“Private investments are a need-to-do, not a nice-to-do” was a quote given by the President and Head of the Private Client group of a well-respected firm to a leading investment publication.

This is a strong statement and when presented to trustees or high-net-worth (HNW) individuals, it can be emotionally compelling.

It implies that to be a good fiduciary of trusts or family wealth, one “need[s] to” construct complex endowment-like portfolios that traditionally include large amounts of private investments.

Taking a line from Mark Twain, even though “need to-do” proclamations can be persuasive, the evidence consistently says this “just ain’t so.”

For the last two years, I have written articles similar to this one for Trust & Estates titled, Can I Do Better? and How To Do Better When Investing for Trusts and UHNW Individuals? They both questioned the use of endowment-style portfolios for family trusts and ultra HNW individuals.

The Evidence Is Consistent

I’m going to keep this relatively short this year, but unlike past years, the title of this piece doesn’t include a question mark.

Why?

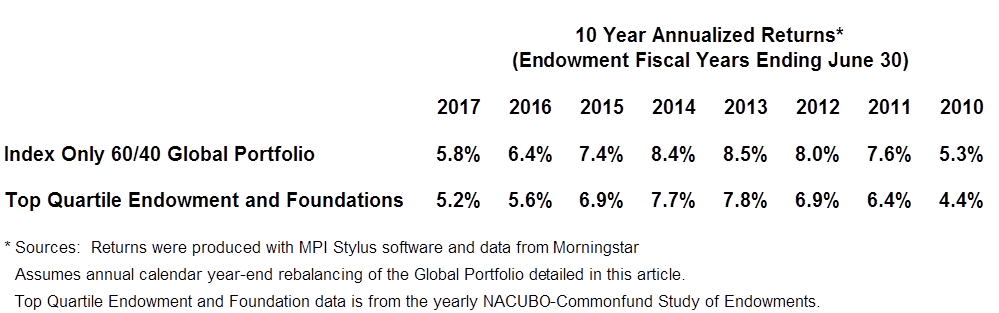

Pictures often speak louder than words and so does the following “Simple Consistently Wins” chart.

Simple Consistently Wins

As in last year’s article, it compares the returns of the same tax efficient, liquid, transparent, daily valued and net of fees portfolio of index funds that are listed below to the top quartile of U.S. endowments and foundations.

This year, however, I analyzed the consistency of long-term results by comparing annualized 10-year returns of top endowments to the performance of simple index portfolios for every year since 2010, which is as far back as the data allows.

Yes, over a very long-term period, which includes multiple up and down markets, keeping it very simple to the point of only rebalancing this mix of funds once a year, has produced returns that rank in the top 25 percent of all U.S. endowments (click here for the full data set from the annual NACUBO-Commonfund studies).

I could probably drop the microphone at this point to make this even more shocking to many like me, who grew up in what I’ll call the active management era.

In addition to mentioning performance, however, notice that in an almost run-on sentence a few paragraphs above, I used the following words:

· Tax Efficient

· Liquid

· Transparent

· Net of All Fees

· Daily Valued

· Returns

Misleading Information?

I’ve written before about how many endowment style investment strategies aren’t tax efficient and how, based on this alone, they might not be appropriate for taxable portfolios (see What Would Yale Do If It Was Taxable). I also think many understand that unlike private equity and hedge funds, which are commonly used in endowments, when you invest in index funds, you have complete liquidity and transparency.

What I don’t think people spend enough time thinking about are how the returns, volatility and fees of many of private strategies that are used in endowment funds are accounted for in a manner that might be “misleading.”

Misleading is a strong word, but it’s the exact one that was used by the well-respected consulting firm, McKinsey, in a piece that included the following words in its title: A Cautionary Tale

In their paper, McKinsey goes on to use the words “unrealistic expectations… [and] dangerous assumption[s]” to describe how private equity returns are most commonly presented in the form internal rate of return (IRR).

When modeling the appropriateness of private equity as an asset class, it’s common to use IRRs, which create projected returns that are at “best overoptimistic and at worst flat wrong” (again, McKinsey’s words, not mine).

In CFA Institute articles titled, Private Equity Presentations: Are Some Tall Tales? and Where Are Fees and Expenses Not Costs?, I detail how both the risk metrics and the fees of the many complex strategies that reside inside complex portfolios can be significantly understated.

Back to my bullet points. Some trustees and families might be discounting the disadvantages of taxes and illiquidity and, maybe even more importantly, evaluating data related to returns, risk and fees that could be quite misleading.

Related to this, The following quote from a top endowment investment office is very telling:

“Consistent with prior reporting and conventional accounting . . . performance-based compensation [is not] a cost of [investment] management.”

And, you read that correctly. Apparently, this leading investor doesn’t view compensation paid to an investment manager as a cost.

I’m not sure who else thinks this way, but when academic reports written by educators from Harvard Business School find that “private equity funds . . . charge average fees of 6% per year,” it seems prudent to account for how much you actually pay in total for investment management.

I could go on and discuss in detail other factors that investors should consider and, to help those who might be critical, even point out issues with some of what I just wrote.

My point, however, isn’t to win the active and complex versus index and simple debate.

It’s to help investors ask better questions and to bring light to a simpler path forward. One that has allowed fiduciaries to not only achieve top-quartile returns, but in a manner that’s 100 percent liquid, completely transparent, low cost, tax-efficient and easy for everyone to understand.

A Simple Question

As I wrote last year, the next time you hear the “need-to-do” pitch, consider asking the following simple but great question that my now 10- and 12-year-old children continue to ask me all the time: Why?

Over multiple long-term time periods, simple strategies have performed just as well, if not better, than most complex active endowment style strategies.

How do I think more trustees and families should invest in a prudent manner to do better?

As David Swensen, the Chief Investment Officer of Yale’s endowment, said in his book, Unconventional Success, stay anchored on the following:

“Only extraordinary circumstances justify deviation from a simple strategy…”

Important Disclosures

Return Data Sources: NACUBO-Commonfund Study of Endowments and Foundations (NCSE) and Morningstar

Past performance does not guarantee or indicate future results.

The Index Only – 60/40 Global Approach (IOGA) returns are based on historical results of the funds listed, but represent hypothetical returns. Actual client returns might differ significantly.

Neither the returns of the IOGA or for the Top Quartile Endowments and Foundations from the NCSE (TER) are net of any investment advisory or investment consulting fees, which would reduce the returns for both the IOGA and ENC if taken into account.

Future returns may be higher or lower. IOGA returns assume reinvestment of all distributions at NAV & deduction of fund expenses. 10-year returns are annualized.

This complete document is for informational purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other instruments mentioned in it.