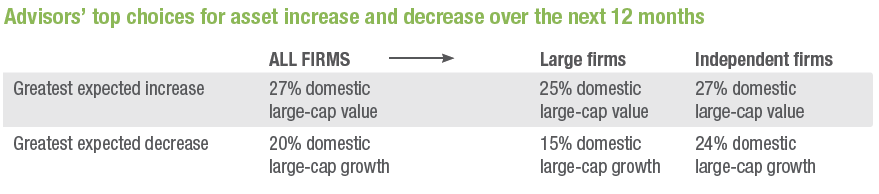

Advisors appear to be shifting away from growth stocks toward value positions—perhaps in response to the strong outperformance of growth stocks ever since the recent financial crisis. In fact, nearly 4 in 10 (39%) advisors say adding domestic large-cap value stocks to client holdings is one of their top two expected portfolio shifts over the next 12 months. This was the most commonly cited addition. Meanwhile, nearly 3 in 10 advisors (28%) named domestic large-cap growth equities as one of their top two expected portfolio decreases over the same time frame—the most commonly cited decrease.

The shift may already be underway: 44% of advisors report that large-cap value equities currently represent a meaningful or significant part of client holdings, while just 36% say the same for large-cap growth. This outlook—favoring value over growth—holds true for advisors from large firms as well as advisors from independent firms. That said, independent advisors expect to make a more dramatic move away from growth stocks than other advisors. Among this group, 24% expect that they will see the greatest decreases in domestic large-cap growth stocks over the next 12 months, compared with just 15% among large firms.

Advisors are not planning to abandon growth stocks completely, however. For instance, 16% of advisors at independent firms expect that their second greatest increase in assets over the next 12 months will be in domestic large-cap growth stocks.