This will be a brief set of musings as I've been out most of the week. Was that a sigh of relief I just heard?

In the week just passed, the market enjoyed a brisk technical sell-off, abetted perhaps by a better balance of economic data than has been the case. In other words, the data, somewhat second tier, didn't warrant the spotlight of, say, more-critical impetuses like NFP, CPI, retail sales and some of the housing statistics. The reason I start off with a technical excuse is because the weakness started with European Central Bank President Mario Draghi's comments early in the week that seemed to suggest the ECB was set to scale back its asset purchases. Though the ECB offered an apology afterward, the market paid little heed.

This strikes me as a case of the bond market looking for an excuse to follow up on overbought technicals. Not that ego has much to do with it, but I closed the previous week with a near-term steepening bias based on those same overbought technicals out the curve—and liked the belly with an overweight short at the longer end. It was a tactic, and it worked. My inclination is not to press it too much further. In large part that's because I'm a fundamentalist at heart and of all the data seen this last week, it's the durable-goods piece that is perhaps the most important. This makes me wary that we could see further softer data in the days to come.

Of course, with the Fourth of July interrupting activity, and then the wait for NFP, it's reasonable to expect more-subdued activity anyway. While the technicals still look somewhat bearish, I'll allow that some supports have been hit, which leads me to book profits on recent shorts and take a look at the data.

I must admit I'm surprised the markets—plural—don't seem to have a strong view on developments in Washington, whether it's the fate of health care legislation or the emotional context of presidential tweets vs. more substantive output. I've been surprised by that sort of thing all along, so nothing in the latest several days is new, and perhaps I'm missing the boat entirely. I'm not retreating from a view that Washington will have a detrimental impact on confidence and prove supportive to rates, but that is a far bigger narrative that is perhaps one factor behind the recent behavior in rates. Certainly, the challenge to the GOP's agenda has not been lost to the bond market, though evidently less so to risk assets.

CHARTS AND THEMATICS: In the spirit of sentiment shifts, I offer the week-over-week changes to the Citi Economic Surprise Index. What I'm trying to display is that in the last week this broad aggregation of economic data surprises has flattened out after being steadily weak since March. The point is that 10-year yields have been tracking this development pretty well, and the recent flattening of the weakness is a reasonable excuse for the rise in yields. In short, the bond market needs more of that particular narcotic, i.e. soft data, to improve. In the absence of mission-critical data or surprises, up or down, to the fundamentals, the technicals come into their own.

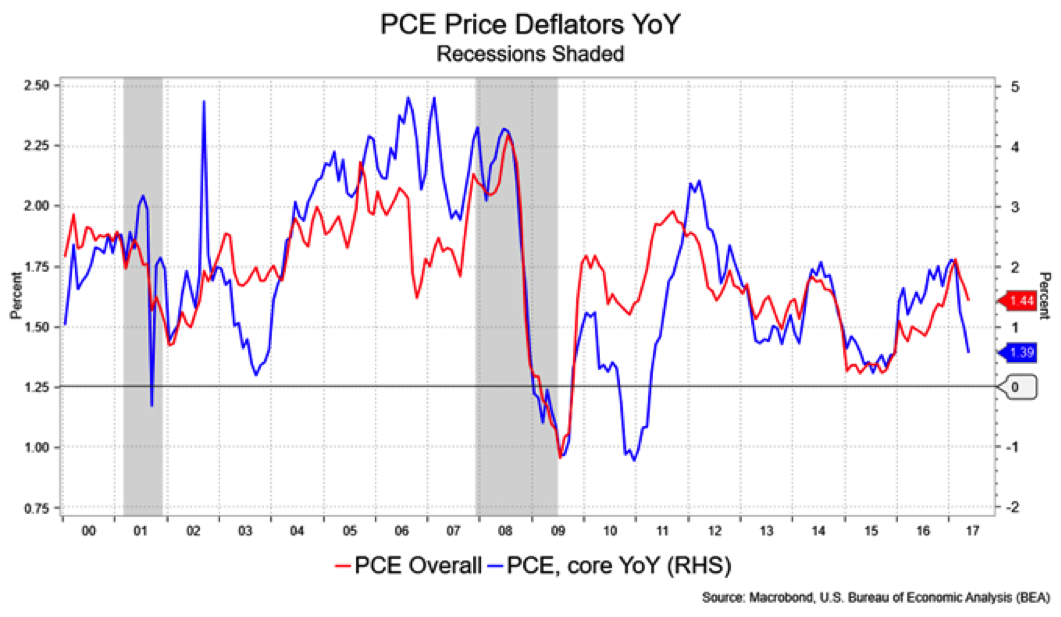

That said, I don't want to dismiss the data. Durable goods was soft, especially the 0.2 percent drop in May's core shipments component, which tracks to GDP, and, although as expected, the PCE deflators at 1.4 percent show a softening pattern. For now, though, the market seems sated with this sort of thing.

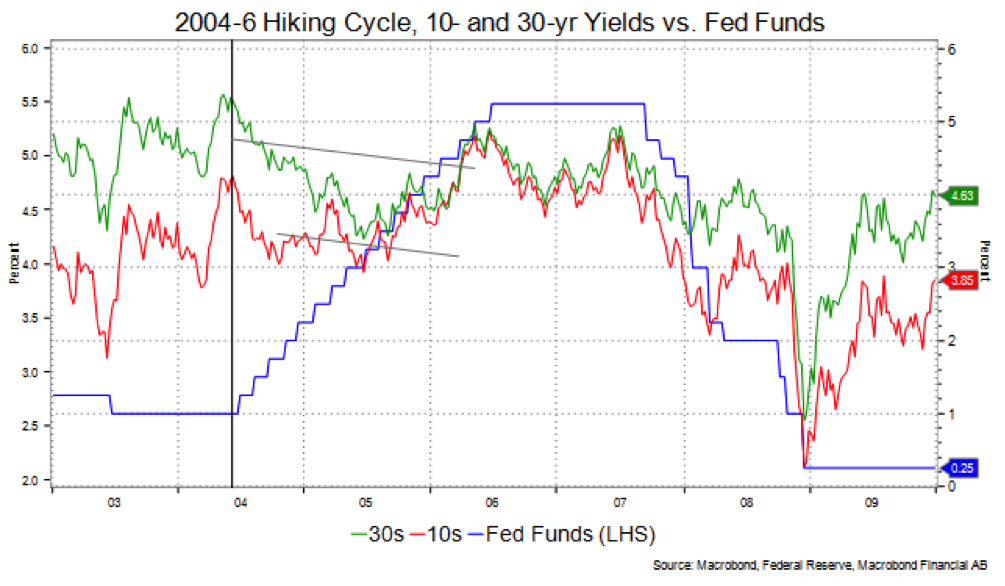

IN THE NEWS: The Wall Street Journal printed a story, “A Bond-Investing Conundrum Returns," which highlighted the Alan Greenspan conundrum of another Fed-hiking era. That one, just over a decade ago, was during the last hiking cycle, when long rates held steady, actually fell, even as the Fed hiked. If the chart below, which illustrates this, is familiar, it's because I used it last week. The article offers a lot of views, including the oddity that if the Fed's hiking continues to push long rates lower they may have to be more aggressive, because lower long rates would encourage people to go for riskier assets. Well, they do have balance-sheet reduction that at the onset could help push rates higher. While the Fed most loudly talks about the unemployment rate and inflation eventually rising to their projection, this article touches on some officials who deem too-high valuations as a reason to tighten policy (Rosengren and Fischer, specifically).

Still, the Fed's influence out the curve is limited unless they are more aggressive with the balance-sheet reduction than the market expects. I don't expect that; they've stressed caution and outlined a gradual schedule, and when trying something new won't want to rock the boat too forcefully. The taper-tantrum comes to mind. This brings to mind a truly interesting dilemma. If the Fed were to raise the Funds rate to over 2 percent—say 2 to 2.5 percent—with the economic data not accelerating more than it has, we could face a flat to inverted yield curve at levels we've not seen before. That doesn't leave much room for accommodation in the event of a deeper slowdown.

Another piece from the WSJ caught my attention: “If You Think Stocks Are Dull, Look at the Economy.” The piece compares the low volatility in the stock market with the low volatility in the global economy. The author writes about the standard deviation of GDP changes in the U.S. at a low 1.5 percent—the lowest it's ever been—on a 3-year rolling basis. I like this line from the piece: “In the years since the financial crisis, the Federal Reserve and other central banks have acted like overprotective parents of a toddler, rushing in whenever the economy looked as if it might stumble. The risk-averse behavior has extended to businesses, making them unwilling to take chances.” It's a brilliant and insightful analogy.

NEAR-TERM MARKET THOUGHTS: With a new set of monthly data coming out and the holiday impact, certainly it's likely to be quiet as early summer doldrums set in. I suspect that people expect NFP to rebound, upward revisions, though the consensus for a 175K gain in private payrolls hardly seems robust enough to set yields markedly higher. It is, however, ample to keep Fed expectations intact and unchanged, which offers nothing much other than steady-as-she-goes in terms of front-end pricing.

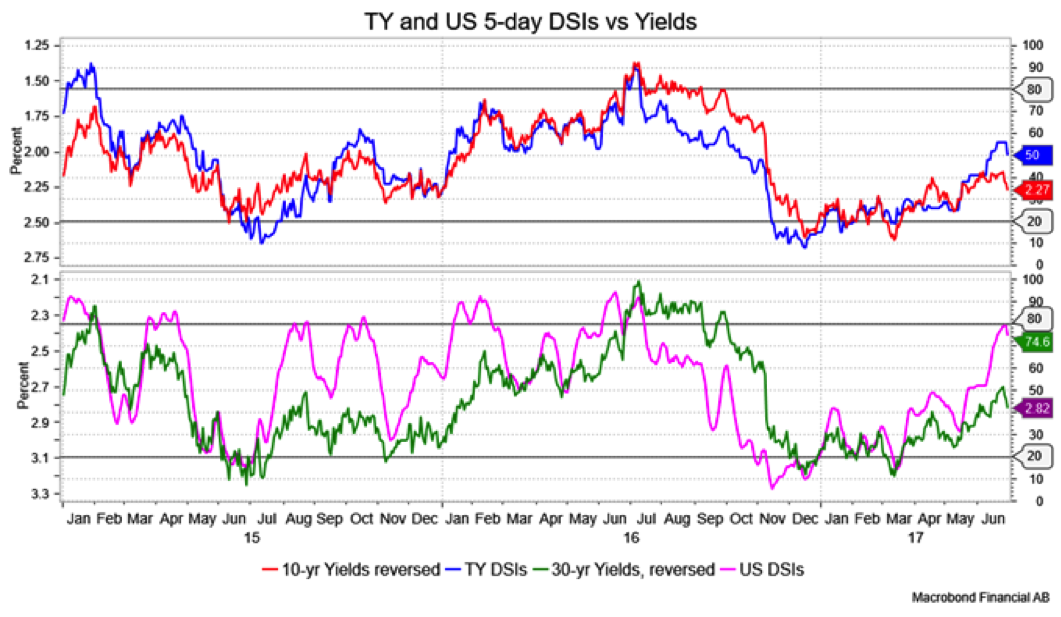

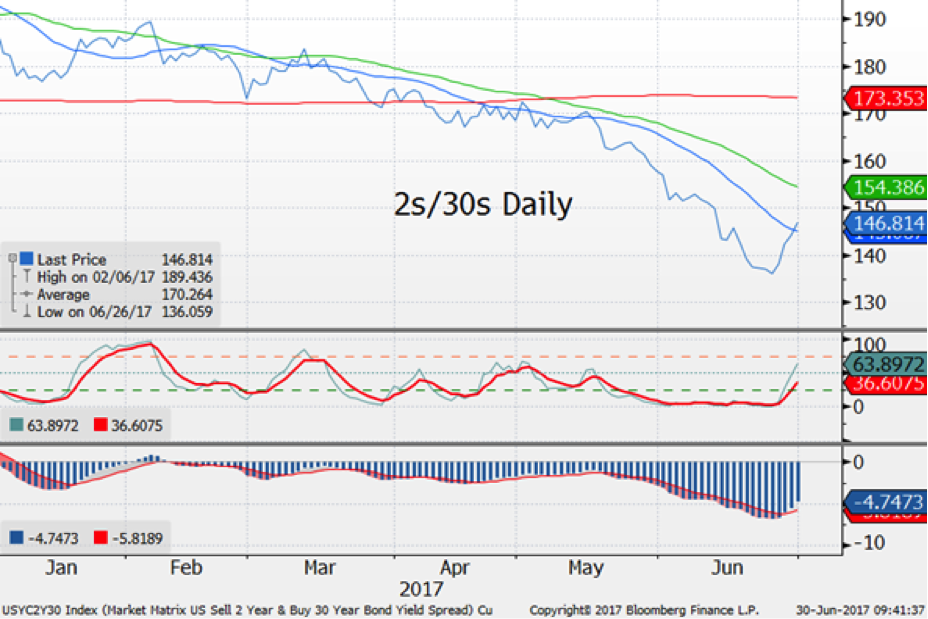

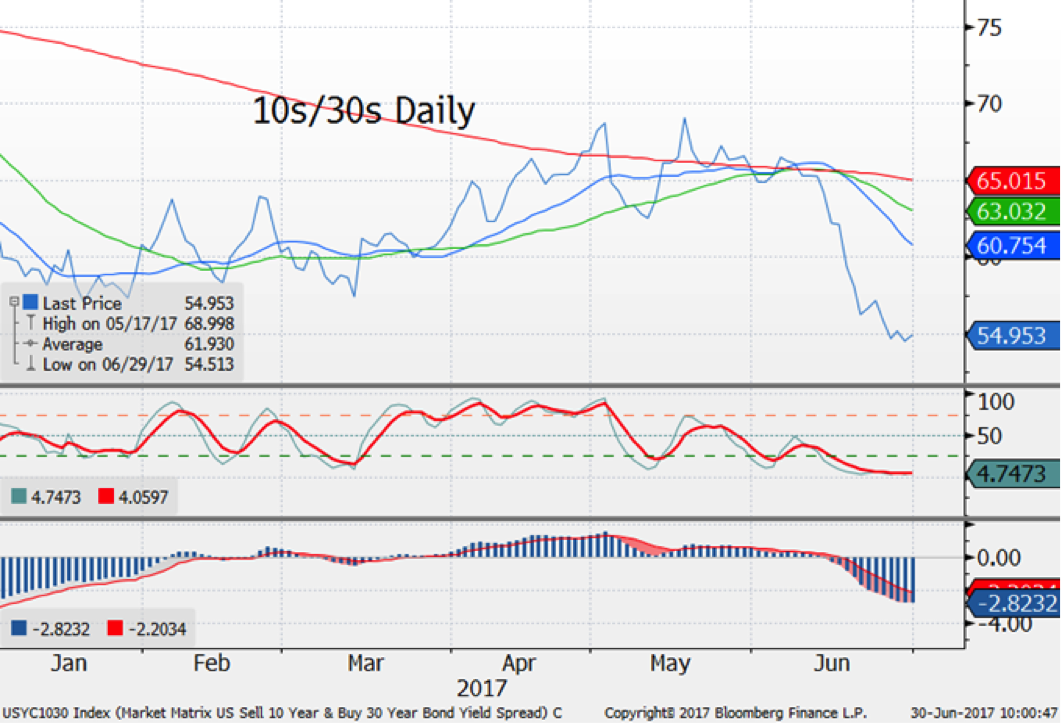

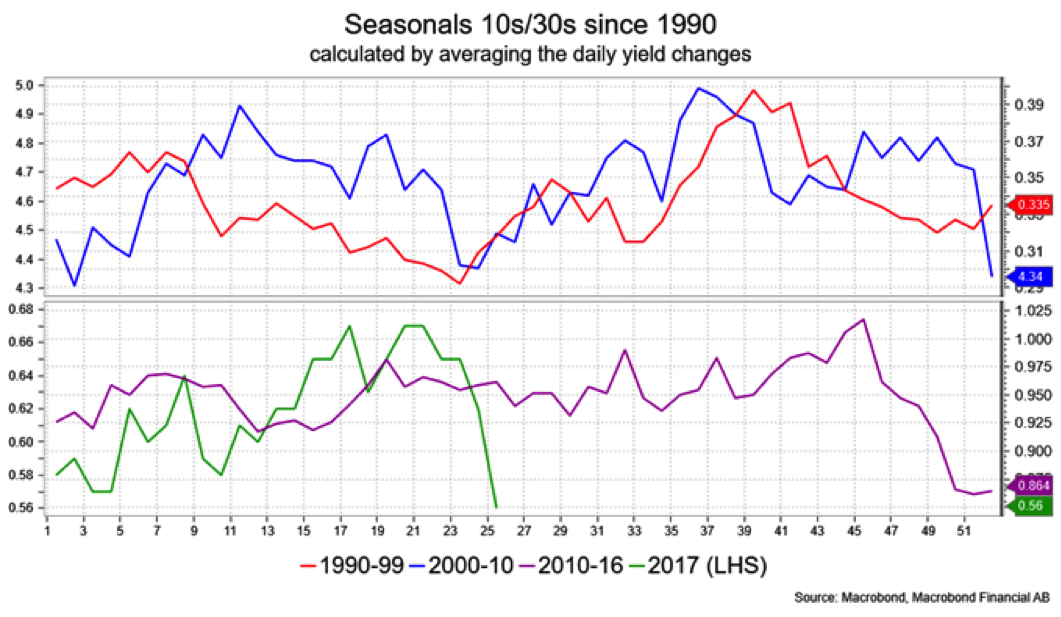

As I look at the charts it still seems that 2s/30s are in steepening mode, so a stab at the 40-day moving average at 154 basis points seems a reasonable target. Note, too, that DSIs on U.S. remain overbought, while for TY they're merely middling. I want to buy the belly vs. the wings, with an overweighted short at the long end—it's worked, though not especially well vs. a plain old steepening idea. Note, all this works against traditional seasonal patterns, which does weigh on my confidence on any longevity or depth to a bearish perspective.

In context, 10-year yields have hit the top of a channel, and MACD is near the neutral zero line; there are better placements for a short. A 10s/30s steepener to the 21-day moving average at 60.7 basis points looks okay in the near term and against the long-term seasonal pattern.

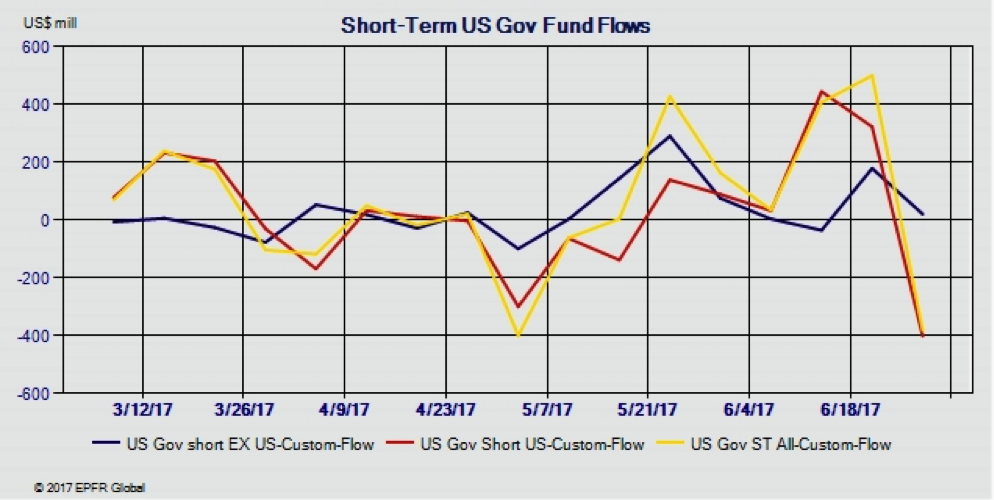

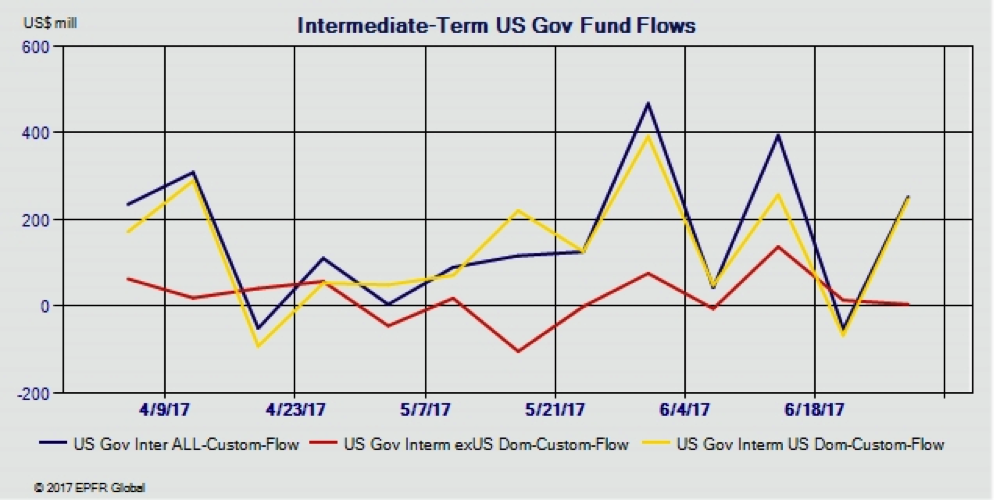

EPFR INSIGHTS: Below is a snapshot of various aspects of EPFR flows with a focus on U.S. government funds. I make the distinction between overall, U.S. investors only and non-U.S. investors. What you'll see is that U.S. investors sold short-term government funds, which is curious given that front-end yields were quite steady, they bought intermediate-term and long-term funds. Hmmm, picking up a cheapening? Let's see if that buying steadies the market in the days to come. Note, too, the contrast with foreign flows, which suggests foreigners didn't do much of anything.

David Ader is chief macro strategist for Informa Financial Intelligence. He can be reached at [email protected].