I was noodling with some charts the other day (yeah, I know, what kind of life is that?) and came across something I want to share with the rest of the class. It’s the correlation of gold to stocks.

Gold’s a traditional portfolio diversifier because its price doesn’t dance to the same tune as equities. Lately, though, that correlation’s been rebounding. I should say those correlations instead because gold mining stocks’ relationship to bullion is trending in a similar fashion.

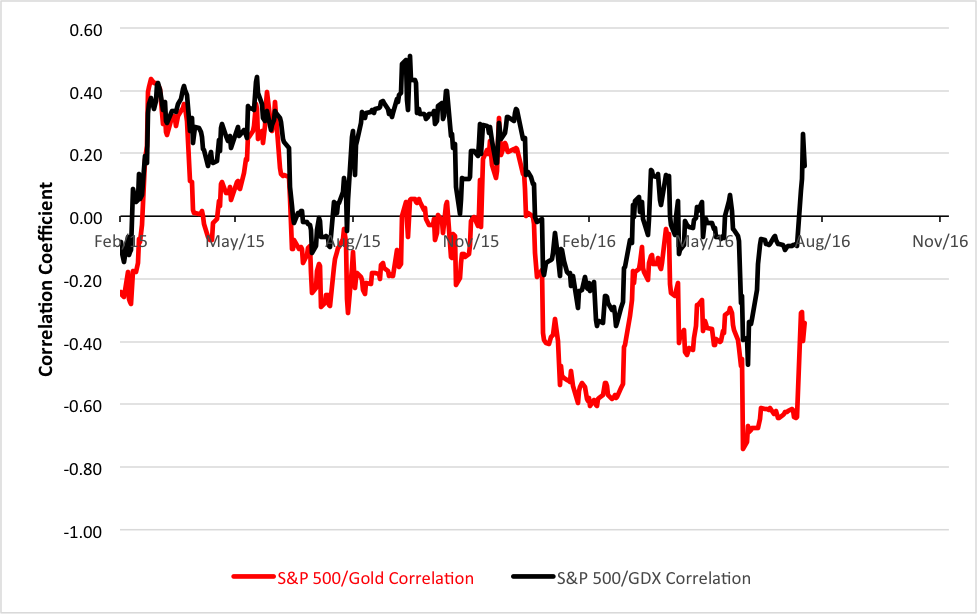

Check out the chart below which depicts rolling 30-day correlations of gold and the VanEck Vectors Gold Miners ETF (NYSE Arca: GDX) to the S&P 500. See the recent upward spikes?

Now, I’m not a Jeremiah, but an upturn off a historic low has presaged trouble in the past. Remember back in 2008-2009 when gold and stocks headed south simultaneously? It was a bad time to be correlated. Asset correlation can wreak havoc even in the most carefully crafted portfolio.

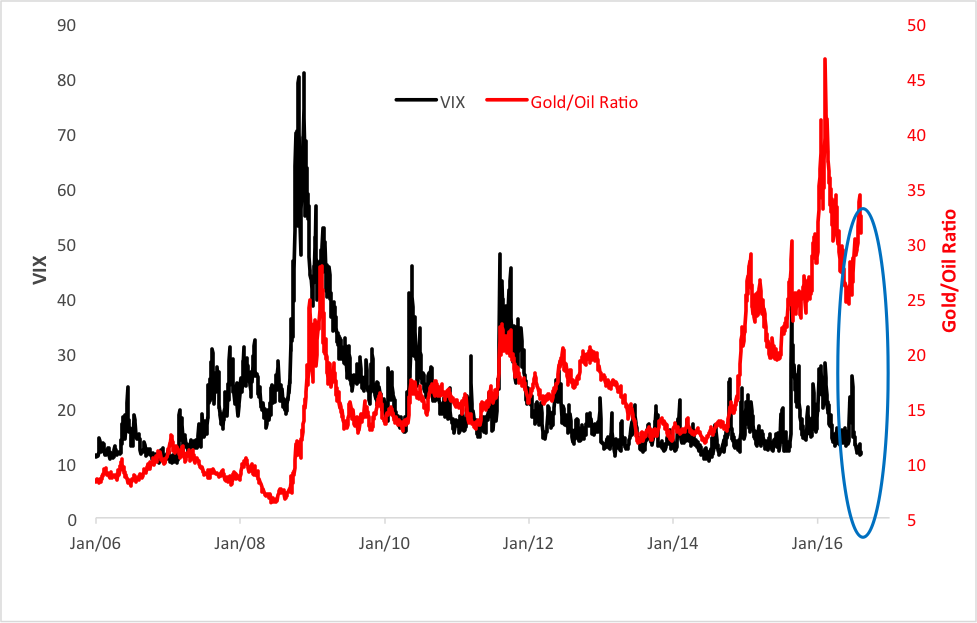

The correlation spike is taking place against a backdrop of seeming complacency according to the CBOE S&P 500 Volatility Index (VIX). VIX has been drifting at the 12 percent level, far below the 20 percent threshold, which normally signals outright fear.

A co-indicator, the gold/oil ratio, is telling a different tale, though. You can see in the chart below how closely VIX and the gold/oil ratio normally track each other. The ratio, which meters gold’s oil-buying power, namely how many barrels of crude can be bought with an ounce of bullion, has historically averaged 15 barrels or so. Wide excursions from the mean are warnings of systemic risk. In mid-2008, as oil prices rocketed toward $150, the ratio sank to six barrels per ounce while VIX was rising. And we all know what ensued after that diversion: a spike in both indicators like you wouldn’t believe. Or do believe. Just check the chart.

Essentially, the gold/oil ratio’s become a measure of sentiment.

And now? Since June, another divergence has been growing. This time, though, it’s the ratio on an upward trajectory, while VIX has ratcheted lower.

This divergence, coupled with the rise in the gold/stock correlation, should give equity investors pause. To pause long enough, perhaps, to reconsider their complacency.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.