often retreating to his study to plot his next investment move.

Know Your Audience

An advisor almost needs two different pitchbooks. The key to success is to know who you’re dealing with. For extroverted clients, the pitch should be less on the numbers than the advisor’s enthusiasm and energy. For introverts, the presentation should emphasize the numbers, analytics and models.

Eric Howie, managing director of Beacon Pointe Wealth Advisors in San Jose, Calif., notices that the referrals of his more introverted clients, while fewer in quantity, tend to be higher in quality than the referrals from extroverts. Howie speculates that referrals from introverted clients pack more credibility precisely because they are more circumspect and often have real consideration behind them.

Howie also notices that introverted clients are much less likely to attend the client appreciation events he organizes. These events by their very nature tend to push introverts outside their comfort zone. He has found good results by making a few adjustments. First, he reaches out personally via telephone instead of email. Second, he makes sure that staff is assigned to cover all clients, especially the introverts. He has also learned that giving introverted clients a small task makes them feel much more comfortable because introverts tend to welcome structure. The task can be as simple as handing out nametags.

Many advisors like working with introverted clients. “One of the things I want to understand is the money mentality of my clients,” says Rebecca Bar-Shain, an advisor with Cedar Brook Financial Partners in Mayfield Heights, Ohio. “Introverts can often give me a coherent statement about what they want to accomplish.”

Rate Yourself

Are you more of an extrovert than an introvert, or is the reverse true? Experts agree that everyone—advisors and clients alike—operate on a continuum and incline toward one extreme or another depending on the context. Yet self-examination can reveal your preferences. Just ask yourself the following questions:

• How often do you think, “The more the merrier?” Extroverts get energy from a lot of people. For introverts, big groups tend to be draining.

• What are your hobbies? Do you run alone or in a running group? If you prefer reading or collecting stamps, chances are you are introverted. Being alone is an activity for introverts. If you spend recreational time in a theater group, ballroom dancing or a basketball league, chances are, you’re an extrovert.

• Do you prefer watching or participating? Introverts tend to be happier watching; for extroverts the reverse is true.

• Do you seek out facts contrary to your opinion? Extroverts tend to be overconfident in their beliefs and resist inconvenient facts. Introverts tend to be more analytical and reflective. Contrary facts are just more grist for the mill and do not threaten.

• Do you prefer to let ringing telephones go to voice mail? Introverts often resist answering telephone calls, finding them intrusive. Extroverts often welcome the interruption.

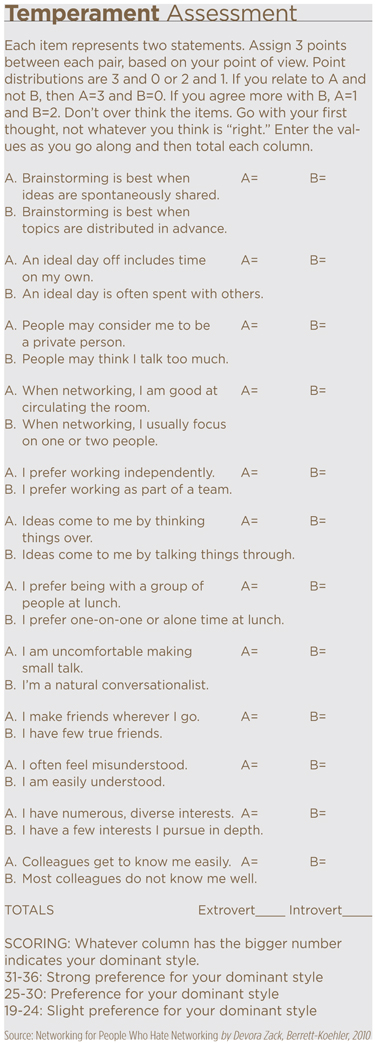

If you want to get a more accurate reading of where you are on the continuum, here are two more options. You can take a free MarketPsych Trader Personality Test at www.marketpsych.com. (Registration is required.) The 74-item assessment is fun, fast, and reveals your position on the extroversion scale (very-low, low, below-average, average, above-average, high or very-high). Or, even more simply, you can take the I/E Temperament Assessment.