There are many reasons why one decides to invest in a particular investment – promising fundamental outlook, technical signals, emotional attachment, or learning.

A few years back my wife and I decided to educate my step-daughter on investing. We determined the best way to teach her is to invest in a company that she could follow. Knowing that she loves Disney, we invested a monetary gift she received in shares of the company. Since our primary objective was to teach her about the fundamentals of investing, we made the purchase without looking at one piece of analysis.

Months later we believed we accomplished our objective. In addition to the excitement of the increasing value in the shares, she also enjoyed walking around DisneyLand, saying she “owned Disney”.

Another type of investment analysis that has been growing in popularity over the years is based on investing in socially and environmentally responsible companies. Historically, this investment strategy was referred to as “socially responsible investing” (SRI), in recent years this strategy has evolved to “environmental, social and governance” (ESG) investing.

Investing with a consideration of ESG factors was thrust into the spotlight when President Trump decided to withdraw from the Paris climate agreement. Reducing carbon footprints have gained great corporate momentum over the years. Though the announcement made for a somber day around the globe, it will not slow that momentum. Investor actions will have a bigger role in pushing corporations to reduce carbon footprints, even if governments fail.

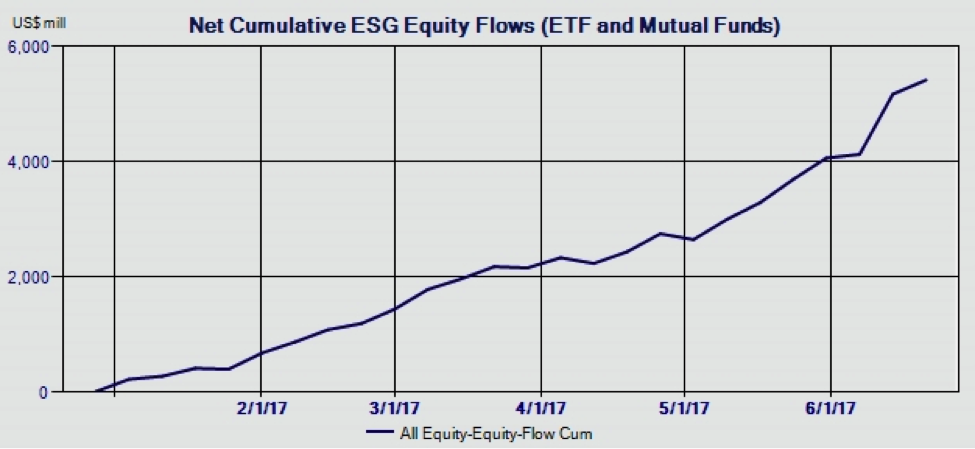

According to EPFR Global, investors continue to pour money into SRI/ESG mutual funds and ETFs. Ending From the beginning of the year to June 21, investors funneled over $5.4 billion into SRI/ESG funds. Investors poured an additional $1.35 billion into SRI/ESG funds since June 1.

In a recent Wealthmanagement.com survey, over 600 financial advisors provided insight on the driving forces behind the demand for SRI/ESG investing. Sixty-five percent of the respondents said they offer SRI options to their clients, with most of the demand being driven by Millennials. Environmental concerns are the No. 1 concern driving clients to SRI funds, followed by human rights and traditional negative screens such as guns, tobacco and gambling.

The number of SRI/ESG investment options for individuals is also growing. In the same Wealthmanagement.com survey, financial advisors were asked what investment vehicles do they use to gain exposure to SRI/ESG strategies. Mutual funds are the most commonly used product at 77 percent, while ETFs (40 percent) and separately managed accounts (28 percent) were also mentioned.

In fact, the use of SMAs is growing throughout the market, but they are particularly useful for investing in environmentally conscious companies. Investors may have different ideas of what constitutes a socially and/or environmentally conscious company, so the transparency and customizability of SMAs helps with the ambiguity of SRI/ESG classifications, as opposed to being locked into one particular manager’s definition.

Below are some of the top performing SRI/ESG managers over the past five years, according to the PSN Global Manager Neighborhood database. As you can see, these strategies hold their own based on return, risk and return-risk metrics against the broad, S&P 500 index.

Ryan Nauman is a VP, Product and Market Strategist at Informa Financial Intelligence. His market analysis and commentaries are available at www.informais.com/blog.