You'd think, after the year we've had, that the mutual fund industry would have taken a giant red pen to its collective product line. This market transition was, hopefully, a once-in-a-lifetime event, creating a unique opportunity to revisit nearly every great, or not-so-great, product decision with a clear eye.

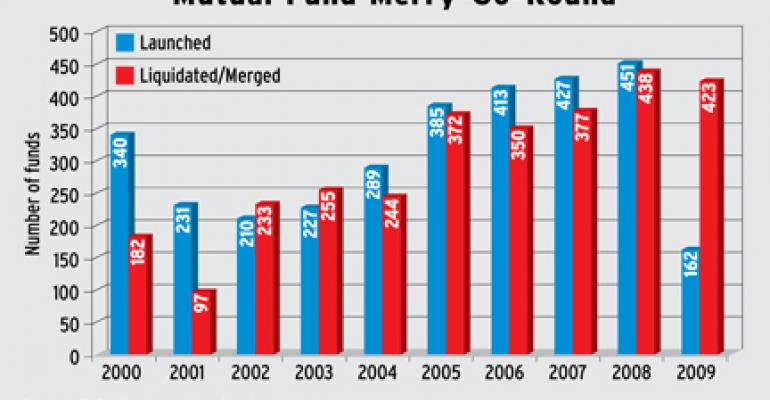

Fund companies have been more aggressive about eliminating products this year than in recent years, liquidating more than 400 funds overall, according to FUSE Research. Nonetheless, the total number of mutual funds available to US investors has hovered around 8,000 for almost a decade.

Since 2000, the industry has launched 3,135 open-end mutual funds, and merged or liquidated 2,971 funds, for a net gain of 164 open-end mutual funds, according to FUSE Research and Morningstar.

Some of the funds launched during this period were truly innovative and valuable to investors — and that is a good thing. Target date funds, for example, may have kept many timid investors exposed to equities during this recent rally.

But investors have seen more than 6,000 mutual funds come and go over the past nine years. They — and their money — have been impacted by proxy votes, portfolio manager assignments and reassignments, pricing changes, and more.

All of this activity costs investors money, of course, and usually by the time a fund is targeted for merger or liquidation it has hung around at the bottom of its peer group for too long, which hurts investors even more.

So we see opportunity for fund companies to be more proactive about product line trimming. Certainly, with all the fund company mergers taking place we will see continued consolidation of duplicate funds. That will bring some additional product line rationalization. The industry should also take a closer look at those long-term laggards. As of September 30, 2009, there were 304 long-term open-end mutual funds that had sported a 1 or 2 star Morningstar rating for 36 months. Perhaps that is a good place to start.

Product line trimming brings many benefits, including a focus on core competencies, a more efficient due diligence process at wholesaling and distribution organizations, and more concentrated flows to the surviving funds.

This benefits fund companies by creating more profitable products, and benefits investors by allowing funds to grow large enough to reach scale and reduce overhead expenses. It does bring some vulnerability too: popular funds can quickly become unpopular as market cycles change. But that can be managed through a focus on innovation and a deliberate approach to incubating new products.

The velocity and volume of the product creation/destruction cycle suggests a clear opportunity for fund shops to create additional structure around the product management process.

Where to start? How about a take-no-prisoners approach — across the industry — to products that lag over the long term? I am reluctant to wave off any product innovation as it is terribly hard to discern the winners from the losers before they are out of diapers, so to speak. But every asset management organization should create a plan for efficiently incubating new product ideas. The reality is that product development is a 51 percent solution — you don't always know where the hits will come from. And the success of the winners provides enough profit to cover the costs of the losers. We just want to be sure to protect and support investors and advisors in the process.

Writer's BIO:

Lisa Cohen is the CEO of Momentum Partners, which provides specialized and objective advisory services to industry leaders who want to drive growth and innovation. www.momentumpartnersonline.com