Investors have poured relentlessly into target-date funds, with assets now topping $481 billion, up from $71 billion in 2005, according to the Investment Company Institute. The portfolios—which include diverse collections of stocks and bonds—are designed for people who will retire in certain years, such as 2015 or 2030. The funds have proved popular because they offer convenient one-size-fits-all portfolios for retirement savers. But many advisors have not been impressed, and skeptics argue that retirement portfolios should be customized to meet the varying needs of clients.

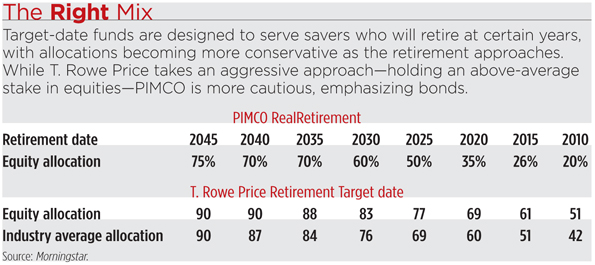

Critics of target funds have received some powerful support from John Bogle, founder of Vanguard Group, who expressed his reservations during a talk at the Morningstar conference in Chicago recently. Bogle argued that the target funds may tilt too heavily to bonds. Under the typical strategy, target portfolios begin with high equity allocations and gradually shift away from stocks as the retirement dates approach. According to Morningstar, the average portfolio designed for people in their early 30s has 90 percent of assets in stocks and the rest in fixed income. The equity allocation falls to 35 percent for savers in their 70s.

To point out the flaws in target-date strategies, Bogle asked the audience to consider the typical retiree who receives Social Security. On the day of retirement, the value of Social Security is comparable to a bond portfolio with $300,000 in assets. Now suppose the saver also has $300,000 in a target-date fund, Bogle said. If the target fund is invested entirely in stocks, then the saver’s total assets effectively have half the value in equities and half in fixed income—a reasonable allocation. But in fact, the average target-date fund for a new retiree only has about 40 percent of assets in stocks. As a result the retiree’s portfolio would have 80 percent in bonds.

Bogle said that the allocations of target-date funds were based on market history. “The strategy is the right way to do things if you look in the past,” said Bogle.

But he said that current market conditions are very different from what prevailed in earlier decades. In the future, bond returns are likely to be puny. Bogle has often argued that the long-term total returns of bond funds typically equal the yields. Because bonds currently yield about 2 percent, the total annual returns for bond funds are likely to be about 2 percent over the next decade. To compensate for such a dismal outlook, investors may need to keep more stocks. Should investors hold the same fixed income allocation “when bond interest rates are 7 percent as when yields are around 1.6 percent?” Bogle asked.

Bogle also expressed concern because many target-date vehicles invest in bond funds that track the Barclays Capital U.S. Aggregate bond index. The index currently has more than two-thirds of its assets in Treasuries and government-backed bonds, which have puny yields. Investors can get fatter yields with corporate bonds. Bogle said that investors should hold some Treasuries, but there should be limits on the allocation to government issues. “70 percent is too much,” he said.

Recent research by Morningstar has provided additional reasons why advisors may prefer building customized portfolios instead of relying on standardized funds. The problem is that many target funds shift their allocations unexpectedly. For investors age 60, the Fidelity Freedom target-date funds have varied their equity allocations from 34 percent to 52 percent at different times. Vanguard has changed the allocation from 38 percent to 58 percent. The Morningstar researchers note that there can be valid reasons for changing allocations. A portfolio manager could add a new asset class, such as emerging markets equities, which could improve diversification. Still, investors in target-date funds must be aware that the allocations are not carved in stone.

Target-date funds can be sound choices that provide diversification for investors with limited assets and no access to advisors. But many advisors may prefer setting their own allocations, designing portfolios to suit the needs of clients.