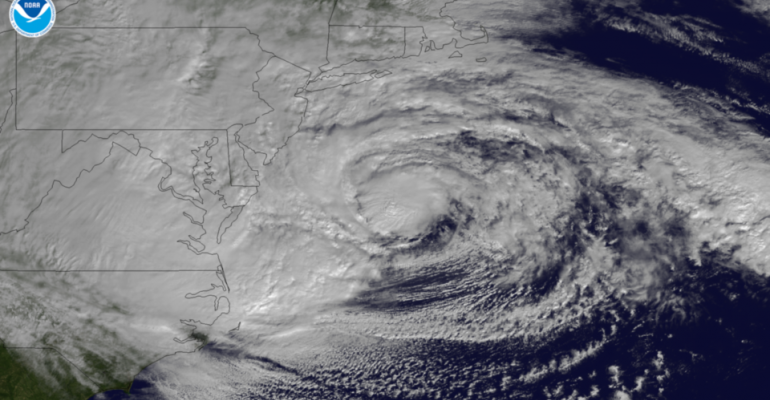

Hurriance Sandy pounded the eastern coast of the U.S. today, closing stock markets and bringing business to a halt for a significant portion of the country. Some are predicting the lethal storm could inflict some $6 billion to $20 billion in total damages and leave millions without electricity. President Barack Obama declared a state of emergency for much of the affected areas.

New York City shut down mass transit service at 7 p.m. Sunday, and schools were cancelled for both Monday and Tuesday. Airlines cancelled more than 12,000 flights and Amtrak suspended service throughout the area; Philadelphia, Washington D.C. and Baltimore have all suspended public transportation.

Most businesses and non-essential government offices have also shut down for the duration of the storm, predicted by some to be the worst to hit the East Coast in a generation.

Morgan Stanley Wealth Management has closed about 109 offices along the East Coast, according to the Wall Street Journal, but all client call centers remain open and clients have online account access. UBS has closed around 50 offices, but operates on a "buddy branch" system, where calls to a closed branch are rerouted to another office in a different geographic region. Wells Fargo too has closed some offices and instituted a "buddy branch" system, according to the Journal.

The storm also brought most financial trading to a halt on the East Coast. The New York Stock Exchange was closed for the first time in 27 years due to inclement weather. The markets will also be closed Tuesday, according to early media reports. Bond markets closed at noon on Monday, and won't reopen Tuesday. "It doesn't make sense to put people in harm's way or to only have half a market," Nicholas Colas, chief market stategist at CongergEx Group in New York, told Reuters. "If just the electronic market was open, that wouldn't provide enough interest with everything else still closed."

The last time the market was closed for weather-related reasons Sept 27, 1985, when officials closed the exchanges in preparation for the landing of Hurricane Gloria. The New York Stock Exchage has never been closed for two consecutive days for weather related reasons.

On January 8, 1996 the opening of the New York Stock Exchange was delayed until 11 a.m. due to a snowstorm that hit the east coast. The exchange opened briefly and closed again at 2 p.m.

Since then, with the exception of the four days following the Sept. 11 terrorist attacks, the stock market has had only six other instances of unplanned closings, ranging anywhere from a few minutes to hours, due to "market irregularities" and computer glitches.

It's too early to say what damage the storm will inflict on property and businesses, and while insurance coverage is important, it's likely not going to cover the extent of the damage in all situations. Advisors should be telling clients to keep good records of all damage to property, including photographs, and to keep documents stored in a safe place.

Less certain is the effect of the hurricane on gas prices: the Consumer Energy Report predicts gas prices will fall in the aftermath of the storm, considering falling demand for fuel.

Insurance companies like Chubb, Travelers and Allstate are expected to take a hit when trading resumes, though some analysts that could be a buying opportunity. KBW Insurance analyst Cliff Gallant told CNBC Monday that dealing with risk "is what these companies do" and any post-disaster dip is usually followed by a rebound. Reinsurers, many owned by Warren Buffet's Berkshire Hathaway, could also see downturns in value in the immediate wake of the disaster.

In London Monday, the insurance sector of the STOXX Europe 600 Index dropped 1.6%, comapred to an overall drop of .7% in the wider index.

Sam Stovall, cheif equities strategist at Standard & Poor's, points out in a research note on Monday that stocks usually rise in the aftermath of major storms. Of the 13 worst hurricanes in U.S. history, only Ike in August of 2008 and Hugo in 1989 saw stocks that ended the following three- and six-month periods in negative territory.

The median six-month gain in equity markets following major hurricanes was a positive 6 percent. Indeed, Stovall points out that equity markets are typically driven by broader global events than localized natural disasters. But the paniced selling during a hurricane can open some windows of opportunity.

Here, some useful links to follow the progress of the storm and its effects:

Sandyfeed is a useful Tumblr-style roundup of observations from those affected from the storm.

Google's Crisis Map is a crowd-sourced map of the hurricane's projected path, weather conditions, shelters and emergency resources.