By Grant Engelbart

In October, CLS Investments, an ETF strategist, noticed an anonymous trader following their models and the trades they made in them. Here’s the firm’s response.

Dear Copycat Trader,

Most advisors understand best trading practices and get help from an ETF strategist to ensure they’re doing right by their clients. However, we can’t quite figure you out. We know you have been following our ETF models and the trades we make in them. We’re assuming it’s because you didn’t want to pay an ETF strategist fee. We, in fact, offer models with multiple strategists and no strategist fee. In addition, there are a number of reasons to allow professional traders handle ETF orders in particular.

We’d like to take this opportunity to fill you in on some ETF trading best practices. ETFs are innovative investment vehicles that provide investors with a number of potential benefits. One is the ability to trade and observe the price of an ETF throughout the day. However, this benefit can turn into a drawback if certain best practices are not followed, such as:

- Never ever use market orders. These cause more issues with ETF trading than anything else (which you may have noticed when you placed the same trades as us). Market orders guarantee execution, but, depending on the size of the order, they can also guarantee very poor execution. ETFs derive their liquidity from their underlying holdings, and using a market order relies only on the current liquidity for the ETF shown on screen. At a minimum, only use limited orders. If you need immediate execution, put the limit at or close to the current ETF price. Better yet, get help from experts like ETF strategists and our trading partners, who eat, breathe and sleep this stuff all day.

- Trade when the markets are open. This sounds fairly straightforward, but since ETFs derive their liquidity from their underlying holdings, closed markets can mean wider spreads and more difficulty transacting. International ETFs often have this issue, as do bond ETFs on certain holidays, such as Columbus Day when the U.S. bond market is closed. Certain commodities can also have lower levels of liquidity after their price fixings end in the afternoon. ETF.com has a lot of great (free) trading data, including a “market hours overlap” field.

- Avoid volatility if possible. Within the first 30 minutes after the market opens, and near the market close, volatility can pick up. Spreads may be wider (as often is the case in the morning), and increased activity towards the close could make transacting close to net asset value more difficult. Also, trading around large economic releases—Federal Reserve announcements, news stories, or other market-moving events—would be unwise.

- Use your partners. There is no sense trading ETFs by yourself. In fact, without working through certain brokers and authorized participants (APs), investors can’t take advantage of the major mechanism that makes ETFs so efficient—the creation/redemption process. Every major custodian has an ETF block desk that connects them to these brokers for your use. Platforms will also have these connections.

We hope this information is helpful. So, how did we catch you? In mid-October of last year, we saw a real-life example of poor trading practices in an ETF as we traded our new Smart ETF Models. We placed a buy trade through several of our platform partners and took the necessary steps to make sure platforms, ETF issuers, and trading firms were ready to handle the orders.

But somehow you knew about our trades.

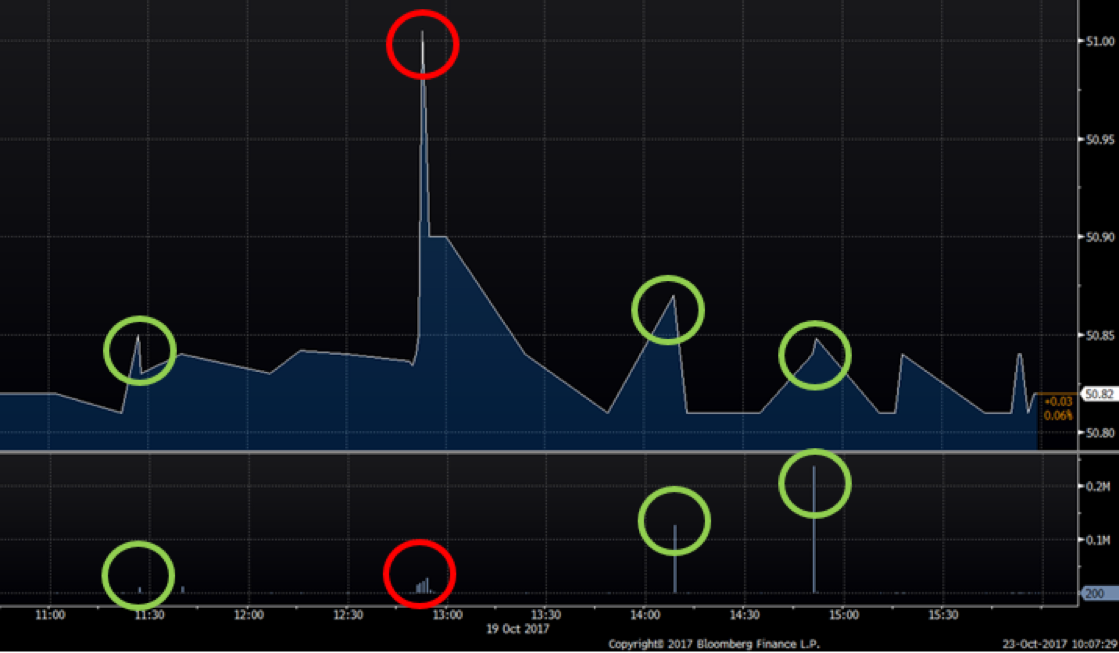

And you violated the first rule of ETF trading: no market orders. A little after noon that day in October, we saw several market orders placed that pushed the price of the ETF beyond its fair value (red circles in the chart below).

Each green circle indicates times when our platform partners executed these trades.

This particular ETF traded at an average bid-ask spread of about 0.1 percent (or about 5 cents) throughout the day. Our platform partners executed inside of that spread, but when you traded around noon, you weren’t so lucky. We estimate the average (volume-weighted) price of your trades was filled at 51.01, as compared to our platform trades being executed at 50.85. That is a large difference and is further amplified across all of the ETFs we were trading.

So, while we are deeply flattered you like our models, please let us help you trade.

Grant Engelbart is a portfolio manager at CLS Investments, an Omaha, Neb.-based ETF strategist.