The number of clients at wealth management firms is shrinking, even as advisors are lowering their fees, according to the latest annual state of the industry report from Price Metrix.

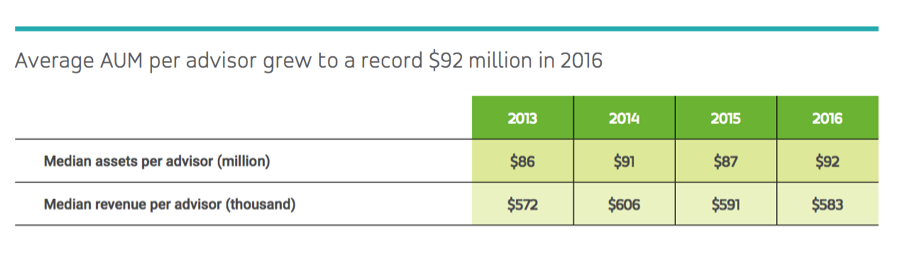

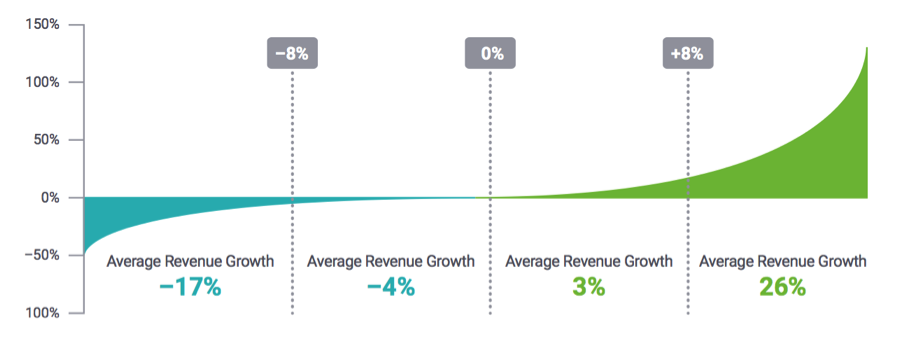

While the median assets under management at wealth management firms has grown 6 percent to $92 million per advisor, the average revenue per advisor fell 1 percent:

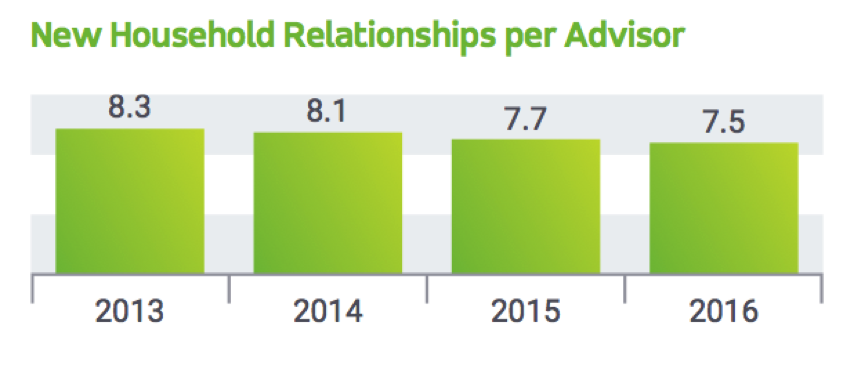

Last year was also a “new low” for the number of clients coming onboard at wealth management firms, according to the report:

"We see advisors working with fewer clients, a trend that’s been ongoing for the past couple of years. That’s not necessarily a bad thing. Fewer clients and more assets managed effectively means every client is getting more service. What’s disturbing is advisors are being paid less on the same basis for that service,” said Patrick Kennedy, a chief customer officer at PriceMetrix, the firm he co-founded before selling to consultancy firm McKinsey.

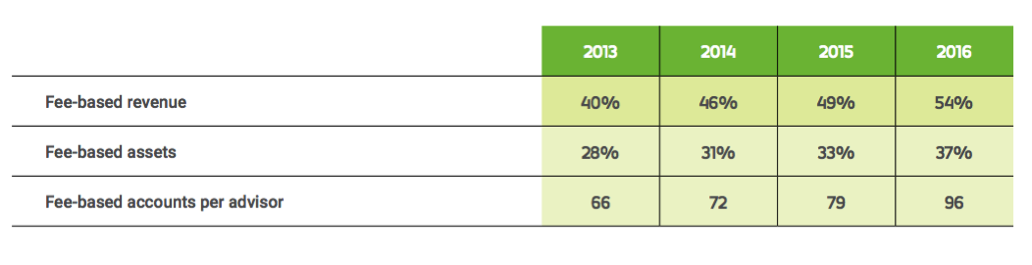

Adding to the concern is that revenue from fee-based accounts has grown dramatically. Asset-based fees accounted for 54 percent of the industry’s overall revenues in 2016:

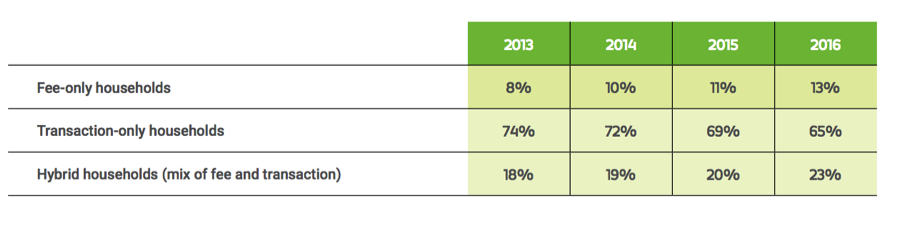

Still, through a different lens, clients remain largely in transaction-only accounts, though hybrid accounts are growing:

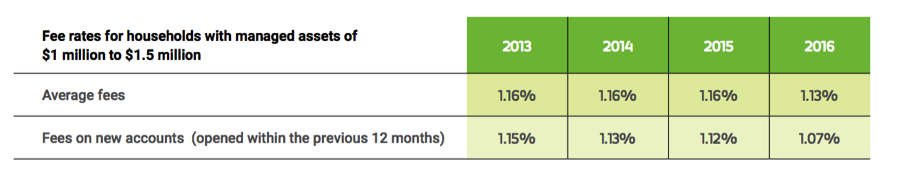

Some advisors are preemptively lowering the price tags for their services, Kennedy says, fearing pressure from new competitors in the space, like robo advisors:

But the pressure on pricing isn’t coming from clients, Kennedy said. "Advisors feel more threatened than they actually are by other channels at this point. This is more sentiment that anything. Not all advisors lowered price. Some did. Those that did, we didn’t see any difference in terms of adding new clients or keeping the clients they had. That would suggest it’s not really clients demanding a lower price, it really gets back to a mindset."

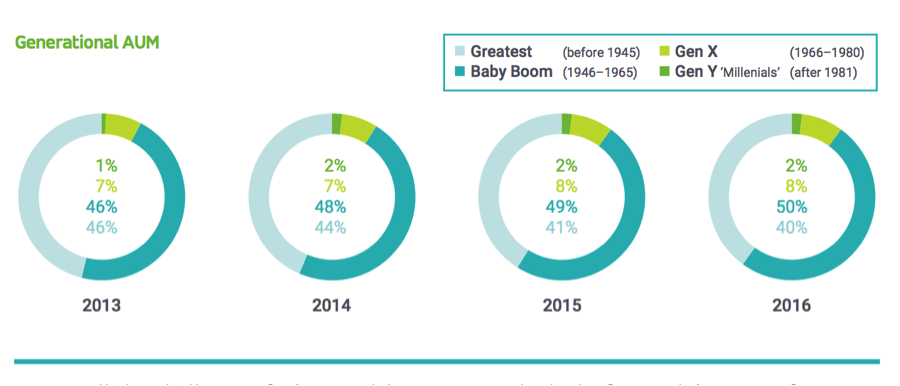

Most concerning is that the needle has not moved much at all on bringing Gen X clients into wealth management firms. “These are folks who are in their fifties, they are a lot closer to retirement than graduation. You want to be seeing more penetration among that group in terms of new clients entering the full-service industry.”

“The magic of this industry is that advisors who are able to pay attention to what others are doing have access to the things that are working,” Kennedy said. For instance, top quartile advisors in terms of growth brought in more assets from Gen X than lower quartiles and had more revenue from fee-based accounts.

“Advisors that grew in this study had more penetration of key products and were adding Gen X clients at a faster rate and maintaining their price levels,” he said. “They key to unlocking growth is stored within the industry itself.”