Demand for stocks and bonds alike was extremely heavy at the start of the new year even as central banks contemplated reducing monetary stimulus, and bond yields jumped. The complacency we’re seeing across asset classes is remarkable.

Demand for bond funds exploded in January after subsiding in November and December. The inflow of $46.2 billion into bond mutual funds and ETFs last month was the third largest inflow on record, exceeded only by inflows in late 2009. Moreover, retail investors were driving much of the buying, pumping an estimated $39.7 billion into bond mutual funds, the fourth highest monthly inflow ever. The continuing popularity of bond funds amid poor performance is quite troubling from a contrarian perspective.

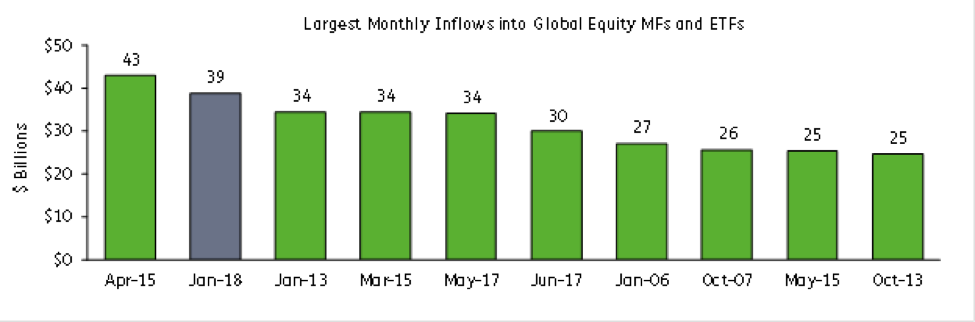

The inflow of $38.8 billion into global equity mutual funds and ETFs was the second highest in our records, exceeded only by the inflow of $43 billion in April 2015. As with bond funds, retail investors drove much of the buying. The estimated inflow of $17.1 billion into global equity MFs last month was the most since July 2015.

David Santschi is the director of liquidity research at TrimTabs Investment Research, an Informa Financial Intelligence company.