In his famous 1991 paper, “The Arithmetic of Active Management,” Nobel Prize winner William Sharpe explained that before costs active management is a zero-sum game, and after costs it is a negative-sum game. He writes: “Properly measured, the average actively managed dollar must underperform the average passively managed dollar, net of costs. Empirical analyses that appear to refute this principle are guilty of improper measurement.” In other words, for active managers to be successful they must have victims that they can exploit. Who exactly are these victims?

The evidence is that the victims are likely to be individual investors. The research has found that, in aggregate, individual investors around the globe underperform standard benchmarks, such as low-cost index funds, even before costs or taxes. When they trade, they are exploited by institutional investors. And while there is a wide dispersion of results among individual investors, even the best traders have a hard time covering costs. Interestingly, research by Brad Barber and Terrance Odean has found that not all underperformance can be attributed to the excessive trading done by individual investors. On average, individual investors exhibit perverse security-selection abilities—they buy stocks that go on to earn sub-par returns and sell stocks that go on to earn above-average returns.

Since alpha is a zero-sum game, if there are losers, even before costs, there must be winners. Who are the winners? The winners are institutional investors, such as actively managed mutual funds. The research shows that on a gross-return basis, active fund managers are able to generate alpha, exploiting the bad behavior of individual investors. For example, Jonathan Berk and Jules van Binsbergen, authors of the 2013 study “Measuring Skill in the Mutual Fund Industry,” found that the average mutual fund has added value by extracting about $2 million per year from financial markets, and that the value added is persistent for as long as 10 years. Berk and van Binsbergen concluded, “It is hard to reconcile their findings with anything other than the existence of money management skill.”

Since alpha is a zero-sum game, if there are losers, even before costs, there must be winners. Who are the winners? The winners are institutional investors, such as actively managed mutual funds. The research shows that on a gross-return basis, active fund managers are able to generate alpha, exploiting the bad behavior of individual investors. For example, Jonathan Berk and Jules van Binsbergen, authors of the 2013 study “Measuring Skill in the Mutual Fund Industry,” found that the average mutual fund has added value by extracting about $2 million per year from financial markets, and that the value added is persistent for as long as 10 years. Berk and van Binsbergen concluded, “It is hard to reconcile their findings with anything other than the existence of money management skill.”

The 2000 study, “Mutual Fund Performance: An Empirical Decomposition into Stock-Picking Talent, Style, Transactions Costs, and Expenses” by Russ Wermers, provides further evidence of stock-picking skill. Wermers found that on a risk-adjusted basis, the stocks that active managers selected outperformed their benchmarks by 0.7 percent per year. However, investors earn net, not gross, returns. The research finds that their total expenses—not just the fund’s expense ratio, but trading costs as well—more than eroded the benefits derived from their stock-selection skills, leaving investors with net negative alphas. What economists call the “economic rent” is going to the scarce resource (the ability to generate alpha), not to the plentiful resource (investor capital). That occurs just as economic theory predicts it should. But while active institutional investors have been able to exploit the bad behavior of individual investors, the fund sponsors have been the winners, not investors in the funds.

The Trend Is Not the Friend of Active Investors

Making matters worse is that there are trends working against active investors. As Robert Stambaugh points out in his 2014 study, “Investment Noise and Trends,” there has been a substantial downward trend in the fraction of U.S. equity owned directly by individuals. In other words, the pool of victims to exploit is shrinking.

Stambaugh noted that at the end of World War II, households directly held more than 90 percent of U.S. corporate equity. By 1980, U.S. corporate equity directly held by households had fallen to 48 percent. By 2008, it had dropped to around 20 percent. The financial crisis certainly did nothing to alter the trend.

Even within the institutional space, the availability of victims to exploit is shrinking. Thirty years ago, almost all mutual funds were actively managed. Today, index funds account for almost 20 percent of the industry, and their share is steadily growing. For example, in 2013, $3.4 billion flowed into active funds while index-based strategies pulled in more than $60 billion. The fraction of institutional assets in passive funds is growing fast as well. By 2006, the amount of institutional assets in actively managed funds was already below 60 percent.

One logical explanation for the rapid decrease in the active share of the institutional market is that institutional investors are more likely to be aware of the academic literature demonstrating just how difficult a game active management is to win. Another possible explanation is that they are also aware that the pool of victims available to exploit is rapidly shrinking, raising the hurdles for successful active management.

Making matters worse is that while the pool of victims has been shrinking, the competition seeking to exploit pricing mistakes has increased dramatically. There are now more than 7,500 mutual funds, according to the Investment Company Institute. That is 14 times more than there were in 1979. The increased competition for a limited amount of alpha reduces the ability of any given fund to outperform.

The increased competition isn’t coming just from actively managed mutual funds. In less than 10 years, the amount of capital invested in hedge funds has increased from about $1 trillion to almost $3 trillion. And with institutional investors now doing as much as 90 percent of the daily trading, who exactly are the victims these sophisticated investors are going to exploit in their quest for alpha? In the zero-sum game (negative-sum after costs) that institutional investors are playing, the other side of the trade is highly likely to be another institutional investor—and only one of the two can be on the right side of a transaction.

The trend to lower expenses is making passive investing even more of a winner’s game. And that is contributing to a virtuous circle—lower costs are helping drive more investors to become passive, shrinking the pool of victims that can be exploited and raising the hurdles for the generation of alpha.

There is another insight that we can draw from the trend. It seems likely that those abandoning active management in favor of passive strategies will be investors who have had poor experiences with active investing. Thus, it seems logical to conclude that the remaining players are likely to be the ones with the most skill. After all, if an investor’s outperformance was based on good luck, the good luck will eventually disappear and they will abandon the game. As less-skilled investors abandon active strategies, the level of competition among the remaining participants will increase. The following example from game theory helps explain why the level of competition is likely to continue to increase, persistently raising the hurdles for successful active management.

Game Theory and Investing

Imagine the following scenario: You are an NBA player. The league is holding a free-throw-shooting contest open to all players. Each participating player will take 100 shots, receiving $1,000 for each shot made. You are given a choice to play or not play the game. If you don’t play, you will get paid based on the average score of all the players who decide to participate. The best free-throw shooter in the league shoots about 90 percent, the average player shoots just 73 percent and you shoot 83 percent. Should you compete or accept the average score of those who participate?

Since you shoot an above-average percentage, it seems like you should play. However, the fact that you are above average is irrelevant because all those with a below-average shooting percentage should choose not to play. Anticipating this occurrence, even those with above-average scores should decide not to play. Logically, only the player with the best percentage should choose to play, and everyone now has an expected return of $90,000.

What does this scenario have to do with investing? As we have discussed, it seems likely that those abandoning active management in favor of passive strategies will be investors who have had poor experiences with active investing. As less-skilled investors abandon active strategies, the level of competition among the remaining players will increase.

The Paradox of Skill

What so many people fail to comprehend is that in many forms of competition, such as chess, poker or investing, it is the relative level of skill that plays the more important role in determining outcomes, not the absolute level. What is referred to as the “paradox of skill” means that even as skill level rises, luck can become more important in determining outcomes if the level of competition is also rising.

Charles Ellis, one of the most respected people in the investment industry, noted the following in a recent issue of the Financial Analysts Journal. He wrote that “over the past 50 years, increasing numbers of highly talented young investment professionals have entered the competition ... They have more-advanced training than their predecessors, better analytical tools, and faster access to more information.” Legendary hedge funds, such as Renaissance Technologies, Point72 Asset Management and D.E. Shaw, hire Ph.D. scientists, mathematicians and computer scientists. MBAs from top schools, such as Chicago, Wharton and MIT, flock to investment management armed with powerful computers and massive databases.

Harder to Match and Harder to Beat

For example, Eduardo Repetto, the co-CEO of Dimensional Fund Advisors (DFA), has a doctorate from Caltech and worked there as a research scientist, and DFA’s co-CIO Gerard O’Reilly also has a Caltech doctorate in aeronautics and applied mathematics. And co-author Andrew Berkin, the director of research at Bridgeway Capital Management, has a Caltech bachelor’s degree and a University of Texas doctorate in physics, and is a winner of the NASA Software of the Year award. According to Ellis, the “unsurprising result” of this increase in skill is that “the increasing efficiency of modern stock markets makes it harder to match them and much harder to beat them, particularly after covering costs and fees.”

Analogous examples are seen in the sports world. For instance, from the advent of the modern baseball era in 1903, seven players achieved a batting average over .400 a total of 12 times. But the last to do so was Ted Williams, who hit .406 in 1941, more than 70 years ago. Yet, today’s players are superior athletes—they are demonstrably bigger, faster and stronger, use superior training techniques and have better diets.

However, all players have these advantages. The result is that as average skill increases, it becomes more difficult to outperform by large margins—the standard deviation of outcomes narrows. In the first 20 years of the modern era (1903-1921) the average hitter batted about .250-.260. During that period, the .400 mark was reached four times. Since 1950, batting averages have been fairly stable in that same .250-.260 range. Yet no one has hit .400. Why? While batting averages were the same in the two eras, the standard deviation has dropped dramatically, from 40.6 points in 1921 to 26.1 in 2003. Batting .400 is now more than a five standard deviation event, with a probability of less than one in a thousand in a given year. In other words, no one hits .400 anymore because the average baseball player of today is far better than the average player of a hundred years ago.

The paradox of skill means that while today’s athletes are more skillful, they are not likely to produce the kind of outlier results that the legends of yesteryear achieved. We see the same phenomenon in the game of active management, where the quest for alpha has become ever more frustrating as the level of skill among competitors rises.

A Declining Ability

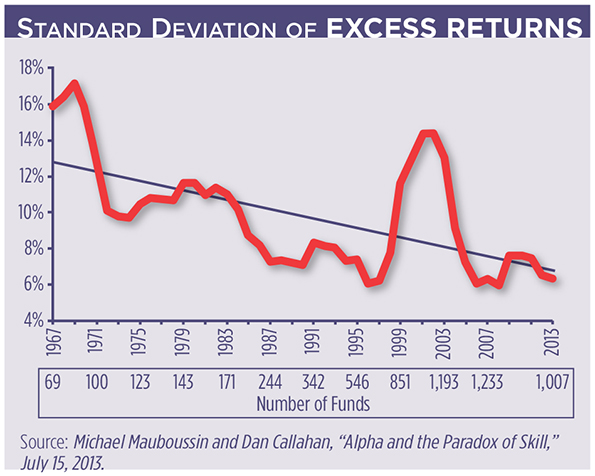

The 2013 Credit Suisse report, “Alpha and the Paradox of Skill” by Michael Mauboussin and Dan Callahan, examined the effects of increasing skill in investing. They plotted the rolling five-year average standard deviation of excess returns in U.S. large-cap mutual funds over the last 45 years. You should expect to see wide dispersions when there are large differences in the level of skill. Their plot above, updated through 2013, demonstrates a clear trend of declining dispersion in excess returns, which fits nicely with our narrative indicating that competition is getting tougher.

The study “Conviction in Equity Investing” by Mike Sebastian and Sudhakar Attaluri, which appears in the Summer 2014 issue of The Journal of Portfolio Management, provides further evidence of a declining ability to generate alpha. The authors found:

- Since 1989, the percentage of managers who evinced enough skill to basically match their costs (i.e., showed no net alpha) has ranged from about 70 percent to as high as about 90 percent, and by 2011 was at about 82 percent.

- The percentage of unskilled managers has ranged from about 10 percent to about 20 percent, and by 2011 was at about 16 percent.

- The percentage of skilled managers began the period at about 10 percent, rose to as high as about 20 percent in 1993 and by 2011 had fallen to just 1.6 percent. This last result matches closely the result of the 2010 paper “Luck versus Skill in the Cross-Section of Mutual Fund Returns.” The authors, Eugene Fama and Kenneth French, found that only managers in the 98th and 99th percentiles showed evidence of statistically significant skill.

Lubos Pastor, Robert Stambaugh and Lucian Taylor, authors of the August 2013 paper “Scale and Skill in Active Management,” provided further insight into why the hurdles to generating alpha are getting higher. The authors, whose study covered the period from 1979 to 2011 and more than 3,000 mutual funds, concluded that fund managers have become more skillful over time. “We find that the average fund’s skill has increased substantially over time, from -5 basis points (bp) per month in 1979 to +13 bp per month in 2011.” However, they also found that the higher skill level has not translated into better performance. They reconcile the upward trend in skill with no trend in performance by noting: “Growing industry size makes it harder for fund managers to outperform despite their improving skill. The active management industry today is bigger and more competitive than it was 30 years ago, so it takes more skill just to keep up with the rest of the pack.” These findings are consistent with everything we have discussed so far.

The authors also came to another interesting conclusion: The rising skill level they observed was not due to increasing skill within firms. Instead they found: “The new funds entering the industry are more skilled, on average, than the existing funds. Consistent with this interpretation, we find that younger funds outperform older funds in a typical month.” For example, they found that “funds aged up to three years outperform those aged more than 10 years by a statistically significant 0.9 percent per year.” The authors hypothesized that this is the result of newer funds having managers who are better-educated or better-acquainted with new technology—though they provide no evidence to support that thesis. The authors also found that all fund performance deteriorates with age as industry growth creates decreasing returns to scale and newer, more-skilled funds create more competition.

Even though the absolute skill level of active managers is increasing, it is getting harder and harder to generate alpha because the level of competition is also increasing. Thus, unless you happen to be Warren Buffett, the winning strategy is not to play. Instead, the winning strategy is to accept market returns in the asset classes or factors in which you choose to invest.