We’ve all heard about the explosion of exchange traded funds. But the heyday may be over unless the funds can find their way into the defined contribution market, Bernstein Research said.

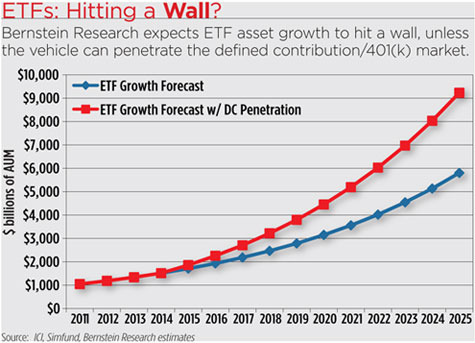

According to a report by Bernstein Research’s Senior Analyst Brad Hintz, industry observers expect U.S. ETFs to grow from $1.2 trillion in assets today to $10 trillion by 2020. But Bernstein’s projections are much lower, with expected growth of $6 trillion by 2025. After 2025, Bernstein expects ETF growth to level off and grow at the pace of the rest of the passive management industry.

“We agree ETFs have ample scope for growth, but that growth will ultimately be bounded unless the ETF industry can evolve away from its roots as a passive product, or break into untapped distribution channels such as 401k plans,” Hintz said the report.

If ETFs do break into the D.C. market, Bernstein’s estimate for asset growth rises to 17 percent by 2025, to $9.2 trillion.

A couple days ago, it looked as though ETFs were making strides into the 401(k) space, with reports that Apple was moving toward an all-ETF retirement plan. But that doesn’t seem to be the case, as the story was taken down shortly after.

What’s stopping the ETF industry from moving into the 401(k) space? Bernstein points to a smaller discrepancy between mutual fund fees and ETF fees within D.C. plans; the tax structure of retirement plans; and trading commissions issues. In addition, by using an ETF inside of a retirement plan, investors also lose some of the benefits of mutual funds, such as investing contributions in fractional shares.

None of these challenges are insurmountable, but failing to address them will be one reason ETFs don't usurp mutual funds as the dominant retail investment vehicle any time soon.