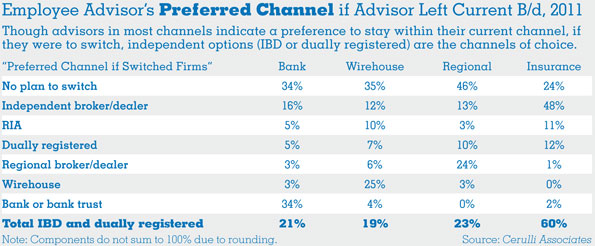

During the last decade, independent broker/dealers (IBDs) have made the case to advisors that the channel offers distinct benefits over the models of the employee-advisor channels: wirehouses, banks, regionals, and insurance b/ds. The lures of increased payouts, broad product options, and greater flexibility to run their business as they see fit have increasingly drawn advisors to independence, resulting in increased market share in these channels. As illustrated in the exhibit on page s22, the IBD channel consistently ranks second, behind only the advisor’s current channel, as a destination of choice for advisors considering a change in affiliation.

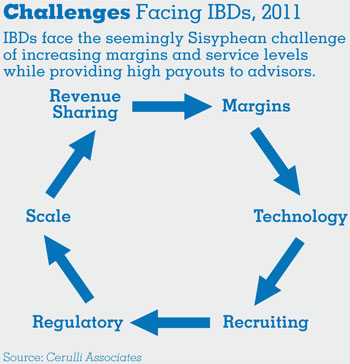

Unfortunately, the very features that draw advisor interest in the channel create conditions that make profitability challenging in the best of times and nearly impossible when times are bad. At the heart of the equation is the revenue split between the firms and the advisors and the explicit and implicit levels of service offered by the firms. As seen in advisors’ cited payouts, technology and service are the largest contributing factors when changing b/ds. Like anyone else, advisors want to receive the highest levels of service possible, while paying as little for it as they can. At the same time, IBDs want to present themselves as providers of quality service but in many cases are trying to do so on shoestring budgets.

Unfortunately, the very features that draw advisor interest in the channel create conditions that make profitability challenging in the best of times and nearly impossible when times are bad. At the heart of the equation is the revenue split between the firms and the advisors and the explicit and implicit levels of service offered by the firms. As seen in advisors’ cited payouts, technology and service are the largest contributing factors when changing b/ds. Like anyone else, advisors want to receive the highest levels of service possible, while paying as little for it as they can. At the same time, IBDs want to present themselves as providers of quality service but in many cases are trying to do so on shoestring budgets.

With increased transparency and communication among advisors, IBDs have been forced to compete on price from a payout perspective while trying to ensure that they can maintain competitive levels of home-office staffing. In many cases, this leads to IBD firms retaining 10 percent or less of the revenue their advisors generate while competing on service with employee-advisor firms that retain 40 percent or more of advisor revenues. Though there are inherent cost differences in how the channels operate (e.g., IBD advisors are responsible for nearly all branch level expenses), this disparity creates a tight operating profit margin situation across much of the IBD industry. While the wealth management arms of wirehouse firms are likely to cite margins of 10 percent with hopes of getting to 20 percent, IBDs are more likely to cite margins in the single digits with goals of getting to 10 percent.

Adding to the ongoing uncertainty of turbulent markets, groundbreaking advances in technology, the potential installation of a universal fiduciary standard, an aging advisor force, and the long awaited transition of baby boomers into retirement make this a watershed inflection point for the advisory industry. While the industry has long been a crucible for continuous change, the change itself has tended to be incremental rather than transformative. At this point, however, it appears the time is ripe for structural change.

While b/ds continue to play an important role in advisor/client relationships, the majority of the core services the firm provides have become a commodity that the advisor or client can now receive from any of hundreds of b/d firms or through the registered investment advisor (RIA) channel. Though Cerulli expects the largest firms in the advisory industry to maintain their rankings in the next several years, we also project that it will be with reduced market share as advisors continue to seek more independent affiliation options.

With such a wide variety of options available to advisors, firms must be able to create truly valuable differentiation, providing ongoing value to advisors. Though firms may be able to hang on for several more years, or even decades in some cases, without substantially reevaluating their models, they are unlikely to thrive. For those firms that expect to add market share, many of the fundamental challenges facing the industry will need to be seen as opportunities to evolve rather than as battles to win.

Scott Smith is an associate director at Cerulli Associates, an industry consultancy.