When it comes to analyzing the bond market’s price action in the last couple of weeks, less is more.

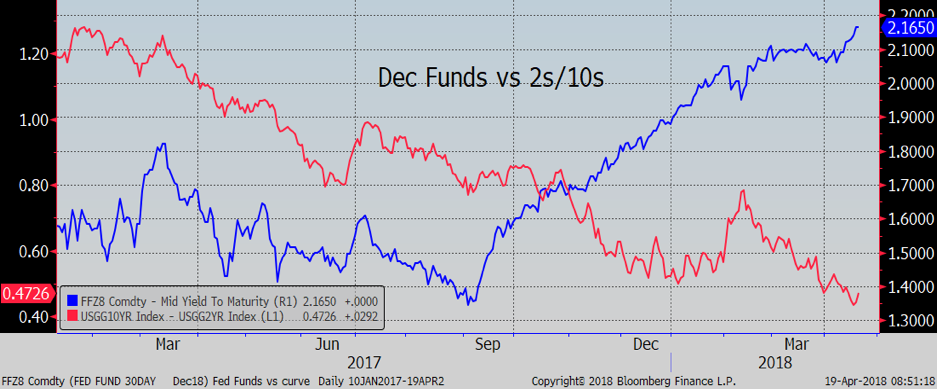

The main theme surely is the flattening curve and all that implies. Behind that has to be the ongoing Fedspeak that has only enhanced prospects of three more hikes this year. Odds for a rate higher than 2.25 percent, implying three hikes, are still under 50 percent but have risen from around 32 percent on April 10 to near 44 percent now.

As to why it’s happening, first and foremost is the Fed. While the Beige Book was solidly beige in its mosaic, it was insistent in its monetary policy path. A few alarms about businesses passing on higher prices gives them cover to do so even as the constant use of the terms “modest” and “moderate” is enough to subdue any enthusiasm for market excitement.

The general gain in yields outside the curve also seems to warrant those words. When 10s and 30s, up a bit over 10 basis points in a two-week period, gets attention in this environment, I’m not sure it’s more than in-range volatility, especially when, like last week, we didn’t get a lot of new fundamental information. I assume the gain was in part a derivative of a better tone to risk assets, which responded to (1) earnings, (2) no new overly dramatic headlines about Trump (Sean Hannity stuff won’t impact the market), (3) the prospects for talks with North Korea, (4) anticipation already about incoming inflation data, and most important of all, (5) the rise in commodity prices.

I want to get back to my core views that the curve will continue to flatten and that 10s will find cycle support at 3.25 to 3.5 percent. This is merely to remind myself that the backup going on may change my timing but not the trajectory of my expectations. Given the position bias for flattening, periodic steepening corrections should be expected but don’t signal a change in view, rather a case of ringing the register, after which there will attempts to justify the price action with something more cerebral until we revert back to flattening.

Here’s a tidbit from a Financial Times piece headlined, “‘New Normal’ Says Build Cash and Prepare for Correction.” The author notes that last year Pimco’s Richard Clarida co-authored a report advising that “Investors should use cyclical rallies to build cash to deploy when markets correct and risks are re-priced.” Is it any wonder why the curve is flattening when a very smart person about to be Vice Chairman at the Fed writes such things?

The column cites the 10-year forward rates in swaps, where the 10-year is 3.09 percent and slips afterwards. In other words, the market isn’t getting overly bearish for the long run. And that is the narrative; the market is offering a cautionary tale, reflected by the curve and forward rates.

The flatter curve for a period of time can bear flattening, allowing longer rates to rise, albeit at a lesser pace to the front, but ultimately seems to be telling us that rates don’t have too far to go. Marketwise, history would seem to be repeating itself.

David Ader is Chief Macro Strategist for Informa Financial Intelligence.