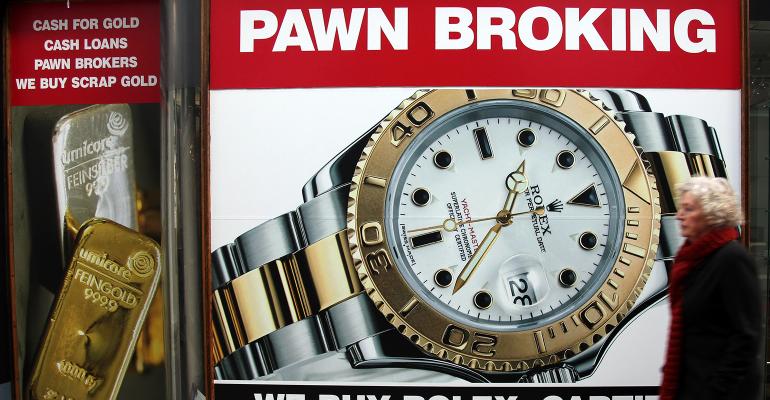

Contrary to popular belief, it’s not just folks down on their luck who need a quick buck that are flocking to pawn shops. Wealthy people looking to fund new ventures or add to their growing art or collectible collections are increasingly using high-end pawn shops for fast access to cash. According to CNBC, a handful of lending companies are tapping into the trend of letting their affluent clients take quick thousand-dollar or million-dollar loans with collectibles as collateral. For instance, a client of Luxury Asset Capital used his watch collection to seal a commercial real estate deal. Because no bank would provide the client a loan in the short time window needed, he mailed in “four very, very high-end luxury” watches in exchange for $400,000 in just 48 hours. “Oftentimes if I talk about my business, the assumption is that people borrowing money from you, they must be in a bad spot. That’s simply not true,” Luxury Capital Asset CEO Dewey Burke said. “We also and more often deal with business owners that are growing.”

Morningstar Launches Quant Rating

Morningstar has introduced its new Quantitative Rating, which uses machine learning to assign a rating to mutual funds and ETFs not covered by the firm’s analysts. Morningstar analysts currently cover 1,800 mutual funds and ETFs, while the Quantitative Rating will cover more than 10,000 funds across 30,000 share classes in the U.S. The new rating system will incorporate the decision-making processes of manager research analysts, their past rating decisions and the data used to support those decisions. The scale for the Quant Rating is the same: Gold, Silver, Bronze, Neutral and Negative. “We’ve trained our machine-learning model to emulate how our analysts make decisions, greatly expanding fund coverage and the proven insights we provide to investors,” said Lee Davidson, Morningstar’s head of quantitative research.

Mercer Advisors Crosses $12 Billion Mark

Mercer Advisors, one of the biggest national registered investment advisors in the country, recently crossed the $12 billion mark in assets under management with its largest acquisition to date. The RIA announced Monday it had acquired Traust Sollus Wealth Management, a firm with offices in New York City and Princeton, N.J. that cater to high-net-worth individuals and has approximately $420 million AUM. The two new offices bring Mercer Advisors’ total to 29 offices.