Most financial advisors feel life insurance is an important part of a client's overall financial plan. In fact, a full 79 percent of advisors said as much in research conducted by Registered Rep. and sponsored by John Hancock. But their clients don't seem to agree: 62 percent of advisor respondents said that their clients' biggest objection to life insurance is that they don't think they need it. Another 45 percent of advisor respondents said their clients don't think life insurance is even part of the wealth management process.

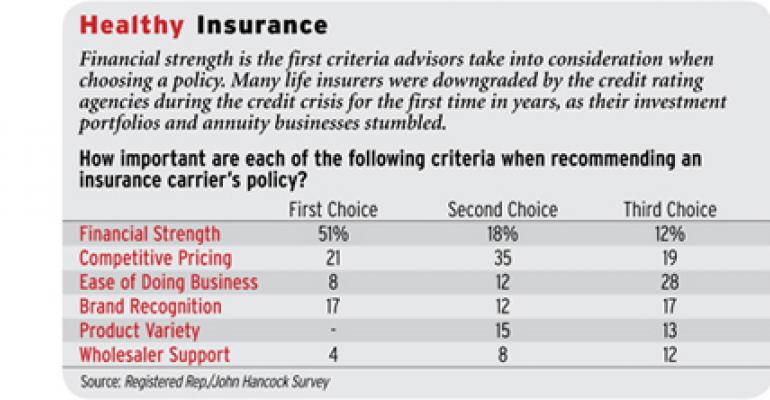

If advisors do convince a client that life insurance is worth it, they may have to do some leg work vetting insurance carriers, after many underwent significant financial hardships last year along with the rest of the economy. “We really did see flight to quality in life insurance and life and long term care insurers, as result of the financial crisis, and that hasn't dissipated at all really,” says Laura Vail Wooster, vice president of long term care communications for John Hancock Financial.