During the past decade, many equity index funds delivered solid results. Seeing that strong record, some investors are concluding that what works with stocks can also succeed in bond markets. But passive funds have lagged active managers in a variety of fixed income categories, including intermediate-term bonds, high yield, and preferred shares. Can passive funds turn around and move to the front of the pack in coming years? Probably not. Many of the index funds have structural limitations that hamper performance.

Consider giant Vanguard Total Bond Market Index (VBTLX), which has $115 billion in assets. During the five years through January, the fund lagged 64 percent of intermediate-term mutual funds, according to Morningstar. The Vanguard fund tracks the Barclays Capital Aggregate U.S. benchmark. Designed to reflect the composition of the investment-grade universe, the Barclays benchmark has 21 percent of its assets in corporate bonds and most of the rest in low-yielding Treasuries and mortgages backed by the government. Recently corporate securities have outdone Treasuries. That has provided an advantage for actively-managed funds, which typically have big stakes in corporate issues.

In the coming years, Barclays index funds are likely to give even worse relative performance. The benchmark is weighted by capitalization, so issuers with the most debt outstanding account for the greatest weight in the benchmark. At a time when Uncle Sam is borrowing like mad, the weight of Treasuries will increase. If interest rates rise in the coming years, as many economists expect, Treasury prices will drop hard. Corporate bonds, which yield more than Treasuries, should prove relatively resilient.

The Search for Yield

In January this year, investors got a taste of what climbing rates could mean for Barclays funds. For the month, rates on 10-year Treasuries rose from 1.78 percent to 2.02 percent. That caused the Vanguard Total Bond fund to drop 0.7 percent. Meanwhile, the average intermediate fund lost only 0.3 percent.

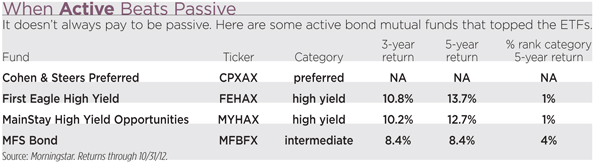

To limit losses, consider an active fund with a hefty stake in corporate issues. A solid choice is MFS Bond (MFBFX), which has 89 percent of its assets in corporates. During the past five years, MFS returned 8.4 percent annually, outdoing the Barclays benchmark by 2.9 percentage points.

MFS portfolio manager Robert Persons has the freedom to own Treasuries, but he is avoiding the issues. He says that government issues have become too rich as the Fed has made massive purchases of Treasuries and mortgages. “If you limit yourself to the issues in the aggregate bond index, you are making a bet that the Fed is going to continue buying and pushing up prices,” he says. “We would rather be in the segment of the bond market that has not been artificially inflated by the Fed.”

Eager to find fatter yields than Treasuries can provide, investors have been pouring into funds that specialize in preferred shares, which typically pay yields like bonds. But in the event of a default, bold holders are paid first, while preferred investors must wait in line. Because they are riskier than bonds, preferred shares yield more. One ETF is the SDPR Wells Fargo Preferred Stock (PSK), which yields 6.3 percent. During 2012, the ETF returned 13.5 percent. But investors did even better with actively managed mutual funds, including Cohen & Steers Preferred Securities (CPXAX), which gained 22 percent.

The Problem with Passive

Can the active managers continue outdoing the index funds? Yes, says William Scapell, portfolio manager of the Cohen & Steers fund. Scapell says that the ETFs are limited in the kind of shares that they can buy. While there are $750 billion worth of preferred securities, the index funds only take what are known as retail shares, the 25 percent of the market that trades on the New York Stock Exchange. Active managers are free to look outside the exchange for the shares that trade over the counter and are known as institutional issues. Since 1997, institutional shares have returned 6.6 percent annually, compared to 4.4 percent for the retail shares.

The institutional shares perform better because demanding institutional investors insist on better yields and more favorable terms, says Scapell. Like all fixed income assets, preferreds suffer when rates rise. But institutional shares tend to lose less than retail issues. This occurs because institutional investors demand structures that are less susceptible to harsh conditions. In a typical deal, an institutional issue would pay fixed interest for 10 years. After that, the interest payments would float along with LIBOR. The floating feature provides protection against rising rates. Retail shares would not necessarily have such protection.

Scapell says that active managers also have an edge because they can avoid securities that are obviously troubled. Index funds must take everything in their universe. “The ETFs were some of the biggest holders of National Bank of Greece preferreds,” he says.

Yield-hungry investors have been pouring into high-yield ETFs, such as iShares iBoxx $ High Yield Corporate Bond Fund (HYG). During the last five years, the fund returned 7.6 percent annually, compared to 8.7 percent for the average mutual fund. Investors could have done considerably better with top active funds, such as Mainstay High Yield Opportunities (MYHAX), which returned 13 percent, and First Eagle High Yield (FEHAX), with a return of 13.7 percent.

Part of the problem with the ETFs is their bulk, says David Sherman, portfolio manager of actively managed RiverPark Short Term High Yield (RPHYX). The two biggest ETFs have total assets of $27 billion. All that cash must go into a limited number of the most liquid bonds. That tends to push up prices of securities that are in the index. New bonds often sell at a price of 100. With investors plowing into high yield, the price of the average security in the iShares ETF is 106.2, compared to 104.6 for the broader Merrill Lynch High Yield Index.

When hedge funds and other speculators want to make a quick bet on high-yield bonds, they can rush into the ETFs, pushing up prices. When the hot money departs, ETFs tend to sag. Investors got a taste of volatility in May 2012. With investors spooked about trouble in the eurozone, the iShares ETF fell 3.2 percent for the month, while the average high-yield mutual fund dropped 1.5 percent. “The ETFs tend to underperform during market downturns,” says Sherman.