By Aline Oyamada

(Bloomberg) --A seemingly tried-and-true method for using the bond market to predict when recessions are likely to strike hasn’t been working in emerging markets.

Inverted yield curves -- when short-term bond yields rise above those for longer-term notes -- have occurred 30 times in major developing nations since 2005, but recessions followed on only five occasions, according to a study by Capital Economics. That goes against conventional wisdom that says inversion signals an economy ready to contract.

Why are emerging markets different? The London-based research firm says the main reason may be that yield curves in a handful of developing nations tend to be flatter and invert more easily and frequently. In other words, it’s just not that big of a deal outside the world’s biggest economies.

“Emerging-market yield curves domestically are not very deep,” said Bianca Taylor, a senior sovereign analyst at Loomis Sayles & Co. in Boston. “For the yield curve to demonstrate market views, the country has to have a long yield curve and a lot of liquidity.”

Mexico and Turkey

Among major emerging markets, Mexico and Turkey currently have inverted yield curves. The spread between Turkey’s 10-year and 1-year government bonds has been negative since April, and yet the country’s gross domestic product is forecast to grow by more than 3 percent in every quarter through the end of 2018. In Mexico, where inversion struck in June, economists also forecast expansion in every quarter through the end of next year.

Brazil

Brazil, Latin America’s largest economy, saw an inverted curve as recently as the first quarter of this year, when it was coming out of recession.

U.S.

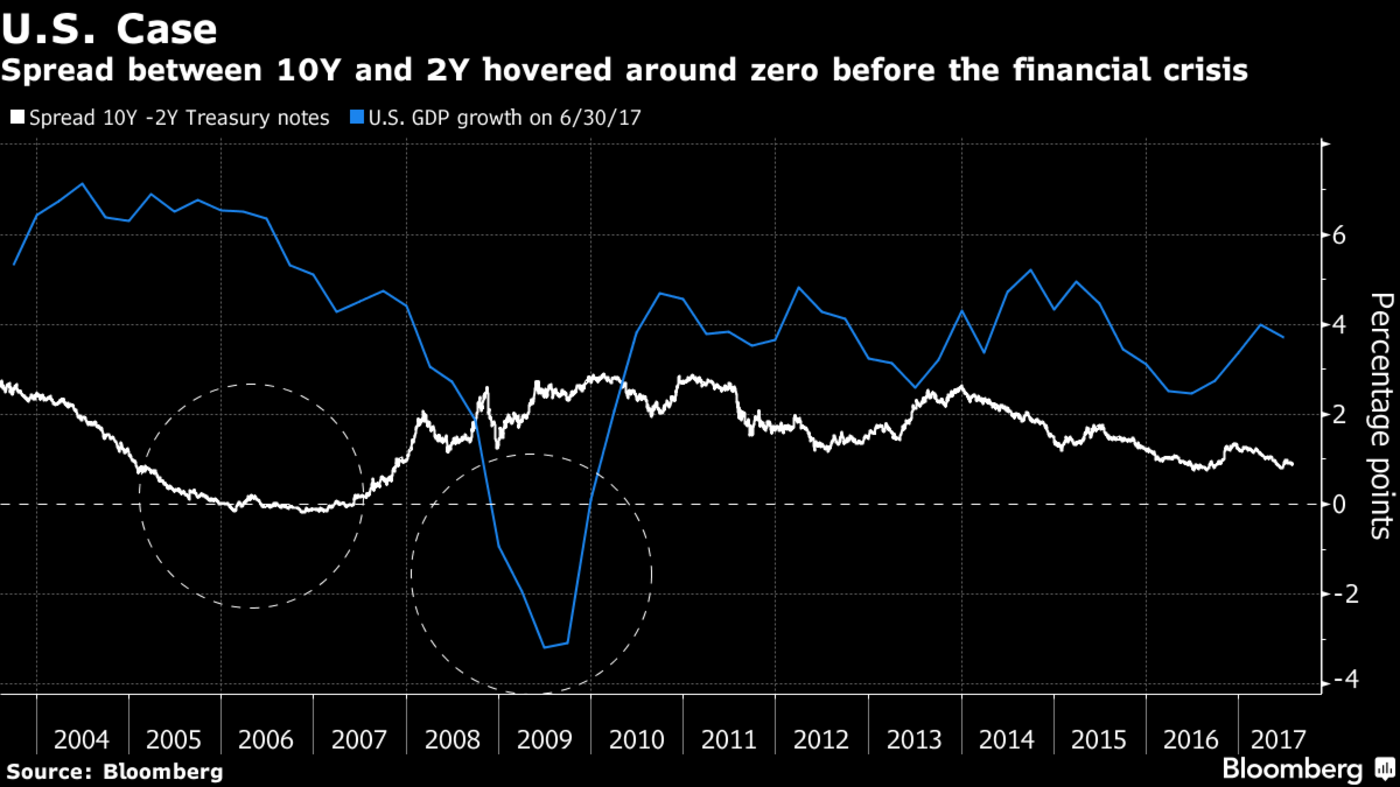

The spread between 10-year and 2-year Treasuries in the U.S. touched negative territory, and hovered near zero in 2005, 2006 and 2007 -- before the global financial crisis.

The MSCI Emerging Markets Currency Index halted a three-day rally, dropping 0.3 percent at 8:54 a.m. in New York.

To contact the reporter on this story: Aline Oyamada in Sao Paulo at [email protected] To contact the editors responsible for this story: Rita Nazareth at [email protected] ;Jeremy Herron at [email protected] Brendan Walsh