Insurance broker/dealers have the most to lose from the Department of Labor’s fiduciary rule because of their dependence on commissions, proprietary products and individual retirement accounts, according to a new report by Cerulli Associates.

“These advisors are most dependent on middle market clients and therefore most dependent on IRAs as the source of business,” said Bing Waldert, director at Cerulli.

“These are also firms that classically haven’t made major infrastructure investments in their broker/dealer.”

The lack of investment in technology could impact these firms’ ability to comply with the new DOL rules, Cerulli said.

Large broker/dealers, however, have the scale to make the operational infrastructure investments needed to comply. Such large firms have already been moving away from commission business towards fee business through a corporate RIA, so they already have much of the infrastructure in place, Cerulli said

But it’s the smaller b/ds, whose advisors serve mostly middle-market clients, that are going to be at risk, Waldert said. Waldert expects there to be continued consolidation among b/ds on the low end.

“Your middle market advisor is highly, highly dependent on IRAs as a source of flows,” Waldert said. “Right now, if they can’t afford to serve them, who are they going to serve?

“If you’re an advisor who’s focused on that, you might say, ‘I don’t want to deal with these small accounts anymore,’ but that may be your clientele today. You may see some low-end failouts.”

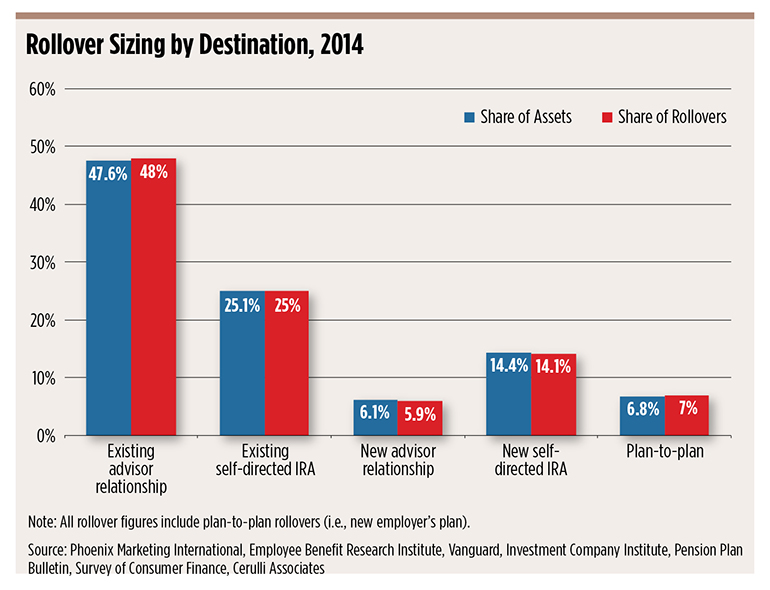

But IRA rollover flows are unlikely to slow down for b/ds and advisors serving wealthy investors. Advisors tend to win more rollovers than direct-to-consumer providers, and, in particular, existing advisor relationships have the highest share of assets and share of rollovers, according to Cerulli data.

The research firm believes that the wealthiest investors will still value their relationship with their advisor, and will be willing to sign the best interest contract exemption, which allows for commissions and revenue sharing, as long as those conflicts are disclosed.

“Even if it means signing the BICE to be able to access the prohibited transactions, we do still think the largest rollovers are going to move to advisors and are going to move to existing advisor relationships,” Waldert said.