Broker/dealers have recently taken definitive steps to improve the profit margins of their wealth management units. These include but are not limited to: increasing the costs of distribution for money managers’ products, reducing or eliminating advisor trainee classes, trimming the size of the advisor force, and targeting wealthier clients. Advisors who have managed to remain in business may have been forced to let go of smaller client accounts (or manage them without compensation), encouraging them to chase after bigger fish. Luckily for these advisors the data suggests the high-net-worth segment is growing though competition will undoubtedly be fierce.

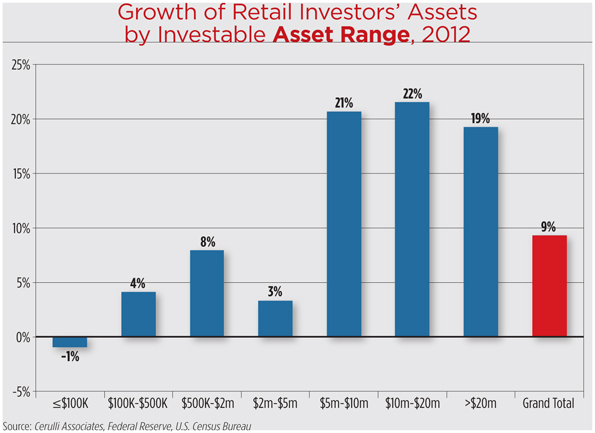

In 2012 the total number of U.S. households grew by 1 percent. However, the number of households with greater than $5 million in investable assets grew by 23 percent. There are much fewer high-net-worth households than mass market homes, but the increase in wealthy clients is significant. This opportunity bodes well for b/ds actively searching for wealthier clients to improve profit margins.

Not only are there more high-net-worth households but, perhaps more importantly, their financial assets are growing at 20 percent on average. This outpaces market appreciation and demonstrates that the high-net-worth population is in need of financial advice. Wealthy clients are increasingly likely to have more complex needs, which means that advisors must carefully consider their own limitations before approaching clients. Advisors need to be true wealth managers with a more extensive skill set if they will serve these clients. Reps with a background of serving mass affluent customers must broaden their knowledge and embrace skills most likely out of their comfort zone.

Some of the more common offerings among advisors serving wealthy clients are estate and tax planning, private banking, and trust services. An advisor with a specific strength may team with a rep that has a complementary skill so they offer a more comprehensive advice model. Executives have noted that the key is to not team up with your “twin,” or another advisor who operates their business exactly the same as yourself. Advisors that choose to be sole practitioners can build out their services by networking with estate lawyers, trust administrators, and CPAs to generate a referral system if the work can’t be done in-house. Regardless of how advisors improve their competence, the key to gaining wealthier clients is recognizing how their needs are different from the mass market and being prepared to help navigate those potential pitfalls before any issues even arise.