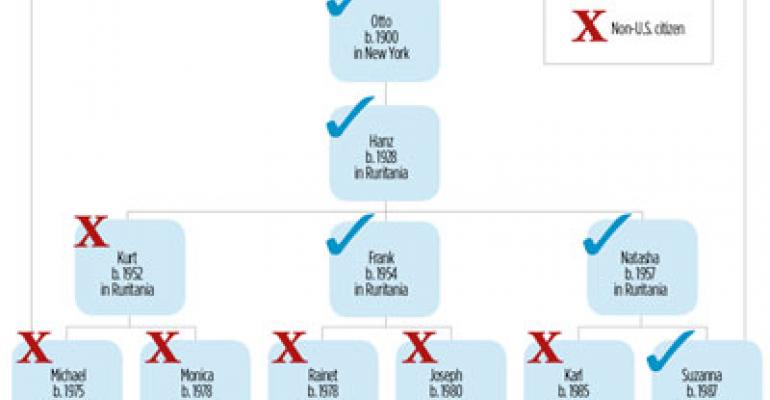

Too often, people who live outside the United States and are citizens of other countries discover that they're U.S. citizens as well and, therefore, owe U.S. taxes.

All access premium subscription

Please Log in if you are currently a Trusts & Estates subscriber.

If you are interested in becoming a subscriber with unlimited article access, please select Subscription Options below.

Questions about your account or how to access content?

Contact: [email protected]

0 comments

Hide comments