Faced with equity markets hitting fresh record highs and the prospect of both the U.S. Federal Reserve and European Central Bank scaling back their market support, investors continued to stuff EPFR-tracked Bond Funds with fresh cash. The week ending Oct. 4 saw inflows hit an 11-week high, taking the year-to-date total over $470 billion, as U.S. Bond Funds recorded their biggest inflow since mid-July and Global Bond Funds took in over $1 billion for the 32nd time so far, this year.

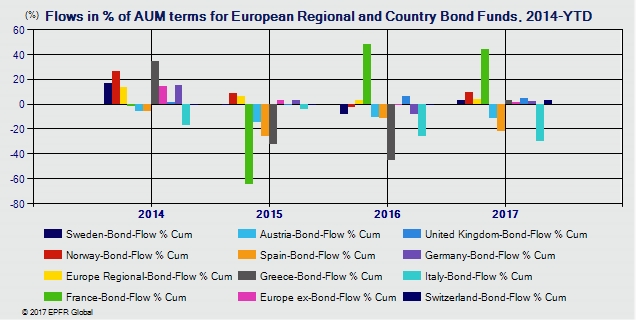

Europe Bond Funds saw outflows in the week ending Oct. 5. Both retail and institutional investors pulling modest amounts out of this fund group as they looked ahead to the ECB's next meeting in late October, when a plan for winding down the current quantitative easing program is expected. Norway Bond Funds again stood out at the country level as rising oil prices bolstered the investment case for this Scandinavian market.

At the asset class level, Bank Loan Funds snapped their longest outflow streak since the start of 2016, with inflows hitting an 11-week high, and High Yield Bond Funds took in over $1 billion for the second week running. Inflation Bond Funds posted their biggest collective outflow since as redemptions from U.K. and Global Inflation Protected Funds climbed to 34 and 45 weeks, respectively.

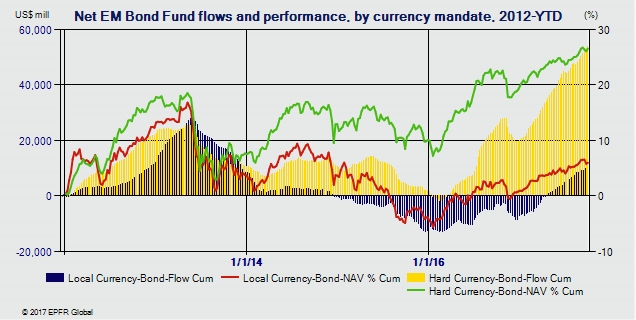

Emerging Markets Bond Funds posted inflows for the seventh week running, although those with local currency mandates recorded their biggest outflow since the fourth week of January. Investors pulled money from Emerging Markets Investment Grade Corporate Bond Funds in early October, with Asia ex-Japan Funds the hardest hit, but committed more money to EM High Yield Bond Funds. At the country level Russia Bond Funds posted their seventh straight outflow and redemptions from Hungary Bond Funds climbed to a 26-week high.

Among U.S. Bond Fund groups, both Short and Intermediate Term Mixed Funds absorbed over $1.5 billion. But expectations of higher interest rates, President Donald Trump's unscripted remark about “wiping out” most of Puerto Rico's debt and the city of Hartford's efforts to restructure its liabilities helped to end Municipal Bond Funds' 12-week run of inflows.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.