For many RIA firms, the technology stack is a mess. It’s the reason why “integration” is such a wealth management buzzword.

Mike Kerins had this realization while thinking through his plans to launch a robo advisor, an idea he eventually pitched to Franklin Templeton where he worked as the head of asset class research.

Though they weren’t keen on the idea at the time, Kerins kept thinking about what kind of product he would like to build. He envisioned a goals-based robo with institutional-quality investment management tools and one that could handle all of an advisor’s technology needs.

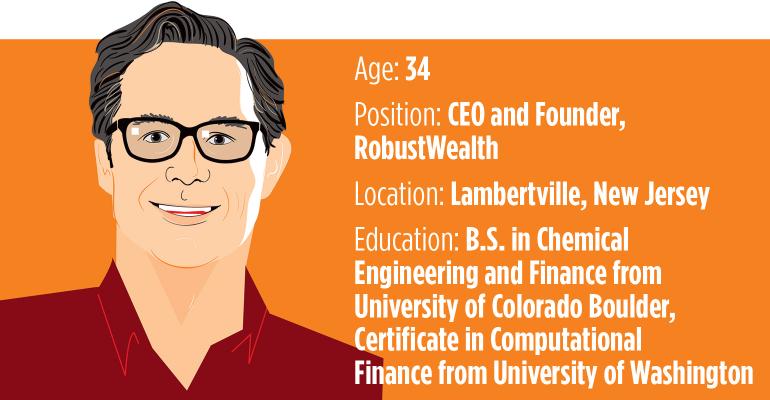

Kerins left Franklin Templeton in 2015 to form RobustWealth, a company he believes accomplishes these three goals. In addition to providing many of the capabilities now standard in white-label robo advisors – paperless account opening, client portal, automated rebalancing, financial planning and tax-loss harvesting – RobustWealth also provides resources for advisors to build a customized website, client communications, billing services, and the ability to create a custom, tiered fee schedule.

Kerins believes it’s these capabilities that set RobustWealth above incumbents like Jemstep, Schwab Institutional Intelligent Portfolios or Betterment for Advisors.

“The robo market for the advisor side is going to explode, but I don’t think the advisor is that well-built,” Kerins said.

For starters, RobustWealth can accommodate in-kind transfers, making it easy for advisors to transfer existing holdings over to the digital platform without much effort or incurring taxes. RobustWealth also lets advisors create their own investment models; the lack of customizable portfolios is a common complaint about many of the white-label robo options available. With just a few clicks, an advisor can create a custom target date strategy and assign this to any or all of their clients.

“We allow them to continue to handle these complex situations, but more efficiently,” Kerins said.

RobustWealth is giving its technology stack away for free, and then charging 20 basis points for access to the robo advisor, investment strategies and trade implementation. Because of this, Kerins says RobustWealth is designed for firms of all sized – from complete startups to established firms. He says the company’s smallest client has yet to attract its first assets, while the largest is an RIA with $400 million under management.

The company currently sits on top of TD Ameritrade’s custodial services and is on the Fidelity’s platform as a sub-advisor while it wraps up integration. Kerins says integration with a third custodian is on the way. The company is also putting together an advisory panel of well-known industry executives that it plans to announce soon.

Eventually, Kerins would like to add alternative investments and individual securities to the platform, as well as a turnkey 401(k) solution for advisors.

Kerins is confident that RobustWealth can make a splash in the industry despite an increasingly crowded market of robos. The goal was to attract $1 billion AUM by the end of the first year, and as the company just on-boarded $35 million in a single week, he believes RobustWealth is on pace to shatter it.