Bond investors find themselves in a challenging spot. While corporate fundamentals are improving along with the U.S. economy, traditional bond market risks appear to be overvalued as a result of accommodative policies from central banks around the world. We think bond investors are not adequately compensated for taking on interest-rate, credit or liquidity risk in the current market environment. This begs the question: What risks are worth taking in the bond markets if these traditional risks are overvalued?

With systematic risk overpriced, individual names are what make certain areas of the bond market attractive, in our view. We think investors should focus on issuer-specific, or idiosyncratic, risks as they hunt for relative value in the bond markets. We believe that a nimble, opportunistic multisector strategy that employs a bottom-up approach may be helpful in finding uncorrelated idiosyncratic risks.

Beware systematic risk in fixed-income markets

Investors with broad exposure have enjoyed the tailwind of declining interest rates for three decades. For the past five years, accommodative policies from the Fed (including three rounds quantitative easing, or QE) and other central banks have been the driving force behind those low rates. But that secular decline may be coming to an end; the tailwind of falling rates may potentially turn into a headwind of rising rates. Investors may not be able to depend on broad exposure to fixed-income markets.

Those who stayed narrowly invested in fixed-income sectors are likely in the same areas where the Fed has been actively purchasing assets. With prices artificially driven higher by Fed action, many low-yielding rate-sensitive securities like U.S. Treasurys and agency mortgage-backed securities, may see income offset by price changes triggered by even slight interest-rate increases.

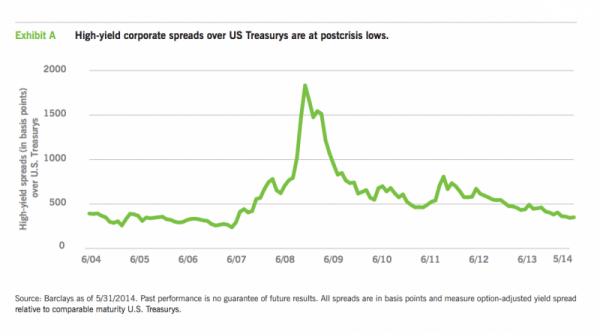

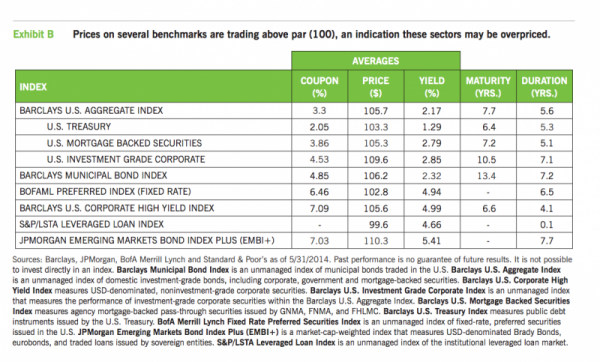

However, with spreads1 over U.S. Treasurys continuing to tighten, we now believe that credit risk may be overpriced as well. For example, corporate high-yield bond premiums have tightened to the lowest levels since before the financial crisis in 2008, as Exhibit A highlights. With spreads as narrow as they are, the yield on corporate bonds may not likely offer enough of a cushion for price declines when interest rates do begin to rise. This issue of high prices and narrow spreads extends beyond high-yield debt. In their search for yield, investors have bid prices of several fixed-income benchmarks above par2, as Exhibit B shows.

Shrinking liquidity may also become a challenge

We also note the irony of an improving economy and the potential for a liquidity crunch. The Fed is confident that we have reached “escape velocity,” meaning that the domestic economy is strong enough to withstand a reduction in its asset purchases. As a result, the pendulum is swinging to a less-liquid market. Meanwhile, investors who look to exit so-called “crowded trades” may find themselves without interested buyers to support prices, exacerbating this liquidity challenge.

So which risks may be worth taking today?

While we think traditional risks in the bond market as a whole may be expensive now, we reason that focusing on idiosyncratic risks, or unique factors of specific issuers, may aid in finding value in today’s bond markets. Capitalizing on such opportunities requires in-depth understanding of the fundamentals of issuers.

We think careful analysis of issuer-specific risks may help uncover income opportunities. Specifically, we think non-U.S. debt (such as emerging-market debt), commodity-related debt issued by companies and countries, and so-called “fallen angels” in the high-yield space may be attractive options for investors to consider.

Increased M&A activity may create value opportunities

M&A activity is heating up; deal-making in the first half of 2014 is at its highest dollar amount since before the financial crisis. With each deal announcement comes greater supply of bonds as corporations finance deals. The challenge has been in finding good long-term value in the market, and that requires investors to be nimble. For this reason our focus is on individual security selection.

We have been hunting for “fallen angels” – issuers that have dropped from investment-grade rating to the high-yield space as they finance M&A transactions – that maintain solid fundamentals. To us, this is an example of focusing on idiosyncratic risks. There is a short-term supply/demand imbalance as a result of high-grade issuers dipping to below investment grade. By taking a bottom-up, fundamental approach, investors may be able to find good relative value.

Investors may want to consider going global

We think investors may find global markets attractive as an opportunity to diversify away from U.S. interest-rate risk. In particular, emerging-market debt has gotten cheaper due to the sell-off over the past year. This comes as investors have begun to price in not only the end of the Fed’s QE, but an eventual rise in the Fed’s base rate.

Growth rates in emerging-market countries, even though they are slowing, still outpace the growth rates in developed nations. However, we don’t believe it is time for broad exposure to emerging markets. In our view, it’s important to differentiate and find select opportunities in the emerging markets.

Finding value in commodity-related securities

In the press conference following the June 18 Fed statement on monetary policy, Fed Chair Janet Yellen labeled recent higher inflation data as “noisy.” With inflation slowly increasing, we think it may be time to consider companies and countries that have real assets behind their balance sheets.

The need for experience, skill and credit expertise

We believe it will become even more important to get exposure to the fixed-income market that may be a little bit different than traditional credit exposures. However, investors will have to work harder to uncover compelling opportunities. This will likely require the use of a bottom-up perspective and the bond-picking skills of a professional manager.

1Spreads measure the difference between the yield of a security and U.S. Treasurys of comparable maturity. Spreads are generally measured in basis points and may reflect credit, liquidity and prepayment risk.

2Par is the face value of a fixed-income security, measured in percentage points, which differs from market value. Bonds trading at par will be quoted as 100.

About Asset Class Comparisons

Elements of this report include comparisons of different asset classes, each of which has distinct risk and return characteristics. Every investment carries risk, and principal values and performance will fluctuate with all asset classes shown, sometimes substantially. Asset classes shown are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. All asset classes shown are subject to risks, including possible loss of principal invested. The principal risks involved with investing in the asset classes shown are interest-rate risk, credit risk and liquidity risk, with each asset class shown offering a distinct combination of these risks. Generally, considered along a spectrum of risks and return potential, U.S. Treasury securities (which are guaranteed as to the payment of principal and interest by the U.S. government) offer lower credit risk, higher levels of liquidity, higher interest-rate risk and lower return potential, whereas asset classes such as high-yield corporate bonds and emerging-market bonds offer higher credit risk, lower levels of liquidity, lower interest-rate risk and higher return potential. Other asset classes shown carry different levels of each of these risk and return characteristics, and as a result generally fall varying degrees along the risk/return spectrum. Costs and expenses associated with investing in asset classes shown will vary, sometimes substantially, depending upon specific investment vehicles chosen. No investment in the asset classes shown is insured or guaranteed, unless explicitly stated for a specific investment vehicle. Interest income earned on asset classes shown is subject to ordinary federal, state and local income taxes, except U.S. Treasury securities (exempt from state and local income taxes) and municipal securities (exempt from federal income taxes, with certain securities exempt from federal, state and local income taxes). In addition, federal and/or state capital gains taxes may apply to investments that are sold at a profit. Eaton Vance does not provide tax or legal advice. Prospective investors should consult with a tax or legal advisor before making any investment decision.

The views expressed in this Insight are those of Kathleen Gaffney and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Eaton Vance are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund.

This Insight may contain statements that are not historical facts, referred to as forward-looking statements. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions.

About Risk

An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical or other conditions. In emerging countries, these risks may be more significant. As interest rates rise, the value of certain income investments is likely to decline. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of nonpayment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. No Fund is a complete investment program and you may lose money investing in a Fund. The Fund may engage in other investment practices that may involve additional risks and you should review the Fund prospectus for a complete description.

Before investing, investors should consider carefully the investment objectives, risks, charges and expenses of a mutual fund. This and other important information is contained in the prospectus and summary prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing.

About Eaton Vance

Eaton Vance Corp. is one of the oldest investment management firms in the United States, with a history dating to 1924. Eaton Vance and its affiliates offer individuals and institutions a broad array of investment strategies and wealth management solutions. The Company’s long record of exemplary service, timely innovation and attractive returns through a variety of market conditions has made Eaton Vance the investment manager of choice for many of today’s most discerning investors. For more information, visit eatonvance.com.

©2014 Eaton Vance Distributors, Inc. | Member FINRA/SIPC | Two International Place, Boston, MA 02110 |800.836.2414 | eatonvance.com

Kathleen Gaffney, CFA, is Co-Director of the Investment Grade Fixed Income Group at Eaton Vance