The wealth management business of Cleveland-based Key Bank has quickly become the fastest-growing division inside the bank, according to a recent profile by Crain’s Cleveland Business. The unit, led by Gary Poth, has added more family office clients in the last 18 months than in the past 10 years combined. The bank attributes the growth to investing in new technology and a focus on new leadership. It has invested over $10 million into that business and hired Douglas Banbury from PNC Family Wealth to serve as head of Key Family Wealth Investments. “A lot of what we see, and you’re seeing this everyday now, is baby boomers hitting age 65. They will continue to do that for the next 15-20 years,“ Poth said. “A lot of these boomers are business owners. They’re looking to transfer their businesses. And you’re seeing a lot of wealth in motion.” Key Family Wealth won a 2017 WealthManagement.com Industry Award in the Family Office Client Initiative category.

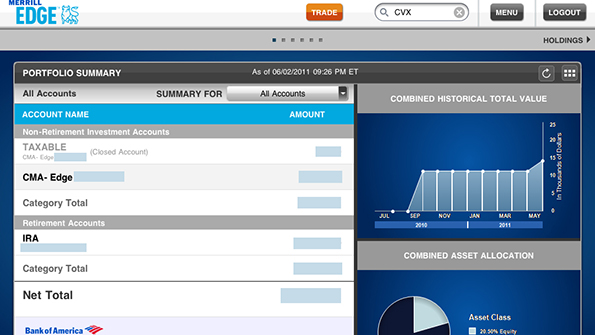

Merrill Edge Rolls Out Better Research to Self-Directed Investors

Merrill Edge, the discount brokerage business of Bank of America’s Merrill Lynch, announced Monday improvements to the research it offers investors. The new initiative will give investors access to BofA Merrill Lynch Global Research, Morningstar, MSCI, Recognia, Trefis, Thomson Reuters and CFRA, powered by data from S&P Global and First Call. But unlike in the past, the research will now also include simplified, jargon-less explanations of companies, their stock prices, earnings, dividends and other information. It will also include insights on why it might be a good time to buy, hold or sell an equity and an overview of their environment, social and governance practices as well.

BNY Mellon Will Unite Asset Managers in 2018

BNY Mellon is uniting its three largest asset managers—Mellon Capital, Standish and The Boston Company—to form one multi-asset manager in 2018. The combined business will have over $560 billion in assets under management, which will put it among the 10 largest in the U.S. and 50 largest globally. In all, the new multi-asset manager will employ more than 300 investment professionals in offices located in Boston, San Francisco, Pittsburgh, London, Singapore and Hong Kong. BNY Mellon Investment Management has a total of $1.8 trillion AUM.