By Carolina Wilson

(Bloomberg) --Sometimes running a wildly popular online marketplace for exchange-traded funds just isn’t enough.

Boston-based Fidelity Investments, whose online brokerage has $322 billion in ETF assets under administration and 18 million retail accounts, is looking to escape the shadows of some of the more prolific issuers that populate its platform. The firm is seeking to start five funds that if approved would be the company’s first new products since 2016, according to a regulatory filing.

And it doesn’t plan to stop there. In addition to the five smart beta equity funds, the firm may look to expand into other areas, according to Matt Goulet, Fidelity’s vice president of sector and ETF investment strategy.

"In areas where Fidelity feels like we have a core competency -- and that could be a whole host of different asset classes and areas -- we feel like we want to bring those products to market with the Fidelity brand," said Goulet.

It’s something of an about-face for a firm that had seemed content to cede most of the shelf space on its platform to others, notably BlackRock Inc., whose ETFs are offered commission-free on Fidelity’s service. Of the 91 funds investors can buy without paying a trading commission, 70 come from BlackRock’s iShares lineup including such core exposures as the S&P 500 Index, the Bloomberg Barclays aggregate bond index and investment grade and high-yield debt. Combined, the iShares funds on the platform have gathered more than $600 billion from Fidelity customers and other investors, compared with $7.2 billion for Fidelity’s own ETFs.

Rival Brokerage

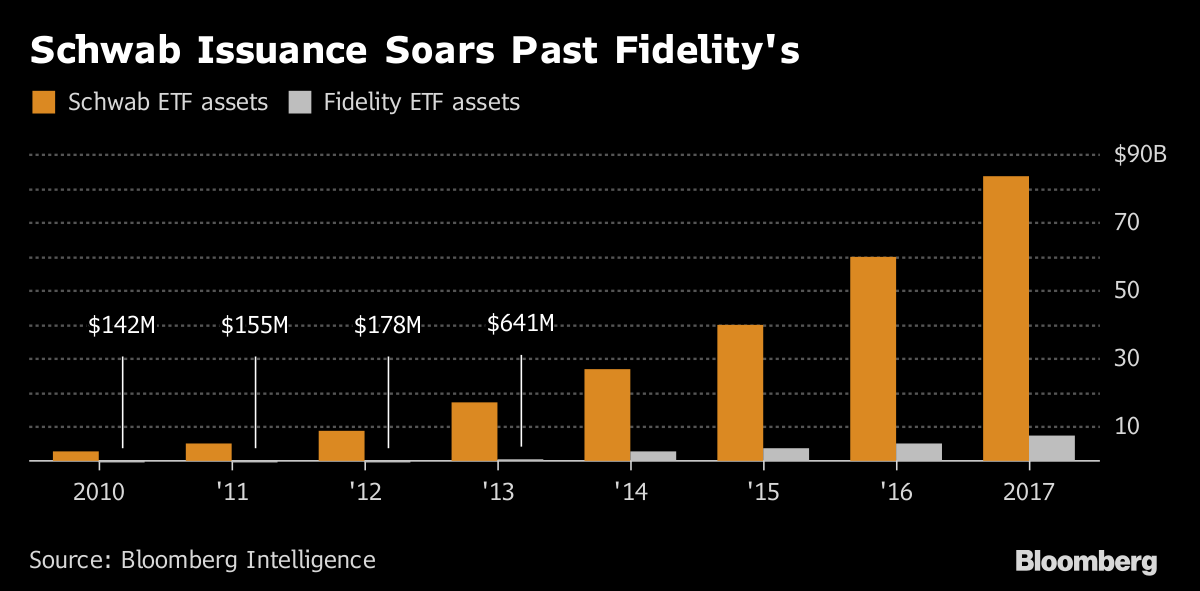

The firm may now be hankering for a bit more space in the shop window. But it’s got a lot of work ahead of it to catch rival Charles Schwab Corp., which has been able to capitalize on running its own trading platform to grow into the fifth largest fund issuer by assets in the U.S. And it’s done so using a very different strategy from Fidelity’s.

On Schwab’s online platform, which offers around 245 ETFs commission-free, many of the core exposures are available via the firm’s own funds. Want broad equity market exposure? Schwab’s U.S. Broad Market ETF, symbol SCHB, tracks 2,500 U.S. stocks at a cost of 0.03 percent per year. Want the same, but in bonds? The U.S. Aggregate Bond ETF tracks the Bloomberg Barclays index for 0.04 percent a year.

"Schwab built their ETF platform using their own ETFs as the core and then rounded it out with other products that are the satellite portion or ways to tilt the portfolio. Fidelity has done the inverse," said Todd Rosenbluth, director of ETFs and mutual funds at CFRA.

"Our asset management business is focused on building a limited number of low-cost, high-quality products that can serve as the foundation of an investment portfolio for a wide variety of clients," said Erin Montgomery, a Schwab spokeswoman.

$1 Billion Mark

So far, the strategy seems to be working. Schwab’s ETFs collectively manage $83.7 billion, with all but one of them passing the $1 billion mark, according to data compiled by Bloomberg. In many cases, the funds are the cheapest in their respective category.

As for Fidelity’s 21 ETFs, they’re mostly the types of exposures that fit more naturally around the edges of a portfolio. The firm sponsors funds tracking U.S. equity sectors, single factor ETFs and actively managed bond portfolios, which are also often the cheapest in their category. When it comes to core holdings available on its platform however, the choice mainly comes down to which BlackRock fund you prefer.

"We believe our partnership provides our customers with high quality products at the best value," said Fidelity’s Goulet. "Not everything has to be a Fidelity-branded ETF."

"Bringing iShares ETFs, Fidelity’s ETFs and Fidelity’s trusted customer platform together has been a great partnership and has helped bring ETF solutions into more investor portfolios," said Jennifer Grancio, global head of iShares distribution at BlackRock.

Still, its new filings show signs of growing ambition. The new "multi factor" ETFs use "computer-aided, quantitative analysis" to build portfolios of mid-cap, large-cap and international stocks, according to a filing. With assets in U.S.-listed smart beta ETFs climbing to $619 billion, it’s a space many issuers are straining to fill. Some of BlackRock’s recent ETFs also follow smart beta strategies, but in fixed income, in an attempt to beat active managers at their own game.

Distinct Advantage

Like Schwab, Fidelity enjoys a distinct advantage when it comes to designing ETFs -- the ability to peer over the shoulders of millions of investors that use its online platform. That can yield some interesting insights, for instance that retail investors tend to gravitate toward stock sector and commodity ETFs, while fixed income funds "are driven by financial advisers in a big way," said Goulet.

"Fidelity is able to spot trends and understand client usage across all ETF providers," said CFRA’s Rosenbluth. "They can skate to where the puck is going."

To contact the reporter on this story: Carolina Wilson in New York City at [email protected] To contact the editors responsible for this story: Yakob Peterseil at [email protected] Margaret Collins