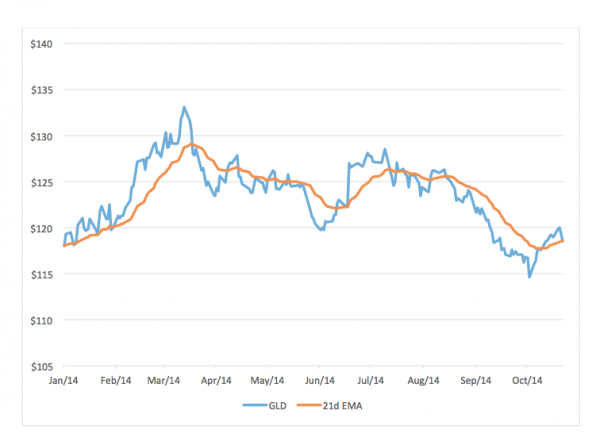

Have you noticed how much gold’s bullish momentum has slowed? The SPDR Gold Trust (NYSE Arca: GLD) dipped below its 21-day exponential moving average (EMA) at the close Thursday—for the first time in ten trading sessions (an exponential average, unlike its simple cousin, weights recent activity more heavily to give users a better sense of current market energy).

Granted, Thursday’s decline didn’t send the ETF’s price deeply below its EMA but, as the bears would say, “ya gotta start somewhere.” What makes this excursion interesting is that it was driven by short selling, a feature we haven’t really seen in the past two weeks.

This is short-term stuff to be sure. But there’s a longer tend working here. You can see part of it on the chart. Gold’s been losing ground since March, punctuated only by June’s relief rally. Gold and GLD have, in fact, been in retreat since 2011. Back then, GLD topped out over $180. Then there’s the retreat of assets from the GLD vault. Once there was more than 1,300 tonnes of bullion backing the trust. This week, holdings fell below 750 tonnes—a level not visited since November 2008.

Does this portend a move in GLD’s price to its 2008 levels? Well, yes, it just might. Amid all the Ebola, ISIS and ECB hoopla, GLD couldn’t rally above key resistance at $121 and that failure could be the stage setting for a breakdown below $100.

When? Well, that’s the question. November? Year’s end? First quarter 2015?

Playing the short side’s never a sure thing. Buying puts, though, can reduce the dollars at risk but necessarily shortens the investment horizon. Luckily, GLD options are becoming cheaper, at least as measured by their embedded volatilities. At-the-money puts, expiring in March 2015 can be had for less than $500 a contract now.

Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.