Everyone seems worried about the upcoming FOMC meeting. Everyone, that is, except the bond market. Let me clarify what I mean by “worried.”

The dictionary defines it as “afflicted with or marked by anxious uneasiness or trouble or grief.” When I look at the recent history of the bond market, I don’t see worry. I see a trading direction, to be sure, but I’d hardly characterize it as worry. Pure and simple, the bond market’s adjusting to the reality of higher interest rates.

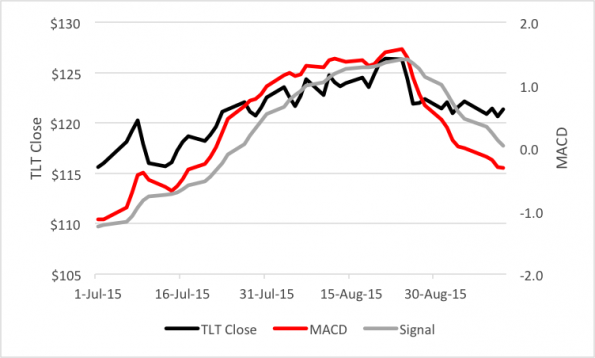

You can see this notion reflected in the price action of the iShares Barclays 20+ Year Treasury Bond Fund (NYSE Arca: TLT). The ETF’s sold off about four percent in the last 15 trading days but, more telling, is the downturn in the fund’s MACD indicator.

MACD is a momentum indicator that shows the relationship between two moving averages, the MACD line and the signal line. A bearish phase is heralded when the faster-moving MACD line falls below the slower signal line. That crossover happened on August 26. There’s been no reversal signaled yet.

The magnitude of downward momentum can be gauged by MACD’s depth below the zero line. MACD, as you can see, is negative and headed further southward.

TLT vs MACD

Whatever worry pervades the TLT market is reflected in its money flow. The last three trading days heading into the weekend were dominated by book-squaring on both the long and short sides.

So, by and large, traders on the long end of the yield curve have been betting on rising rates. Apparently, all the jawboning about the recent jobs report, the soft oil market, the absence of inflation and, yes, even a looming specter of recession, isn’t dissuading them.

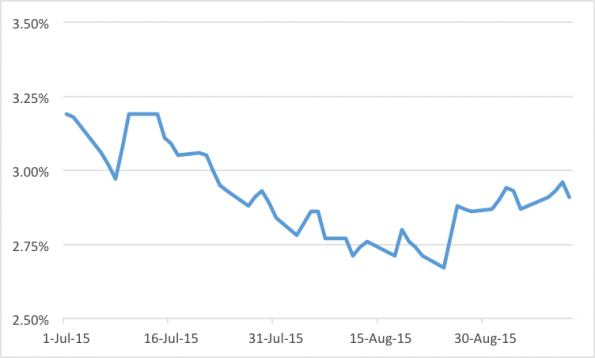

You can see that, too, in the shape of the yield curve. Look at the spread between three-month Treasury bills and the long bond.

Yield Curve: 3-Month Bills vs 30-Year Bonds

The curve’s steepened at the same time as TLT’s MACD headed south. A steepening curve doesn’t bespeak recession. So, will the Fed raise rates in September? The bond market seems to have already priced in a hike.

So, who’s worried?