By Cormac Mullen

(Bloomberg) --Bond bulls are firmly in hibernation.

Only 3 percent of investors say global yields will be lower in the next year, according to the latest survey of fund managers by Bank of America Merrill Lynch. A record 85 percent of investors say bonds are overvalued and 82 percent expect interest rates to rise in the next year, according to the Oct. 6 to 12 poll of money managers overseeing $585 billion. The level of underweight positions in the debt market reached the highest in seven months.

Investor expectations for a rise in bond yields have been boosted this month, in part by speculation President Donald Trump could pick a new Federal Reserve chair who’s bent on hawkish monetary policies. Stanford University economist John Taylor, known for a rule that would suggest higher interest rates, was said to have impressed the president in an interview last week.

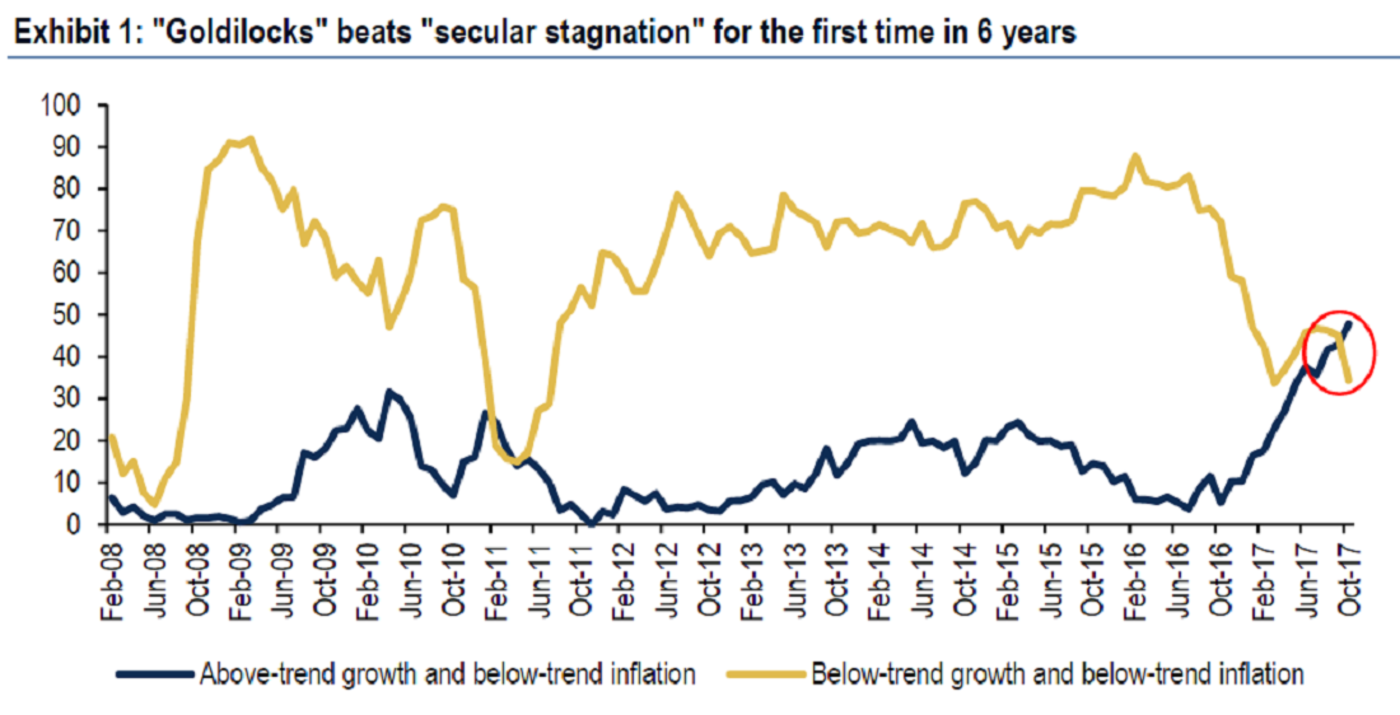

For the first time since 2011, the percentage of investors expecting a “Goldilocks” economy of steady growth with tempered inflation rose to a record 48 percent, outnumbering those seeing stagnation. Investors are shifting into banking stocks, Japanese securities and out of bonds, developing nation assets, utilities and healthcare stocks, according to the report.

Cash positions fell to 4.7 percent, the lowest since May 2015, as the positive sentiment led investors to put funds to work. However, the low cash levels shouldn’t be taken as a contrarian signal, according to Bank of America.

“Cash balances dipped this month but remain somewhat elevated,” said Michael Hartnett, chief investment strategist. “A faster drop in cash leading into 2018 would indicate a sell signal from investors.”

To contact the reporter on this story: Cormac Mullen in Dublin at [email protected] To contact the editors responsible for this story: Samuel Potter at [email protected] Cecile Gutscher, Sid Verma