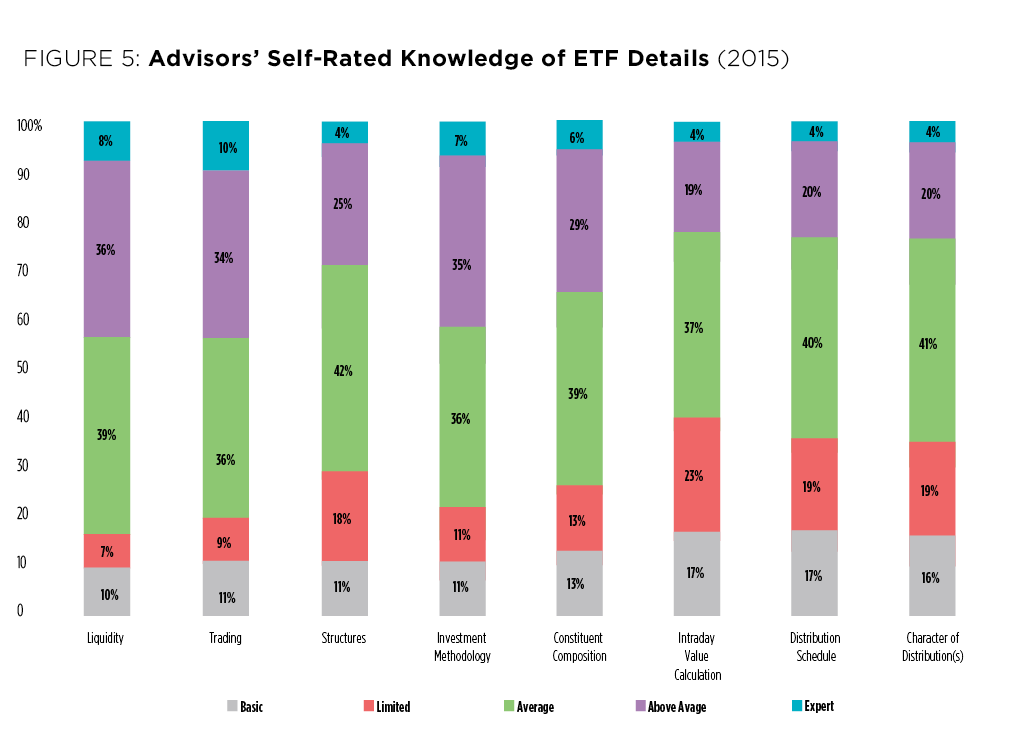

Given the broad adoption of exchange traded funds and the financial media attention to their potential risks and pitfalls, it is interesting to review advisors’ self-rated knowledge of the most important aspects of ETFs. Survey results portray clear differences between knowledge segments and indicate details in which practitioners feel they could use education. Notable areas for improvement in advisor knowledge are the intraday value calculation, distribution schedules, and character of distributions. All of these details are relatively technical aspects of ETFs and advisors can arguably be forgiven for not being experts in such matters, but as more creative and alternative ETFs are launched, advisors would be wise to better understand the underlying details. And, as noted above, the intraday pricing dislocations in late summer of 2015 garnered a lot of media attention and may motivate many advisors to spend some time to improve their knowledge in this area. Aspects such as liquidity and trading, which receive a lot of attention in the financial media, are relatively well-understood by advisors, with only 17% and 20% of advisors stating they have below average knowledge in either of these areas, respectively.

Next Part 6 of 6: Providers Most Closely Associated with ETFs