While gift planners understandably prefer the charitable remainder trust’s (CRT) flexibility in the design of the commencement and duration of payments, the charitable gift annuity (CGA) can be surprisingly effective as well. The acceleration of both long-ago and recently funded gift annuities can achieve a donor’s philanthropic and financial goals.

Surrendering the Right to Payment

For those who established annuities years ago, the subsequent very low inflationary environment has preserved much of their purchasing power from the annuity payments. Further buoyed by still strong capital markets, an annuitant might feel quite comfortable gifting the right to either all or a portion of future payments to the charity issuing the gift annuity. The surrender permits the charity to use the residuum for the donor’s charitable purposes specified in the annuity agreement. Of course, the gift annuity agreement should clearly specify that the annuity may be assigned to the issuing charity. If the agreement merely states the annuity is non-assignable, then there’s the theoretical issue of whether the annuity is assignable to the charity. You can remove that uncertainty by seeking a private letter ruling.

The amount of the charitable gift will be the present value of the foregone payments using the charitable midterm federal rate for the month of the assignment. However, the charitable deduction may not always equal the foregone payments. The deduction should be the lesser of the: (1) amount of the gift, or (2) unreturned investment in the contract. Internal Revenue Code Section 170(e)(1)(A) denies the charitable deduction for the gain; namely, the ordinary income element and any unreported capital gain.1

Commutation Tax Consequences

Let’s examine these tax consequences of a commutation with the following example:

In April 2010, a 72 year old contributed $100,000 in cash for the right to receive $5,900 for life. Using the applicable federal rate (AFR) of 3.2 percent, the donor is entitled to a deduction of $40,709. Five years later in April 2015, the donor decides to surrender the rights to payment of the entire annuity to provide cash for the capital fund drive of his community hospital. Using the AFR of 2 percent, the present value of the annuity is $54,122. Through April 2015, $36,798 in basis has been unrecovered. Our donor will be able to deduct $36,798, which is $17,324 less than the present value of the gift at the time of commutation.

Applicable AGI

Our next question is: What’s the applicable adjusted gross income (AGI) limitation? That is, what has the donor contributed? The answer isn’t as straightforward as you might instinctively believe.

Revenue Ruling 86-60 concluded that the assignment of a right to payments from a CRT was a capital asset with the charitable contribution to be valued at fair market value at the time of commutation.2 Is the waiver of the right to future payments of cash a gift of a noncapital asset and thus subject to the 50 percent of AGI limitation? Does it matter if the CGA was originally funded with long-term capital gains property? Interestingly, there doesn’t appear to be legal authority specifically addressing these questions regarding a CGA. If the CGA were funded with cash, a 50 percent limitation should be correct.3 If the CGA were funded with an appreciated asset, the applicable limitation should depend on whether the annuitant has been taxed in full on the capital gains at the time of the waiver of the right to future contributions.4 If there’s no more capital gains to be taxed, then the 50 percent limitation governs. If there’s still more capital gains to be taxed, the 30 percent limitation will apply.5

Commuted Payment Gift Annuities

Unlike a CRT, whose duration may be for a term of years not to exceed 20, a CGA can be paid only as a single life annuity, a joint and survivor annuity or a two lives in succession gift annuity.6 Nevertheless, a number of PLRs and a General Counsel Memorandum clarified the tax consequences of a CGA agreement permitting the commutation of a deferred gift annuity for either: (1) installment payments for a number of years certain, or (2) a lump sum amount.7 The recipient of the payments may be either the donor or a donee selected by the donor.8 The recipient was entitled to a lifetime payout but had the ability to sell or assign the right to the CGA payments to the issuing charity or a third-party selected by the donor in exchange for either a lump sum or installment stream.

Let’s examine two circumstances when the commuted payment assists the philanthropically minded client to achieve priority financial planning goals, such as enhancing retirement income or financing the cost of higher education for a family member.

Improving Cash Flow in Retirement

In the first scenario, the donor seeks to improve her retirement income for a short period of time to tide her over until the commencement of a larger Social Security benefit (either at normal retirement age or later). For example, Sarah, age 62, will receive through age 67 a buyout as part of an early retirement program. Were she to commence her Social Security benefits at either age 62 or 67, the amount would be less than optimal in addressing her expenses. She also would like to continue her charitable giving. A commuted payment annuity would work well here. Sarah funds the CGA now with the payments to commence in five years and be paid over seven years. These payments of $11,734 provide enough after-tax income so that Sarah can wait until age 70 and, thereby, maximize allowable Social Security benefits, which will be increased by 8 percent annually from age 67 to age 70.9

The net result is that Sarah has not only made a deductible charitable gift of $33,750 reducing her taxes by $9,450, but also received $82,138 in payments from the commuted payment annuity that enabled her to maximize her Social Security benefit.

Financing Professional Education

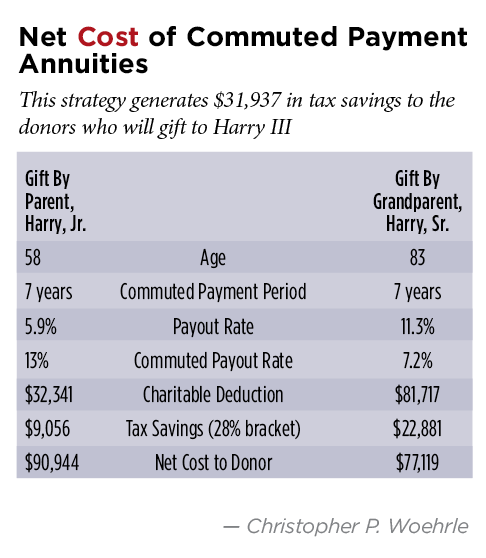

In the second scenario, a parent or grandparent would like to fund over time the college and professional education of a child or grandchildren. For example, Harry Jones III,

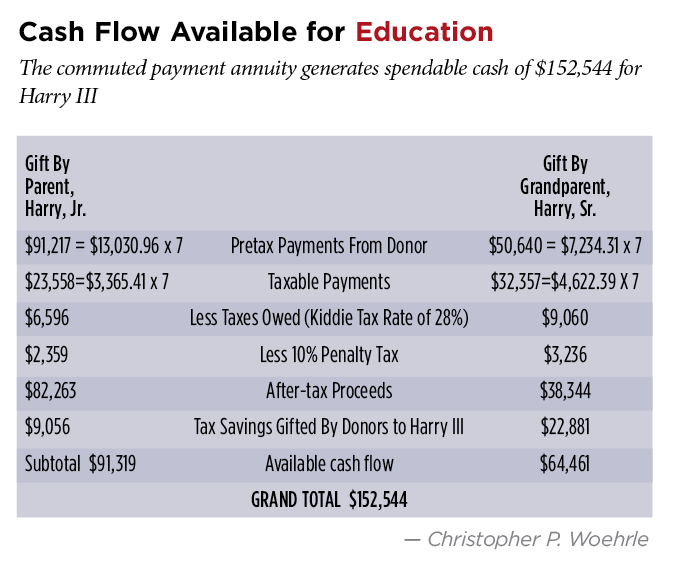

age 10, has been identified as academically gifted. It’s anticipated that he’ll ultimately be accepted into a 7-year joint BS-MD program at the state university. Harry’s parent (Harry Jr., age 58) and grandparent (Harry, Sr. age 83) would like to provide some support so Harry III won’t be burdened by student loans, which average between $160,000 and $190,000 for recent medical school graduates.10 They would like Harry III to feel comfortable practicing in an area of genuine interest, even if it’s not the most lucrative specialty. His debt load will be modest compared to his peers, as he’ll have funds of $154,544 contributed to him by his family in a tax-savvy manner. See “Net Cost of Commuted Payment Annuities,” p. 12, for the calculation. This amount includes $31,937 ($9,056 + $22,881), as Harry Sr. and Harry Jr. will be gifting their respective tax savings. See “Cash Flow Available for Education,” p. 12 for the calculation. By minimizing the student loan indebtedness of Harry III, both his parent and grandparent believe he’ll be more inclined to follow his professional interest.

Harry III and his family, however, must navigate income and transfer taxes.

Income taxes and penalty owed by Harry III. The annuity payments to Harry III are unearned income subject to the “kiddie tax” (that is, a tax applied to a child’s unearned income of more than $2,100) until Harry III becomes 24, as it’s highly likely he won’t be providing more than half his support during his undergraduate and professional training. The taxable portion of each annuity distribution triggers a 10 percent premature

distribution penalty tax.

Gift tax consequences for Harry Sr.’s and Harry Jr.’s gift. Each has made a taxable gift to Harry III though each’s unused unified transfer tax exemption will be

sufficient to eliminate the need to pay a gift tax.

Gift and generation skipping transfer (GST) tax for Harry Sr. ’s gift. Harry Sr. made a GST because Harry Jr. is alive at the time of the transfer to Harry III. Of course, Harry Sr. likely will have available a sufficient amount of his GST tax exemption of $5.43 million, so that no tax will be owed.

The weak point of this plan is a non-tax risk. The payments are beyond the donor’s control: Harry Sr. and Harry Jr. are relying on Harry III to adhere to the purpose of the payments. Harry III might later decide not to earn a professional degree. Harry Sr. and Harry Jr. most likely would establish a trust mandating that funds received will be paid only for education. Because the trust would be acting as the agent for Harry III, there would be no immediate taxation of the deferred payment annuities.11

Commutations of CGAs can be a way to begin “charity at home” and end it (early) for charity!

Endnotes

1 Internal Revenue Code Section 170(e)(1)(A) and IRC Section 72(a).

2. See Revenue Ruling 86-60 citing Treasury Regulations Section 1.170A-1(c)(1), which requires a charitable contribution other than money to be valued at fair market value at the time of contribution.

3. IRC Section 170(b)(1)(A); Treas. Regs. Section 1.170A-8(b).

4. IRC Section 170(e) (1)(A).

5 Because a portion of the unreturned investment is taxed as capital gains, IRC Section 170(b)(1)(B) should govern.

6. See IRC Section 514(c)(5)(B).

7. See General Counsel Memorandum 39826

(Aug. 27, 1990) concluding that a college selling deferred annuities doesn’t incur unrelated business income within the meaning IRC Sections 511-513. See Private Letter Ruling 9407008 (Nov. 12, 1993), in which the donor could assign the right to payments so long as the assignment was made before commencement of the first annuity payment.

8. General Counsel Memorandum, ibid, noted in its summary that the recipient of the annuity payments was contemplating use of the funds for college, but there was no requirement in the gift annuity for the funds to be so used.

9. 42 U.S.C. 402(w)(6)(D) authorizes a delayed retirement credit rate of 2/3 of 1 percent per month for each year of work between normal retirement age and

age 70.

10. Association of American Medical Colleges, “Physician Education Debt and the Cost to Attend Medical School, 2012 Update” (February 2013), Table 1 and

Figure 1, at p. 3, https://www.amc.org/download/328322/data.stateddebtreport.pdf.

11. IRC Section 72(u) provides that the holding of an annuity by a trust as agent for a natural person shall be treated as if held by a natural person. See Private Letter Ruling 9699057 (June 24, 1996) for the factors examined by the Internal Revenue Service in concluding that a trust was acting as an agent for a natural person.