Financial advisors who start their own RIA practices find themselves surrounded with a host of responsibilities that may be new to them, especially if they are jumping over from, say, a traditional broker/dealer.

“Independence is lonely,” says Stuart Silverman, chairman emeritus of Fusion Advisor Network, an Elmsford, N.Y.-based practice management and business consulting group, acquired last summer by NFP Advisor Services Group. “A lot of these firms tend to spend their time reinventing the wheel. If you’re a small business owner and entrepreneur, you’ve got to do everything from create your own marketing, to run your own P&L, to hire your managing staff.”

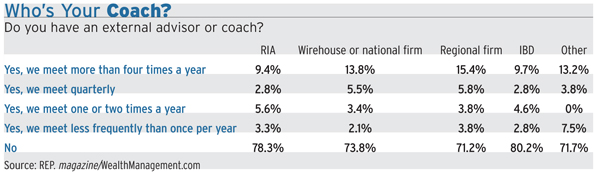

Despite those challenges, obtaining help from outside sources isn’t always top of mind for registered investment advisors. A survey of 180 RIAs this year by REP. magazine/WealthManagement.com found that just 21 percent were using an outside advisor or coach at least part of the time, compared to nearly 25 percent of advisors at wirehouse or national firms and nearly 29 percent at regional firms.

Philip Palaveev, chief executive of The Ensemble Practice, a consulting group in Seattle, says there’s a greater likelihood that wirehouse and regional advisors will use in-house coaching services, since those offerings are endorsed by the management. There are no third parties steering RIAs to those services, he says.

Yet some RIA practice owners feel the need to seek out business advice if they’re looking to get their practices to the next level, Palaveev adds. These advisors envision their businesses as being larger and more sophisticated entities that can function on their own some day without the advisor himself at the center, he says—a factor that’s important when trying to sell the business.

Silverman agrees that some RIAs want to take the long view. “They’re the ones who say, ‘I really want to build a business, I want to make this a machine that’s not dependent on me,’” he says.

It’s not a problem of time or money constraints, he says. There is plenty of profitability at medium and large firms, and predictability of revenue streams. But some firms that find themselves in that groove may not see any necessity for seeking outside advice, he says.

“I see a lot of firms that let the business happen to them. People get set in their ways; people get lazy. Some people just don’t want to change. I know firms that say, ‘Yeah, we know we can do it better, but I like my quality of life.’

“It’s legitimate to a point,” Silverman says. “But if you’re going to be going to work every day to do this, why not build a really valuable asset? And why not build one that’s transferable?”

It’s often easier for an outside observer to look objectively at the performance of the advisor and his practice, he says. At firms with multiple partners, each principal can hold the other accountable for the work that needs to be done. In solo practices it’s easier to head off on tangents. A coach can keep an advisor on track with the plans they set up.

“The firm has to be willing to use the ideas,” Silverman adds.