I hate repeating myself. I really do.

I got a lot of, um, questions from gold aficionados about my July 22 column (“Money Managers Leaving Gold Behind”). Most queries disputed my metrics, i.e., the vault assets backing a gold ETF and the size of Comex gold futures positions.

My thesis was simple: the gold futures market, which of necessity mirrors the physical metals market, had been broadcasting signals of an impending break in bullion prices. Waning speculative momentum was also reflected in the SPDR Gold Shares Trust (NYSE Arca: GLD), the world’s largest bullion-backed exchange-traded product. In short, July’s steep selloff was telegraphed.

So, the break happened and spot prices are now churning in a consolidation level below $1,100. Gold’s four-year bear market has taken yet another downward lurch.

But sometimes a bear market gets oversold. An oversold point is fast approaching in gold.

Looming in the background is a big short position in gold futures: among commercial traders, the largest net short exposure in year. And hedge funds? Money managers are now net short too, a condition never before seen since the Commodity Futures Trading Commission started reporting disaggregated trader commitments in 2006.

That alone, for many traders, is a signal of an oversold market.

But wait. There’s more. The Relative Strength Index and the Money Flow Indicators for GLD are scraping along at oversold levels.

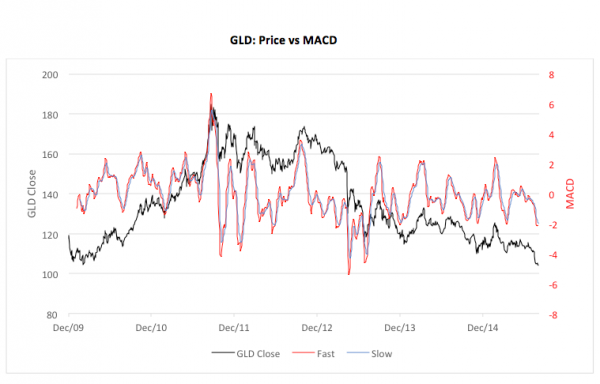

GLD’S MACD indicator is also just ticks away from a buy signal. See the chart below? The red line is the fast MACD signal. When that crosses to the upside of the slower blue line you’ve got the classic pattern so often sought by gold buyers.

So why, with all this, would I be headlining a column about a shorting opportunity? Because gold’s not yet run its bearish course. A strong Yankee dollar, hawkish stirrings at the Fed and weak physical demand for metal make for some lousy fundamentals. All that, and more, is reflected in the longer-term chart pattern for GLD. No bottom’s been put in yet. There’s, in fact, a strong likelihood for new lows at the $90 level – translatable to $950 or so in spot gold — before too long.

What I’m talking about here is taking advantage of whatever cyclical strength the gold market offers to sell. Such an opportunity is nigh.

Investors can tactically short gold by buying one of four short gold exchange-traded products:

| Leverage | ETF/ETN | Expense (%) | Assets ($mm) | 1-Year Return (%) | |

| ProShares UltraShort (GLL) | 200 | ETF | 1.57 | 85.8 | 31.0 |

| DB Gold Double Short (DZZ) | 200 | ETN | 0.75 | 66.0 | 33.1 |

| DB Gold Short | 100 | ETN | 0.75 | 26.0 | 16.0 |

| VelocityShares 3X Inverse Gold (DGLD) | 300 | ETN | 1.35 | 22.4 | 45.7 |

With a couple of hundred dollars in potential gold downside, there’s a product for virtually any speculator, depending on one’s taste for leverage.