Despite all the data ahead of NFP, it was inevitable that a nuanced shift in the Federal Open Market Committee statement would garner more attention than was warranted.

I refer to the notion that “Inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the near term.” The takeaway seems to be that if inflation ran a bit over that, or under for that matter, it wouldn’t compel the Fed to respond with more or less of the projected trajectory of hikes. In other words, the market’s pricing is about right in the Fed’s view, though if it were to err I continue to think it would lead to a third hike in December. Perhaps Fed rhetoric is keeping some powder dry in light of heightened volatility and eccentricity—I refer to the markets as much as politics.

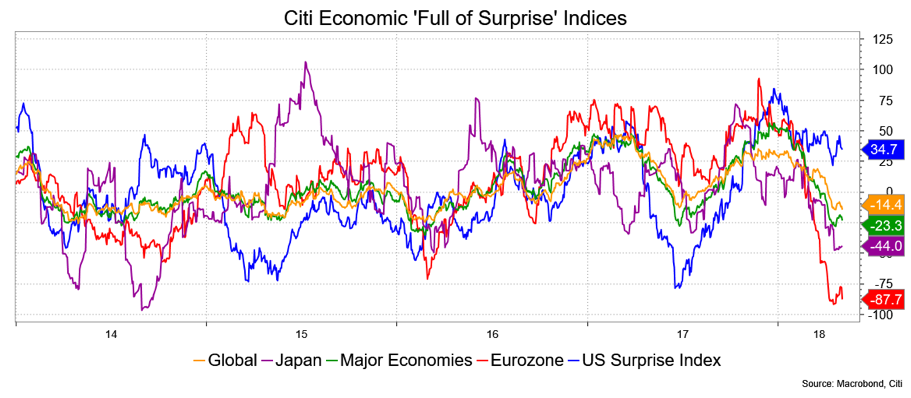

Perhaps, too, there are some global concerns. In recent weeks, much of the data elsewhere has been disappointing, as reflected in the various Citi Economic “Full of Surprise” Indices. In the last few days, we’ve had Eurozone consumer price index come in at 0.7 percent year-over-year on the core and 1.2 percent on headline, softer German retail sales, a tepid 0.1 percent U.K. GDP in Q1, a mild CPI in Japan with a dip in consumer confidence, and I gather emerging markets have had a tougher time with the dollar’s strength.

Or, perhaps, the Fed is thinking about the potential for base effects to come into play. Year-over-year figures might look higher simply because they were so weak on a month-over-month basis a year ago before they revert back to a less threatening trajectory. I think the potential for heightened inflation figures in the next couple of months will spook the bond market and push 10-year Treasury yields into that 3.25 to 3.5 percent sweet spot. I’m aware I may be talking of my position overlaid with analysis, but judge that work for yourself.

While at the same time I get the largely sideways move in the market into the NFP report that I’m surprised the Refunding announcement and prospects for still more issuance didn’t spook the bond market. Was it the data misses? Personal income, real spending, housing data, ISM indexes? Or, maybe it’s just a case of waiting to see how things pan out, especially as stocks signal a series of technical warnings. My sense is that trading volumes have been less than stellar and people are waiting for a deeper sense of direction, preferably to the downside, ahead of supply.

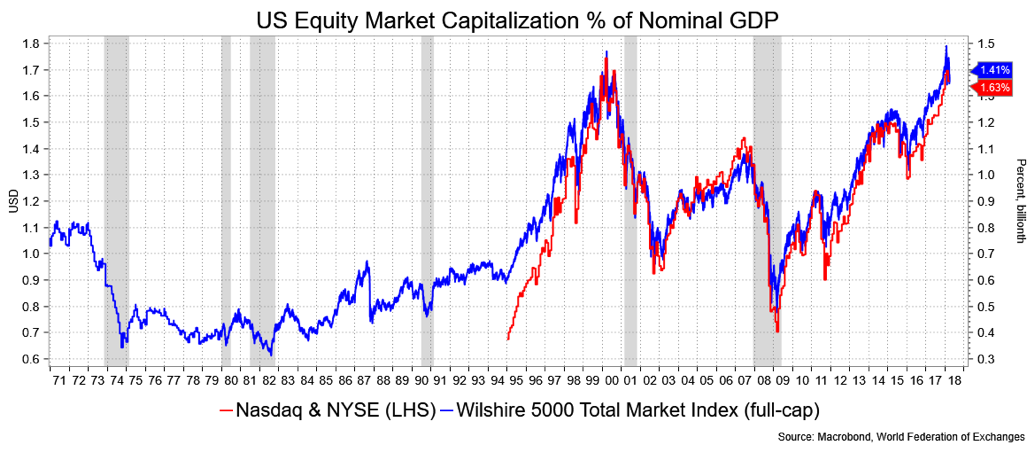

I would be remiss if I didn’t acknowledge that what is holding up the bond market surely is the equity market. Maybe the old adage of “sell in May, go away” is coming to fruition, and if so, it dovetails with seasonal patterns for interest rates that no one likes to believe in (because such patterns are so hard to justify) but hold up well enough. Stereotypes are sometimes based on manifested proclivities. I suspect that bonds are reacting to stocks more than anything else; the attempt to read something dovish into the FOMC statement hints at that.

Here’s the thing, since the start of 2017, the S&P 500 has returned 16 percent against the AGG ETF with its paltry 1 percent. (At the end of January the S&P 500 had been as high as 28 percent total return.) So, now maybe what we’re seeing is a rebalancing as the equity performance comes under pressure, especially when yields are rather more generous. Twos at the start of 2017 were just 1.22 percent and 10s were 2.45 percent.

David Ader is Chief Macro Strategist for Informa Financial Intelligence.