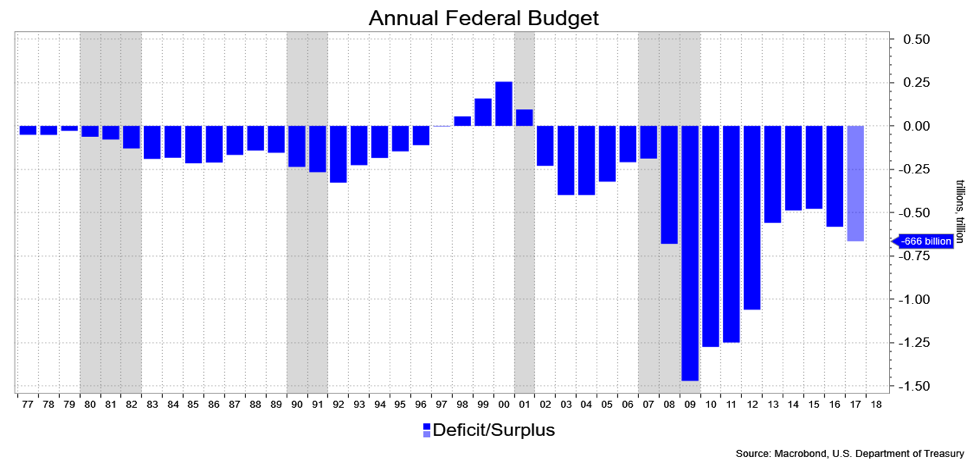

Just about every media outlet reported on the 2017 Federal Budget Deficit, which comes in at -$666 billion—the sixth largest in history. That’s 3.6 percent of GDP. I haven’t come across anyone mentioning the Omen-esque “666” element, but then I suppose people are merely marking this achievement in a non-recessionary time, as most assuredly the deficit is about to expand and that has nothing to do with Trump’s “tax reform.” I put that latter bit in quotes because it isn’t so much tax reform per se but rather a stimulus measure with some tax reform elements to it. Even without any changes, the CBO projects the budget deficit to increase to 5.6 percent of GDP in 10 years. For the record, outlays hit a high due to increased costs of Social Security, Medicare and Medicaid. We’ll be seeing that again and again in the years ahead.

On the immediate horizon are the Treasury refunding details where, surely, the long end is pondering the handling of that supply, the likelihood of increased issuance in the coming months and maybe a word on longer bonds, the ultra longs, on the way.

Is there any wonder the bond market is under pressure as we await the outcome of the whole tax thing? It does have to be paid for some way, somehow. In the very immediate sense, this sort of picture raises at least some doubt as to the efficacy of Trump’s tax aspirations as a plan that will help control the already rising deficit. Other than the politicized economic analysis—which is not analysis at all, but the stuff of pep rallies and campaigns—there is no reason to expect the tax plan won’t boost the deficit even further.

With the likes of Republican Sens. Bob Corker and Jeff Flake saying they won’t seek re-election, the rift within the GOP widens, which makes me think that deficit hawks will have their say about the plan, meaning it won’t be as large a tax cut as has been proposed and/or some of the corporate tax cuts will be offset by cutting tax breaks elsewhere.

I have in front of me the Q4 2012 Quarterly Outlook from Van Hoisington and Lacy Hunt of Hoisington Investment Management, which I carry with me at virtually every meeting I have with my own readers.

In that issue, they go over the seven key reasons why a large deficit is a headwind for economic growth. This message is, I think, worth relaying for our purposes. They wrote;

- Government debt relative to the GDP has reached extremely high levels. Rigorous statistical examinations of different countries and time periods, including the period since 1800, indicate that such debt levels have a deleterious effect on economic growth. High government debt diminishes long-term decision-making because high debt raises the possibility of increased taxes or future financial crises. High debt also undermines future growth when it primarily finances current consumption rather than productive investment.

- Due to commitments made under Social Security and Medicare, the U.S. government debt-to-GDP ratio will rise dramatically because the default response is to borrow the funds needed until that option is exhausted. The elevated borrowing will accelerate the rate at which economic growth deteriorates.

- The multiplier on government expenditures is trivial, if not negative. At the end of three years, deficit spending produces no higher level of GDP, but private GDP is shifted to the government sector. In addition, government debt has a higher percentage of GDP, and interest and repayment must be shouldered by the diminished private sector.

- The marginal tax multiplier is significantly negative. Each 1% increase in the marginal tax rates will reduce real GDP between 2% and 3% by the end of three years, provided that tax rates are permanent. Short-term tax rate changes have a considerably lower multiplier because, as the studies show, households will save the bulk of what they consider to be transitory income.

- Temporary fiscal policies destabilize the economy by creating uncertainty and eroding the foundation for long-term decision-making. The fiscal cliff is a result of temporary policies that reached their expiration point. When households and businesses don’t know the rules of the game, they are forced to forego longer-term, but higher return-generating, projects.

- The tax expenditure multiplier (itemized deductions) is slightly negative.

- As high debt levels diminish economic performance, interest rates remain low for protracted periods of time. Ultimately, however, the marketplace may lose confidence in the government’s ability to sustain the debt levels, and a country will reach Reinhardt and Rogoff’s “bang point” or Cochrane’s “condition,” causing interest rates to rise.

The folks at HIMCO are sticking to their guns on this, meaning the increasing level of indebtedness keeps them bullish on bonds for the long term. The deficit story in the U.S. is certainly an issue we should all be concerned about ,though I’ll concede that in the short term, the fear of it and the Fed’s tightening response to the perceived stimulus from the incoming tax breaks are likely to be upward pressure on rates, creating a buying opportunity in the coming months.

David Ader is Chief Macro Strategist for Informa Financial Intelligence.