In a week laden with provocative headlines ranging from another North Korean nuclear test, GOP progress on the tax bill, more sexual harassment stuff (Garrison Keillor?!? Lake Wobegon hid some secrets!), Bitcoin at $11,000, “Tillerson out” talk, Trump saying a government shutdown is good for him, and splitting nuances between Jerome Powell and Janet Yellen, the themes of steady long rates and shape of the yields remain rather the dominant market declarative.

From a rate perspective, 10s and 30s are challenging what had been a narrow range while 2s grudgingly lift to 1.78 percent on hawkish Fed words.

Such price activity warrants the hope that things are coiling, as in a spring about to burst forward. This is tempting, as ever-narrowing ranges don’t last, but it’s the direction of that burst that is the real question. I think to break out of the curve is to revisit recent highs, at least, and favor the short end, which heretofore has done a good job of discounting the Fed. Viscerally, I find myself favoring the downside—meaning higher yields. I’d get the curve’s behavior that’s contained the longer end:

- Inflation remains low

- The Fed hasn’t backed away from further rate hikes

- We have new information in the form of the supply cycle where Treasury hopes to keep the current average maturity of debt stable

- Which means more front-end issuance relative to long issuance than we expected

- In the spirit of flogging a dead horse, given the relative performance of stocks vs. bonds this year, year-end rebalances seems about right

- There is a reasonable risk that if the tax “reform” boosts the economy, the Fed will likely hike per their own dot-plot expectations, i.e., a bit more than the market believes

- Other central banks are still buying bonds

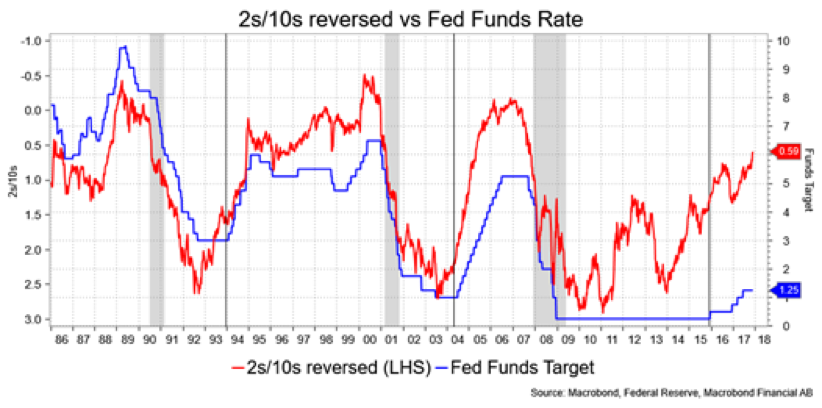

What’s missing from those items is the flattening yield curve, and low rates, telling us a recession is on its way. Robin Wigglesworth, who wins the award for the best last name in journalism, wrote in the Financial Times “Yield curve faces test of its predictive powers” and came up with various challenges to the rule of the thumb that the flattening yield curve relays something about slower growth ahead.

It is, of course, too soon to dismiss the curve’s predictive abilities specific to slower growth ahead, but bear in mind the distance between a flattening curve and a recession can be measured in years.

Further, a flattening curve does generally presage slower growth, but slower growth does not always presage a recession. Indeed, it seems evident that in the quarters immediately before a recession, when the Fed’s hiking has stopped, the curve anticipates the real slowdown and starts to steepen.

In short, the curve in items 1-7 above is telling us a lot of things, many of which are new or unique to this cycle. It may not be predicting a slowdown or recession, but it certainly is telling us something about the cycle. Wigglesworth cites a 56-page Federal Reserve Bank of San Francisco study, Interest Rates Under Falling Stars, by Michael Bauer and Glenn Rudebusch. The abstract effectively says that the “equilibrium real interest rate” (r*) and “perceived trend in inflation” (pi*) are treated as constants in determinants of the yield curve in macro-finance models, however, adjusting for changes within macrotrends, i.e., not treating them as constants, alters estimates for risk premiums in bond yields among other yield diminishing ideas. They write, “expectations about the level of inflation must have played an important part in pushing down bond yields” and “as inflation expectations have stabilized, our estimate of the equilibrium real interest rate has exhibited a pronounced decline.”

To wit, there’s more to the curve than traditional omens of a recession and so understanding those factors continues to make the curve an elemental tool in making rate decisions.

David Ader is Chief Macro Strategist for Informa Financial Intelligence. To read more, download the pdf version at ADER'S MUSINGS.